How Imran Khan's fall could push Pakistan closer to Saudi Arabia

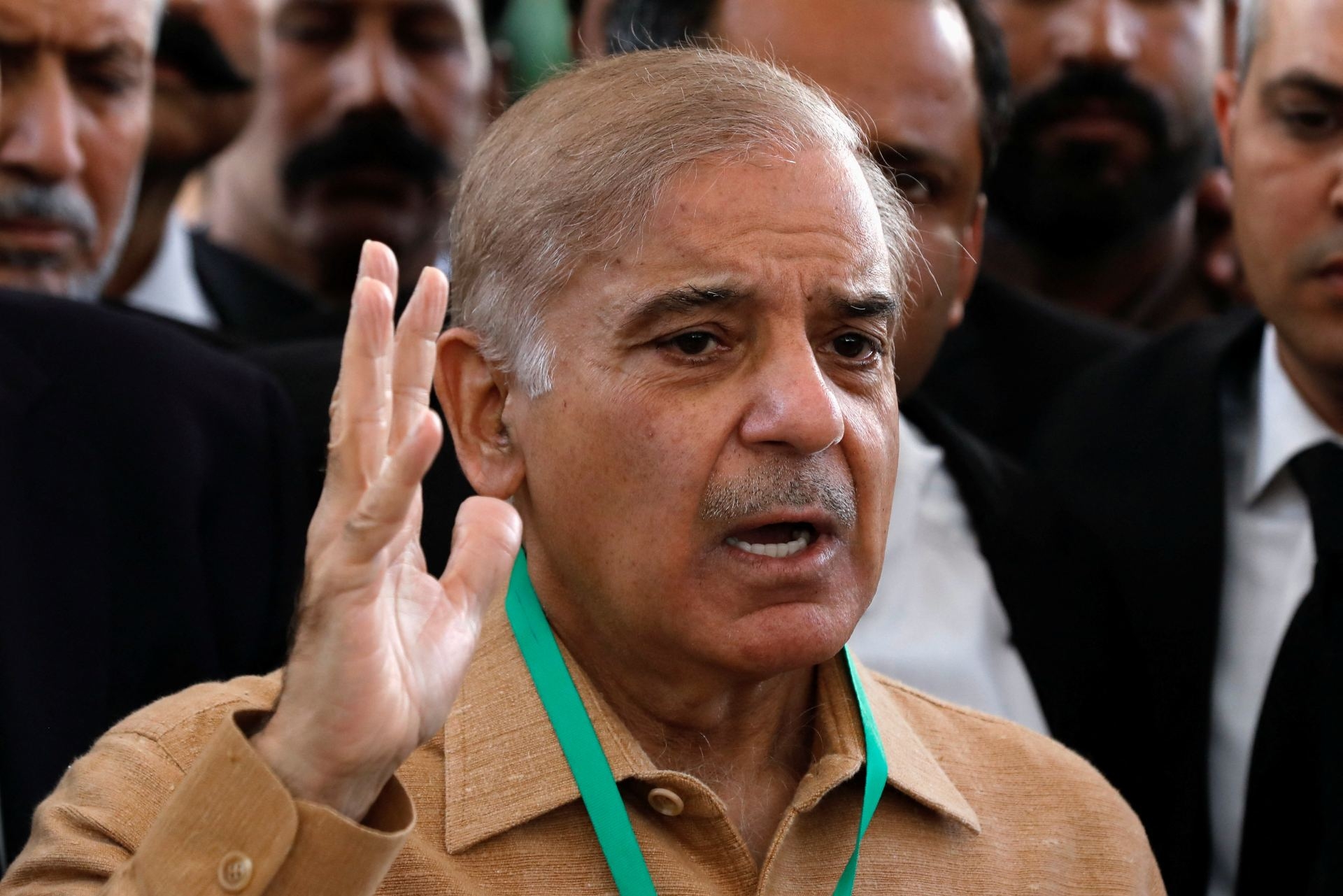

Pakistan's new prime minister, Shehbaz Sharif, will find it difficult to consolidate his country's position in the Arab and Muslim world and match his ousted predecessor Imran Khan's charisma as a global statesman, analysts have told Middle East Eye.

