Egypt's balance of payments deficit hits new high

Egypt ran an overall balance of payments deficit of $1bn for the first half of the 2014/15 fiscal year, compared to a surplus of around $2bn in the same period the year before, Egyptian media said on Sunday.

Egypt’s current account deficit - which marks the gap between the flow of goods, services and cash transfers into, versus out of the country - widened to $4.3bn. At the same time last year, the current account deficit stood at $866m, reported Mada Masr.

The Central Bank of Egypt attributes the deficit to $3bn in repayments of bonds and deposits. In November, the government repaid $2.5bn in central bank deposits made by Qatar, according to the Egyptian daily.

Egypt has been trying to pay back $7.5 billion which Qatar deposited into the Egyptian central bank after the 2011 revolution to help prop up the Egyptian economy during the presidency of Mohamed Morsi.

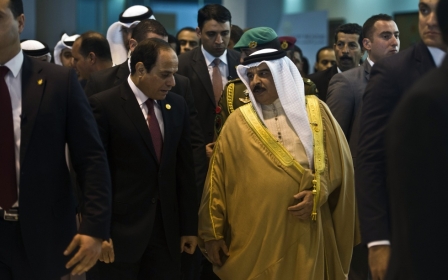

Relations between Cairo and Doha deteriorated since then-army chief Abdel Fattah el-Sisi removed Morsi in July 2013 and led a crackdown on the Muslim Brotherhood.

Since Morsi's overthrow, Egypt has relied on financial support from Saudi Arabia, the United Arab Emirates and Kuwait instead.

The ministry has defended the financial gap by saying that the widening deficit is a reflection of “the commitment and ability of the Egyptian economy to honour its external obligations on a timely basis”.

Analysts, however, have said that the figures are a reflection of a widening trade deficit, a net outflow of portfolio investment and a fall in grants to the government, which could be happening despite a rising tourism revenue and a small increase in foreign direct investment.

The current account deficit was driven by a 33.6 percent increase in the trade deficit, which exceeded $20bn, mostly driven by merchandise imports. From July-December, Egypt imported more than $32.4bn worth of goods, while exporting around $12.2bn worth according to Mada Masr.

Repayments of bonds and central bank deposits led to net outflows for both portfolio investment and central bank liabilities. A slight bump in foreign direct investment, which rose from around $2.07bn to reach $2.73bn was not enough to outweigh the overall outflow of funds.

These figures reflect more than a six-month period ahead of the Egypt economic investment conference held in Sharm el-Sheikh earlier this month. During the conference, Egypt signed investment deals worth more than $138 billion on the first two days of the conference, while its Arab Gulf neighbors - Saudi Arabia, Kuwait and the United Arab Emirates - pledged another $12 billion to help stabilise its economy.

World Bank negotiations

In order to further help stabilise Egypt's economy, the World Bank and Egypt finalised negotiations over a $500m loan, the Egyptian minister of housing Mostafa Madbouli announced in a press statement on Sunday.

The loan, allocated for "social housing", will be paid back by Egypt over the course of five years, reported Ahram Online.

The project, which was unveiled in late 2014, aims to build 1 million residential units across the country for low-income families.

Last September, the World Bank agreed to offer Egypt $1.5bn for financing social housing and sanitation projects for villages over a period of three years.

Managing director of the World Bank, Sri Mulyani Indrawati, said in her speech at the Sharm El-Sheikh conference earlier this month, that the bank is committed to supporting the Egyptian government in improving its social safety net to help the poorest members of society, reported Ahram Online.

The World Bank's commitment to Egypt currently includes 25 projects for a total of US$4.9bn as well as 43 trust fund grants worth US$190.2 million in the sectors of energy, transport, water and sanitation, agriculture, irrigation, health and education.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.