Suez Canal: Salvage teams join efforts to refloat ship as traffic suspended

Salvage teams from the Netherlands and Japan have been hired to devise a plan to refloat a giant container ship blocking the Suez Canal, the company leasing the vessel said on Thursday.

Taiwan's Evergreen Marine Corp said Dutch firm Smit Salvage and Japan's Nippon Salvage had been appointed by the ship's owner and would work alongside its captain and the Suez Canal Authority (SCA) on a plan to refloat it.

"Evergreen Line will continue to coordinate with the shipowner and Suez Canal Authority to deal with the situation with the utmost urgency, ensuring the resumption of the voyage as soon as possible and to mitigate the effects of the incident," Evergreen said in a statement.

"As the vessel is chartered, the responsibility for the expense incurred in the recovery operation; third party liability and the cost of repair [if any] is the owner's."

Earlier on Thursday, the SCA said it had temporarily suspended traffic through the canal as efforts to dislodge the 400m long container vessel that has blocked the waterway continued for a third day, with eight tugs working to straighten the ship.

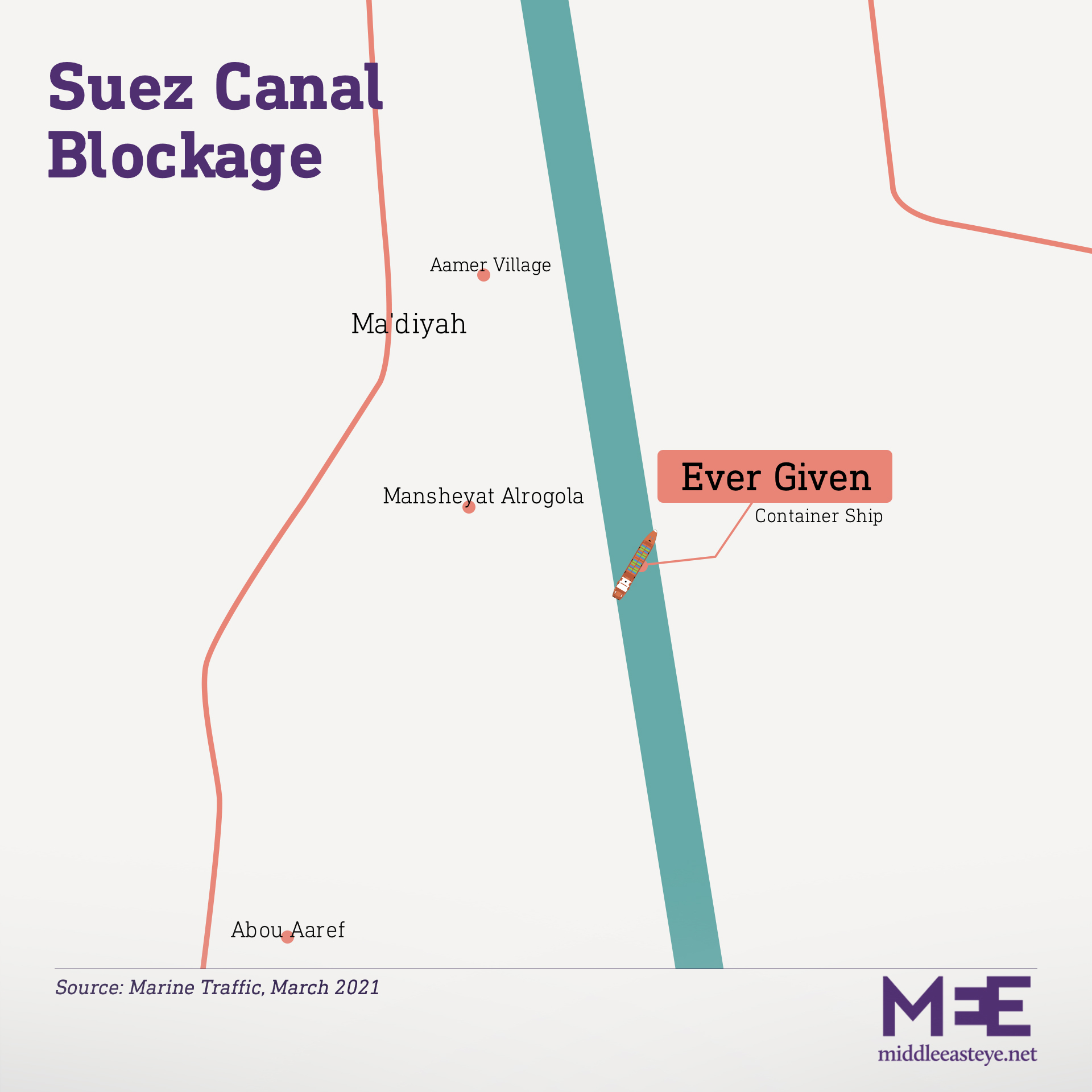

The Ever Given vessel ran aground diagonally across the single-lane stretch of the southern canal on Tuesday morning after losing the ability to steer amid high winds and a dust storm, the SCA said in a statement.

Ship-tracking software shows the tugs surrounding the Ever Given and three more heading towards it.

The ship's GPS signal shows only minor changes to its position over the past 24 hours, however.

It is now blocking transit in both directions through one of the world's busiest shipping channels for goods, oil, grain and other products linking Asia and Europe.

The technical manager of the ship said on Thursday that another effort to re-float the vessel will be undertaken later in the day after an earlier attempt was unsuccessful.

Bernhard Schulte Shipmanagement (BSM) said in a statement that dredging operations to assist re-floating were continuing.

"A further attempt to re-float the vessel at around 0800 hours local time this morning was not successful, and another attempt will be made later today," it said.

"Once re-floated, the vessel will undergo a full inspection and BSM will cooperate fully with the relevant authorities on reports of the incident."

'Enormous beached whale'

Peter Berdowski, CEO of Dutch company Boskalis, which is trying to free the ship, said it was too early to say how long the job might take.

"We can't exclude it might take weeks, depending on the situation," Berdowski told the Dutch television programme Nieuwsuur.

He said the ship's bow and stern had been lifted up against either side of the canal.

"It is like an enormous beached whale. It's an enormous weight on the sand," said Berdowski.

"We might have to work with a combination of reducing the weight by removing containers, oil and water from the ship, tug boats and dredging of sand."

