Brazil football fans welcome potential Middle Eastern investment in domestic league

Brazilian football fans say they are excited by the prospect of foreign investment in the spiritual home of the beautiful game, with many hoping Middle Eastern capital will allow the domestic league to serve as an alternative to Europe for players in their prime.

Domestic teams have traditionally been structured as non-profit associations, led by powerful presidents elected by fans every three or four years. But a law introduced last year which allows clubs to operate as companies has opened the door to possible takeovers from abroad.

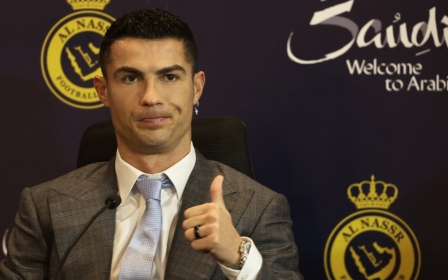

Investors from the Middle East have shown themselves among the most keen to capitalise on the revenue potential of football's global reach.

'It is true that capitalism has improved the income of athletes... but football is essentially a playful, recreational, cultural activity'

- Aldo Rebelo, former minister of sports

With many Brazilian teams burdened with high debt loads and the national currency weakened by the coronavirus pandemic, the new model - which is inspired by the English Premier League - could help ailing clubs turn their finances around.

City Football Group (CFG), which owns Manchester City and nine other clubs, is currently locked in negotiations to buy the newly promoted Brazilian Serie A team Bahia for $133m.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

The deal, which will see the Abu Dhabi-backed CFG secure a 90 percent majority share in the club, has received backing from more than 98 percent of Bahia's club members.

"We are honoured that Bahia's shareholders have placed their trust in us and voted in favour of City Football Group's investment," CFG chief executive Ferran Soriano said early last month.

“We will prioritise strengthening squads and youth divisions to compete at a high level, engaging with fans and improving their experience, achieving solid long-term financial sustainability and always keeping in focus the strong values, roots and identity of EC Bahia."

'You have to win to be profitable'

In the past year, US investors have also made moves for two of Rio de Janeiro's most historic clubs, Botafogo and Vasco da Gama.

Virtual reality entrepreneur John Textor, who owns 40 percent of English Premier League side Crystal Palace, acquired a 90-percent stake in Botafogo in March and invested a reported $330m in the club.

"Football is no different than any other business. You have to win to be profitable," the 56-year-old told CNN last year, shortly before the club splashed out on a dozen new players.

The Miami-based 777 Partners, which owns Italian side FC Genoa and has shares in other European teams, has acquired a 70 percent stake in Vasco da Gama.

"Investment in Brazilian football will further improve the financial quality of clubs and give more opportunities to young players to shine on the world stage," Rogerio Jose de Souza, a Brazilian football fan told MEE.

"I hope Arab investment will shine a light on them."

According to the fan, foreign investment could also see a change in Brazil's historical reliance on player sales. Clubs could be able to hold onto their star players for longer or sell them for a higher price, generating more revenue for the club.

'Open up investment opportunities'

Before the law was passed last year, just two of Brazil's top-tier clubs operated as companies: Cuiaba, owned by local tyre manufacturer Drebor; and Red Bull Bragantino, which is part of the Austrian beverage company's international stable of teams.

European powerhouses Manchester City and Paris Saint-Germain, who are privately backed with money from Gulf states, have become household names in recent years due to the amount of money injected into the clubs.

Despite Brazil's strong claim to be the home of the beautiful game, the same cannot be said for the likes of Cruzeiro, Santos or Flamengo.

Brazil, who has won the World Cup a record five times, has produced some of the most iconic players in the history of the game - from Pelé and Socrates to Ronaldinho and Neymar. But according to the Swiss-based CIES Football Observatory, there are more Brazilian players playing abroad than any other nation.

With the national squad crashing out at the quarter-final stage of the Qatar World Cup, some returning fans said foreign cash could help Brazilian clubs nurture better talent and even help the Selecao perform better in future football tournaments.

"It would be a very good step for us to open up investment opportunities with Arab countries," Luiz Carlos Almeida, a Brazilian architect who attended the tournament, told MEE.

The surge of investment coincides with an agreement last May by Brazil's largest clubs to create a league modelled on the English Premier League that will centralise talks to sell transmission rights and marketing contracts.

'Playful and recreational activity'

The breakaway initiative, known as Liga Forte Futebol, has 26 clubs on board including Rio de Janeiro giants Flamengo, plus the five first-division outfits from Sao Paulo: Corinthians; Palmeiras; Sao Paulo; Santos; and Red Bull Bragantino.

The teams from Rio de Janeiro and Sao Paulo, which have traditionally been the most powerful in Brazilian football, want a greater say over how TV broadcasting rights, both domestically and overseas, will be shared.

They've suggested that the money be split in a 40-30-30 equation – 40 percent equally shared; 30 percent according to competition performance; and 30 percent based on other factors such as crowd attendance, streaming numbers and even social media follower count.

Despite opposition from smaller teams that the model for income distribution will favour the bigger clubs, there has been little resistance among the majority of Brazilian football fans.

"I have a very pessimistic view on transforming football into a business activity," Brazil's former sports minister, Aldo Rebelo, told MEE.

"It is true that capitalism has improved the income of athletes, created millionaires and served as a showcase for sports and other products, but football is essentially a playful, recreational, cultural activity.

"The club's new owners will have the right to do whatever suits their business objectives," Rebelo added. This could include changing the club's name, colours and even the regional headquarters of the teams as seen in the NFL.

"I don't think the founders of these clubs envisioned this fate for these institutions."

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.