Sharif was sworn in a week ago in the final act of a political drama in Islamabad which saw Khan defeated in a parliamentary vote of no confidence in his near-four-year leadership after Pakistan’s supreme court ruled that his efforts to block the vote were unconstitutional.

But Khan's popularity has only been consolidated by the manner of his departure from office - the former cricket star has been pulling in huge crowds at his political rallies across the country - with many analysts predicting early elections in which he could yet make a comeback.

Some of Pakistan's key international partners have also been watching unfolding events with caution.

Saudi Arabia, which has been Pakistan's closest ally in the Gulf, only congratulated Sharif five days after he had been sworn in, even though Sharif had made a special mention and thanked the kingdom for support in his inaugural speech, hinting at Saudi Arabia’s quiet nod of approval to his premiership.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Sharif, the brother of another former prime minister, Nawaz Sharif, has served several terms as chief minister of Punjab, Pakistan’s most populous province, and is considered a capable regional administrator.

But he lacks experience in international affairs. His career has also been chequered by corruption allegations, including an ongoing case - currently adjourned - in which he is accused of laundering 16 billion rupees ($90m). Sharif denies all allegations.

'Strong personalities'

Hussain Nadim, the executive director of the Islamabad Policy Research Institute, a Pakistani foreign ministry think tank, told MEE that Pakistan's change of leadership was unlikely to affect its relationship with Saudi Arabia in broad terms.

"Pakistan's Gulf policy is institutionalised, its strategic importance runs very deep. We have agreements and understandings which are decades old," he said.

But, Nadim added, Sharif could struggle to engage with Saudi Crown Prince Mohammed bin Salman quite as effectively as Khan. The Saudi king and crown princes have traditionally enjoyed direct lines of contact with Pakistani prime ministers and military chiefs, rather than relying on diplomatic channels, he explained.

"That's where strong personalities can influence relations. Mohammed Bin Salman and Imran Khan had really hit it off, their personalities had matched. While Pakistan needs Saudi Arabia for its endemic economy worries, Saudi Arabia wants Pakistan even more so, as western security guarantees fade," said Nadim.

Khan's recognition of the importance of cultivating a personal relationship with the crown prince was evinced when he met the Saudi royal at the airport on his first visit to Pakistan in 2019, and then personally drove him back to his official residence.

Under Mohammed bin Salman's rule, thousands of Pakistani prisoners have been released from Saudi jails, many of whom had been imprisoned for immigration offences and petty crimes. Saudi Arabia has also announced several billion dollars’ worth of investment projects in Pakistan.

Khan, meanwhile, responded to Saudi requests to take a tougher line on Iran over its attempts to recruit young Shia men from Pakistan and Afghanistan to fight alongside the Houthis in Yemen.

"This kind of old school diplomacy or statesmanship isn't seen anymore, and the new prime minister will find it difficult to fill Khan's shoes," said Nadim.

Other analysts cast the relationship between Mohammed bin Salman and Imran Khan in different terms, suggesting that the former Pakistani prime minister's pro-Islam rhetoric and aspirations as a spokesman for the Muslim world - tendencies on display during Pakistan’s recent hosting of the foreign ministers’ meeting of the Organisation of Islamic Cooperation - had set alarm bells ringing in Riyadh.

"Imran Khan's growing stature as a global statesman, loudly raising the issues of Islamophobia, Kashmir, and Palestine around the world was overshadowing Mohammed Bin Salman as the leader of the Muslim world. This was seen as a threat by Bin Salman," Sami Hamdi, head of political risk at International Interest, told MEE.

"While MBS is taking Saudi Arabia through a de-Islamisation process, organising raves in the desert, opening bikini beaches, banning the call to prayer on loudspeakers from mosques, Imran Khan's pro-Islam rhetoric was fast gaining popularity in the Gulf, and across the Middle East."

