EU, US lift Iranian sanctions as part of Iran nuclear deal

The European Union and United States on Saturday agreed to begin lifting economic sanctions against Iran after the UN atomic watchdog announced that the country had complied with the terms of last July's landmark deal aimed at scaling down its nuclear programme.

The decision adopted by the EU's 28 member states to lift the sanctions still has to be published in the bloc's Official Journal to enter into force, which is expected to happen imminently.

Iran's President Hassan Rouhani said Saturday's implementation of the deal with world powers was a "glorious victory" for the "patient nation of Iran".

In comments posted on his official Twitter account, he wrote: "I thank God for this blessing & bow to the greatness of the patient nation of Iran. Congrats on this glorious victory!"

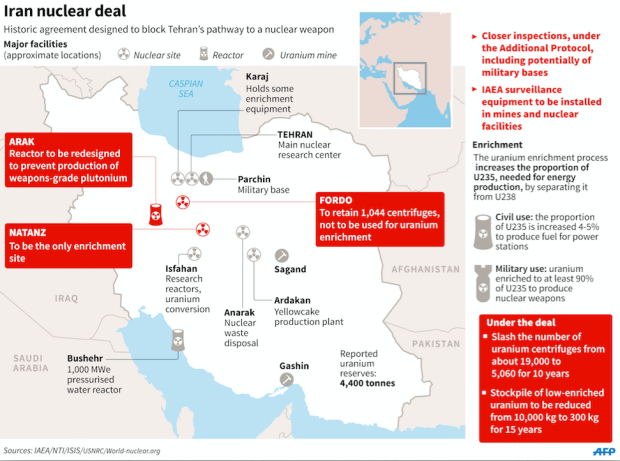

The historic nuclear accord between Iran and major powers entered into force after the UN confirmed that Iran has scaled back its atomic programme with the International Atomic Energy Agency saying its "inspectors on the ground verified that Iran has carried out all measures" agreed under the 14 July agreement.

EU foreign policy chief Federica Mogherini said that as a result "multilateral and national economic and financial sanctions related to Iran's nuclear programme are lifted".

"All sides remain firmly convinced that this historic deal is both strong and fair, and that it meets the requirements of all," Mogherini said in Vienna in a joint statement with Iranian Foreign Minister Mohammad Javad Zarif.

"This achievement clearly demonstrates that with political will, perseverance, and through multilateral diplomacy, we can solve the most difficult issues and find practical solutions that are effectively implemented," they said.

Ahead of the official announcement, Zarif said this "was a good day for the world".

"It's a good day for the people of Iran ... and also a good day for the region. The sanctions will be lifted today," Iran's official ISNA news agency reported him as saying.

The announcement was made in Vienna, where the nuclear agreement with world powers was reached last July, and where world leaders including US Secretary of State John Kerry gathered for last-minute talks on the deal.

Along with IAEA's announcement, Iran can now reclaim about $100bn in frozen overseas assets, with a crippling ban on oil exports also to be loosened.

Restrictions on Iran’s shipping, energy, banking and automotive sectors will begin to be lifted, along with so-called secondary sanctions, which penalised foreign nationals with large dealings in Iran, being cancelled.

On Saturday, before the expected IAEA announcement, Iranian media said the US had already relaxed restrictions on civilian aircraft, which had seen Iran receive no new aircraft parts from the West in decades. The Iranian stock market responded positively to the latest development, setting new highs on the back of the news.

However, sanctions on nuclear materials and those in place on Iran’s alleged funding for terrorist groups, its human rights abuses and its military programmes will all remain in place.

The EU, which on Friday said it was ready to act as soon as the IAEA gave the green light, will initially provide Iran with far more relief than the United States.

“We have been having a great deal of interest from investors since the deal in Vienna despite recent events in China [where there has been stock market turbulence and shrinking economic growth projections],” Sanam Mahoozi, PR manager for Tehran-based Turquoise Partners investment firm, told Middle East Eye.

“Some of [the] multinational energy companies have had a presence in Iran prior to sanctions and have indicated their willingness to work with Iran when legally able. Iran’s vast energy resources are underdeveloped, and the country needs investment in this field. Iran’s potential is based on its population, vast resources as well as its strategic location between Europe and Asia,” she said.

All eyes on oil

Iran is the world’s fourth-largest country in terms of oil reserves, with the government previously saying that it will fast-track oil production as soon as sanctions are lifted.

"Can we wait and not produce after lifting the sanctions? Who can accept it in Iran," oil minister Bijan Zanganeh told CNN in an exclusive interview in September last year.

According to Zanganeh, Iran could see its production swell by as much as 1.5 million barrels a day before the end of 2016, bringing the country’s total production levels to some 4.2 million barrels a day.

Some analysts see this as too optimistic, with most saying that a target of 500,000 million barrels, at least initially, would be more realistic for the OPEC producer.

“How fast Iran can put oil back on the market will now be a key issue for oil markets, with many sceptical that it will be able to do this nearly as fast as it has forecast," said Ric Spooner at CMC Markets.

Global oil prices have fallen by more than 75 percent since last summer - a post-war first - with Brent crude on Saturday falling to below $30 a barrel for the third time in a week. Analysts believe that further shocks may be around once restrictions are lifted, possibly pushing oil down closer to $20 a barrel, James Williams of oil and gas consultancy WTRG Economics told AFP.

The oil price collapse has been caused by a glut in production, with the oil-production cartel OPEC ruling to keep production steady and therefore prices weak, and on fears of a global economic slowdown, with investors particularly concerned about economic data coming out of China, one of the world's leading energy consumers.

Many analysts believe that Iran’s regional rival Saudi Arabia has pushed OPEC to keep production steady as a means of damping demand for Iranian oil and US shale oil and gas, but Iran's government seems to have remained defiant.

Reports indicate Iran already had 13 large and fully loaded crude oil carriers ready and was planning to ship the fuel to India the minute sanctions were eased. The shipment is so large it will meet India's import needs for almost a week, Reuters said.

Unlike many other large oil producers, who have long exploited their supplies, causing production to become more difficult and expensive, the relative lack of investment should give Iran a lot of breathing room, even during these turbulent economic times.

Ali Ghezelbash, deputy chairperson of the European Iran Research Group, told MEE that he believes that Iran's production break-even point - the calculation of how much oil would have to retail for in order to make extraction viable - may be about $15, depending on the field.

He also expects that lifting of the sanctions will help other, less-talked-about, Iranian sectors such as metal production to boom.

“Iran actually produces more steel than the UK or France,” Ghezelbash said. “It is one of the largest metals producers in the world overall and a top five global producer of cement. It has a lot of this kind of industry based upon the gas-intensive approach.

“The challenge of course is that none of these other industries may be as lucrative in terms of a cash flow as the crude [oil] industry, but even at $40 and $50 a barrel, the [oil] industry basically prints money as far as Iranian production and its costs are concerned."

Hurdles ahead

Even so, challenges remain.

The Iran deal with foreign powers operates on a snap-back system, meaning that sanctions would be re-introduced if Iran were deemed to violate the terms of the agreement in any way. Some of the deal's provisions are also set to run out in 15 years, meaning that Iran could revert to enriching uranium to a higher level at a later stage.

"Iran may test the boundaries of the agreement. It is critical that violations do not go unpunished, or the deal could be killed by a thousand paper cuts," Kelsey Davenport, of the Arms Control Association, said in a statement.

This year's US presidential and congressional elections could also spell trouble for the deal, with many Republican presidential candidates likely to take a tougher stance on Iran. While many believe the deal will help boost the reformist camp in Iran, many conservatives have been less receptive to the new relationship with the West.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.