Cash-rich Gulf nationals rush into New York's luxury property market

Georgina Atkinson pops into the lobby bar of Manhattan's Park Lane hotel nearly out of breath.

“We have had a considerable uptick in property viewings,” the head of Knight Frank’s US residential developments in Dubai tells Middle East Eye, before ordering up a drink to celebrate brisk business and talk luxury real estate.

Atkinson’s New York visit coincides with a surge in the number of Knight Frank’s clients from the Gulf region entering the city's market.

“Gulf buyers are looking at New York with fresh interest.”

'The dollar’s strength has actually led to more interest in luxury New York property among our high net worth clients'

- Georgina Atkinson, Knight Frank

Real estate insiders and brokers who specialise in catering to well-heeled Middle Easterners in the city echo her assessment.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

“This is definitely a new trend,” Adel Assaf, an agent with the luxury real estate group Corcoran, told MEE.

“In the 1980s, you had the Russians and Japanese. In the 1990s, the South Americans. Now a new type of Khaleeji is rediscovering New York City.”

Khaleeji is an informal term used for nationals from the Gulf Arab peninsula (or Khaleej).

When border restrictions followed the Covid-19 pandemic, foreign real estate transactions dried up. The volume of purchases by international buyers across the US was $59bn between April 2021 and March 2022 - the second-lowest figure on record since 2009, according to the National Association of Realtors.

The number of inquiries for Manhattan real estate has accelerated since February, brokers tell MEE. While Gulf buyers aren’t alone in hunting for luxury property in the city now, they have certain advantages over other foreigners.

Dollar is king

Gulf economies have been buoyed by rising energy prices at a time of mounting global economic headwinds. Saudi Arabia’s economy grew 8.7 percent in 2022, the highest rate among G-20 countries. The UAE’s economy chalked up a 7.6 percent growth rate last year. As a result, Gulf nationals have seen their wealth balloon.

Dubai was the top-performing luxury residential property market last year, with prices surging 44 percent in value. Riyadh ranked third with prices up 25 percent, according to Knight Frank's 2023 Wealth Report released in March.

Meanwhile, Saudi's Tadawul and Abu Dhabi’s ADX index were two of the world's top-performing stock markets last year. Gulf nationals generally have high exposure to their countries' equities.

Retail investors make up about 67 percent of trading volumes on the Tadawul compared to about 25 percent in US markets. Although Gulf stocks are down this year, they are still high by historic standards.

A rising US dollar has also energised the market.

“The dollar’s strength has actually led to more interest in luxury New York property among our high net worth clients,” Atkinson said.

'These guys are more discerning than the older generation'

- Adel Assaf, Corcoran group

The dollar is viewed as a safe haven during times of geopolitical turmoil. Rich Gulf buyers who already have exposure to Europe have turned to luxury US property to diversify their real estate portfolios. One major advantage they have over other foreign buyers is that their national currencies are pegged to the dollar.

“They aren’t negatively impacted by the exchange rate,” Atkinson said.

“If anything, currencies like the Emirati Dirham are overvalued compared to the dollar,” Assaf, from Corcoran said. “These guys have a lot of buying power that their counterparts in Europe and South America don’t have.”

Brokers note a geographic and financial divide among well-heeled Middle Easterners in Manhattan.