BSM said dredgers were working to clear sand and mud from around the vessel to free it, while tugboats in conjunction with Ever Given's winches are working to shift it.

"We are working very quickly to bring the problem to an end and prevent delays for transiting ships," George Safwat, the official spokesperson of the authority, told Middle East Eye on Wednesday.

Wind 'hindering the operation'

Marine services firm GAC issued a note to clients overnight saying efforts to free the vessel using tug boats continued, but that wind conditions and the sheer size of the vessel "were hindering the operation".

Several dozen vessels, including other large container ships, tankers carrying oil and gas, and bulk vessels hauling grain have backed up at either end of the canal to create one of the worst shipping jams seen for years.

Roughly 30 percent of the world's shipping container volume transits through the 193km canal daily, and about 12 percent of total global trade of all goods, Reuters reported.

"This is by far the world's most important maritime passageway," independent maritime transport expert Ahmed al-Shami told MEE.

"This is why problems in it will have their toll on international trade."

Shipping experts say that if the blockage is not likely to be cleared within the next 24-48 hours, some shipping firms may be forced to re-route vessels around the southern tip of Africa, which would add roughly a week to the journey.

But the chairman of the Suez Canal Authority told media that despite the blockage some cargo was able to move south and that efforts to dislodge Ever Given would continue.

Consultancy group Wood Mackenzie said the biggest impact was on container shipping, but there were also a total of 16 laden crude and product oil tankers due to sail through the canal and now delayed by the incident, amounting to 870,000 tonnes of crude and 670,000 tonnes of clean oil products such as gasoline, naphtha and diesel.

Huge insurance claims

The owner and insurers of the Ever Given could face claims totalling millions of dollars even if it is refloated quickly, industry sources said on Wednesday.

The ship's owner, Japanese firm Shoei Kisen KK, and its insurers could face claims from the SCA for loss of revenue and from other ships whose passage has been disrupted, insurers and brokers said.

"All roads lead back to the vessel," said David Smith, head of marine at insurance broker McGill and Partners.

Shoei Kisen could not be reached for comment, Reuters reported.

Container ships of this size are likely insured for hull and machinery damage of $100-140m, insurance sources say.

The ship was insured in the Japanese market, two of the sources said.

The cost of the salvage operation is also borne by the hull and machinery insurer.

"It is potentially the world's biggest ever container ship disaster without a ship going bang," one shipping lawyer, who declined to be named, told Reuters.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.