Saudi Arabia and SoftBank: Future tech fund slump costs Riyadh billions

When Saudi Arabia’s Public Investment Fund was brought under the direct control of Crown Prince Mohammed bin Salman in 2015, and the fund’s programme was announced in 2017, it was under a mandate to invest at home and abroad to be a financial enabler of the kingdom's economic diversification efforts.

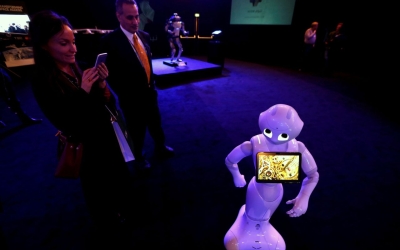

One of its earliest and biggest splashes was in Tokyo-based SoftBank’s $100bn Vision Fund, which invested in high-profile technology companies and, in keeping with its name, aimed to bankroll futuristic developments in artificial intelligence, robotics and gene-sequencing.

Saudi Arabia, along with Abu Dhabi’s sovereign wealth fund, Mubadala, contributed almost two-thirds of the fund’s capital, with PIF investing some $35bn.

The investment with the Japanese conglomerate seemed a perfect match for the kingdom’s Vision 2030, outlined in 2016, with SoftBank making a commitment to enable diversification efforts through involvement in technology, renewable energy and in MBS’s $500bn Neom mega-city project on the Red Sea coast.

SoftBank’s links to Saudi and MBS, by then the kingdom’s crown prince, came under scrutiny in October 2018 following the murder of journalist Jamal Khashoggi, but it largely managed to ride out the negative publicity.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Just a year ago, the media gushed about SoftBank being a major disruptor on the start-up and venture capital tech scene, while a second Vision Fund was announced. Riyadh was initially keen on getting involved but backed away last year as problems emerged with the first fund, according to Rory Fyfe, managing director of Mena Advisors, a regional research and consultancy company in London.

In late 2019, financial issues started to surface at US workspace company WeWork, in which SoftBank had invested $18.5bn, as well as other investments. The year ended for SoftBank with a $13bn loss.

Then in 2020, problems started to mount across its portfolio as the economic fallout of the Covid-19 pandemic spread. Companies in which it had invested, such as in Uber, where it had put in $9.3bn, saw their share prices drop, along with scores of other firms, wiping out a further $18bn for the Vision Fund in the first three months of the year.

‘An absolute car crash’

Of the 88 companies the Vision Fund had invested in, SoftBank announced in mid-May that it expected 15 to be successful and that 15 could go bankrupt.

“This bet (by Saudi Arabia) has been disastrous, first WeWork, and now more bad news. It is an absolute car crash. They have lost a colossal amount of money,” said Hugh Miles, editor of Arab Digest, a private members club producing a newsletter on political-economic issues, in Cairo.

But according to Fyfe, the damage to PIF’s holdings in the Vision Fund “are not as serious as the headlines suggest”.

He cited gains in parts of SoftBank’s portfolio over the past year offsetting some of the more recent losses. “Uber has since regained most of the lost ground, as have others, and there are holdings such as Guardant Health that have done incredibly well. So it’s not a huge success story, but also not a disaster, aside from WeWork, which seems unlikely to ever recover,” he said.

Out of the $35bn PIF had invested in the fund, some $21bn was in preference shares paying 7 percent a year. What was not clear was to what extent Saudi Arabia had been receiving such interest payments, and if PIF would garner better treatment due its significant investment.

“PIF is a relatively senior investor compared to others, so may lose less, but there are lots of question marks, and the devil is in the details,” said Rachel Ziemba, an adjunct senior fellow at the Center for a New American Security in Washington.

‘A bad investment for everyone’

While the outlook for SoftBank is not rosy, with the planned Vision Funds expected to be scrapped, the impact for PIF may be an “isolated problem from their point of view”, said Miles. “Maybe PIF’s other investments, like in online education, will offset the losses.”

The PIF is structured into different units, meaning losses in any one investment segment do not overly impact the whole business. “SoftBank is an economic headache for the Saudis, but one should not overstate its importance to the overall economy,” added Miles.

Indeed, with most investors in SoftBank and its Vision Fund having taken a hit, Saudi Arabia is not alone. “SoftBank was a bad investment for everyone, in the way it was conceived and executed,” said Theodore Karasik, a senior adviser to Gulf State Analytics, a Washington-based consultancy.

“It was a long-term investment approach (by PIF), but ran into a brick wall. Politics got a bit too much mixed in, and that might leave a bad taste in some Saudis’ mouths.”

While a 7 percent annual return on PIF’s investment in the Vision Fund - around $1.47bn a year - was a motivator for investment, “it probably wasn’t the big reason. It was the structure”, said Ziemba.

Saudi Arabia had hoped to take advantage of the Vision Fund’s stakes in so many disruptor companies and cutting-edge technologies at a local level as part of economic diversification as well as in its futuristic plans for Neom City.

As MBS told Bloomberg in a 2017 interview: “We want the main robot and the first robot in Neom to be Neom, robot number one. Everything will have a link with artificial intelligence, with the Internet of Things - everything.”

There are opposing views as to whether the Neom project will be shelved or not, depending on the government’s finances going forward and decisions taken by the royal court.

So far, the sovereign wealth fund has been able to go on the offensive despite the SoftBank debacle, investing $7.7bn this year in blue chip companies, including Facebook, Disney and major international oil companies.

“The SoftBank numbers are a disaster when taken within their own scope, but at the same time, the investments PIF has done during the Covid-19 pandemic, across a number of industries and countries, will pay off in the future," said Karasik. "There is credit and cash available to make strategic investments around the world.”

Oil price woes

The bigger impact to PIF’s investment chest are tied to Aramco, the national - and the world’s largest - oil company. Its revenues have been slashed due to lower oil prices, while further privatisation is now in doubt.

Riyadh had initially wanted to float 5 percent of Aramco through an initial public offering (IPO) to raise up to $100bn and bolster PIF’s $300bn fund. In December, it sold a 1.5 percent stake for $26.5bn.

“The longer-term, future sales of Aramco stock were intended to transform PIF into a $3tn fund. That will be harder and less lucrative given the scepticism of international investors in the original IPO when the oil price outlook was far rosier,” said Fyfe.

The drop in oil price has also impacted Aramco’s 2019 plans to acquire a 70 percent stake in the country’s petrochemical giant Sabic from the PIF for $69.1bn. With Sabic’s value dropping 40 percent this year, the deal is now potentially worth $45bn, of which $25bn was to be paid upfront by Aramco.

“The decline in oil prices is an immediate impact on the Sabic deal and how Aramco IPO revenue is used,” said Fyfe.

The money from the Aramco sale could also be redirected to balance the government’s strained budget.

“Downsizing the Sabic deal is basically reallocating state funds from PIF investments to the budget … It is not entirely clear where these [IPO] funds have gone though,” Fyfe added.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.