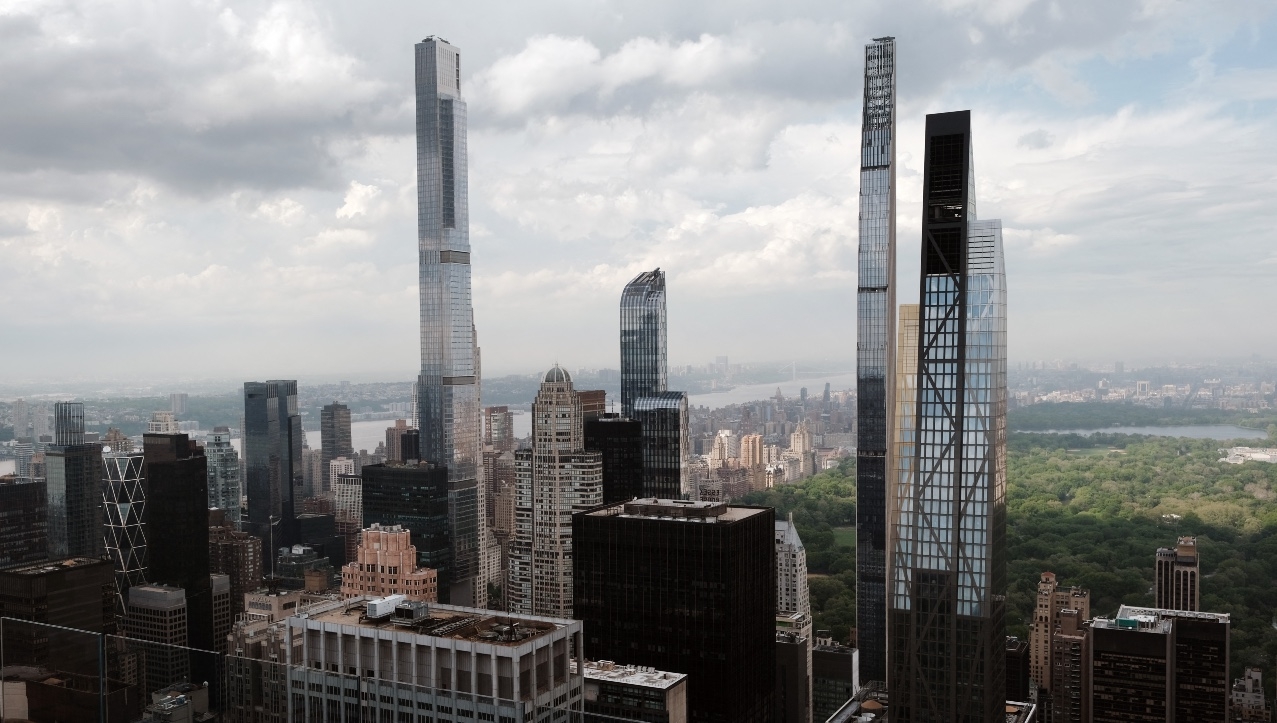

Kholood Breiche, a real estate agent with Corcoran, and who is originally from Lebanon, said her clients from the Levant favour the trendy West Village and Soho neighbourhoods. But flush with petrodollars, Gulf buyers are also looking at Billionaires Row, along the southern end of Central Park.

“Our Gulf clients want anonymity and exclusivity. They are after trophy assets predominantly in the prime segment of the market and typically valued above $5m,” Atkinson said.

They gravitate towards swanky branded residences like Aman New York and Mandarin Oriental on Fifth Avenue. Brokers also tell MEE there have been discreet enquires from the Gulf into the new Towers of the Waldorf Astoria.

'Not your dad's Khaleejis'

Deep-pocketed buyers from the Gulf scooping up Manhattan penthouses isn’t necessarily news.

Saudi Prince Nawaf bin Sultan bin Abdulaziz Al Saud once owned an Upper West side triplex with a rain fountain and panic room. He sold the property for $36m in 2018. Members of Qatar’s ruling al-Thani family own a bundle of Manhattan properties, including a 45,000-square-foot mansion on the Upper East side.

But a few factors distinguish this property rush. For one thing, it's being led by young crypto traders and financiers, real estate insiders say.

“These aren’t your dad’s Khaleeji buyers,” said Assaf, who is currently working with two prospective clients from the Gulf.

'The Khaleejis are making all cash offers. Financing doesn’t register as a concern'

- Kholood Breiche, real estate agent

One, a 27-year-old Emirati crypto trader is eyeing a $6m beach house on Long Island with a helipad, which he aims to pay for in digital currency. The other, a 30-year-old financier from Qatar, has his sights on a classic three-story brownstone.

“These guys are more discerning than the older generation. They watch the market and are smarter for sure. And they have accumulated a lot of crypto wealth,” he added.

Despite a flood of liberalising social laws in the UAE and Saudi Arabia, young Gulf citizens are attracted to New York’s lifestyle. Doha, Riyadh and Dubai are all connected to New York by direct flights, but the city remains distant.

“Back home everybody knows everybody,” Mohammad*, a 26-year-old Gulf national studying in New York told MEE. He sat with a group of friends at one of the city’s many Mediterranean fusion restaurants. A spread of colorful cocktails and mezze dotted the table while the hit song Tel Aviv Ya Habibi blared in the background.

“Here you can go out and let your guard down. People at a bar aren’t trying to guess my family name. They don't care."

Back to school

Atkinson says her Middle Eastern clients are more mature; mid-30s and married with children. But even then, the demographics of Gulf buyers in New York reflect a changing region.

In Saudi Arabia, old-school princes are selling off luxury assets that have long epitomised the bling of royal life as a result of 37-year-old Crown Prince Mohammed Bin Salman’s efforts to tighten the purse strings of the ruling Al-Saud family.

Prince Bandar bin Sultan, a former Saudi ambassador to Washington, sold a $155m country estate in England in 2021. More recently, a mansion in London’s Regent Park once owned by Saudi Prince Khaled bin Sultan al-Saud has been put up for sale by creditors for $305m after a loan secured against it expired. The sticker price would make it London’s most expensive residential sale on record.

Gulf buyers have traditionally gravitated to European capitals like London. The top countries of origin for foreign buyers in the US are Canada, Mexico, China, India, Brazil, and Colombia, according to the National Association of Realtors.

Atkinson said that London remains the favoured destination, but Manhattan is sneaking up.

Both cities are attractive because of their proximity to top-tier universities. The UK is home to Oxford and military schools like Sandhurst, where legions of Gulf royals have studied, but New York has Columbia University and NYU.

“People shouldn’t underestimate the importance of education when ultra-high net worth clients choose residential properties. It’s one of the main drivers,” she told MEE, pointing to a client she has from the Middle East looking for an apartment for his daughter who is studying at NYU.

Manhattan’s comparative appeal has also been boosted by Brexit, recent political chaos in the UK, and safety concerns, she said.

Gulf shoppers also don't have to worry about rising mortgage rates which have been holding back domestic buyers.

“The Khaleejis are making all-cash offers. Financing doesn’t register as a concern,” Breiche said. “In today’s market, cash-rich Khaleejis have the advantage."

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.