Hamdi said Khan was constantly pushing the Gulf kingdom on sensitive matters of geopolitical importance.

"By convening an OIC conference on Afghanistan as soon as US and Nato forces wrapped up operations in the country - Saudi wasn't comfortable because they weren't sure how to react.

"Also, at the recently concluded OIC summit when Khan said that the Muslim world had failed Palestine, the Gulf leadership was particularly angry because they are seeking closer ties with Israel.

"And then in the last few days, the UN resolution on Islamophobia, he's making MBS look like a weak leader."

Hamdi suggests that Khan had become too much of a political headache for the Gulf kingdom and that many there would be happy to see him gone.

"They are happy with Sharif, here is somebody who is less loud and more amicable to taking a back seat."

Removal disapproval

But Umar Karim, an assistant fellow at the King Faisal Centre for Research and Islamic Studies, told MEE that the manner of Khan’s removal from office – amid unproven allegations made by Khan and repeatedly denied in Washington of a US plot to oust him – was likely to have been met with disapproval in Riyadh.

"At a time when Mohammed Bin Salman and [Abu Dhabi Crown Prince] Mohammed Bin Zayed were avoiding phone calls from the US president and while Khan was taking an anti-US line, it won't go down well with the Gulf leadership that stakeholders within Pakistan buckled to US pressure and saw off a hugely popular prime minister," said Karim.

Speaking prior to Khan’s defeat in parliament, a State Department spokesperson said there was “absolutely no truth” in allegations that the US was encouraging opposition MPs to vote against him, and stressed Washington’s support for “Pakistan’s constitutional process and rule of law”.

Karim sees growing differences of opinion between Khan and Pakistan’s powerful military chiefs as dealing a heavier blow to the former prime minister’s political fortunes.

"Pakistan's foreign policy orientation is inspired by its military, which wasn't happy that Khan was pushing an anti-West foreign policy agenda," he said.

At the Islamabad Security Dialogue earlier this month, for instance, there were clear signs of tension between Khan and the Pakistani military chief, General Qamar Javed Bajwa.

Bajwa criticised the Russian invasion of Ukraine, contradicting the civilian government's stance, and called for the removal of an unofficial blockade of US military hardware for the country.

"This leaves a huge trust deficit between the Gulf kingdoms and the country's military," said Karim.

"The Pakistani military chief, by criticising the Russian invasion of Ukraine has gone against the line taken by Saudi and the UAE. This has some leaders in the Gulf wondering whether Pakistan is shifting from the Chinese bloc to the US-led bloc."

According to Karim, Pakistan's military is signalling that it would like to sit between both blocs in a balancing act that would require both the military and the civilian government to commit further to the Gulf.

"Pakistan's military's reliance on US military equipment, and on funds from the US economic aid package and the IMF are two major reasons why the country is eager to have one foot in the western bloc," he said.

The US had recently blocked the sale of Turkish-manufactured attack helicopters for the Pakistani military by denying third-party certification for engines manufactured by the US.

Pakistan has also been on the Financial Action Task Force's (FATF) grey list since June 2018, for not effectively countering terrorism-linked financing and bringing in anti-money laundering measures.

One way of displaying Pakistan’s commitment to the Gulf, according to Karim, is through closer military-to-military cooperation, though, he said “the civilian government's posturing will play a key role in further improving relations”.

Pakistan has recently concluded a two-month training exercise with the Saudi heavy mechanised brigade, including tanks and artillery. Pakistani soldiers have in the past conducted border security operations on the Saudi-Yemen border, and helped the kingdom in strategy, consulting and training roles.

A change of leadership has done nothing either to improve Pakistan’s economic situation and, with the country’s foreign exchange reserves fast depleting, Shehbaz Sharif will be as dependent on Saudi financial help as his predecessor.

According to Karim, the price of that help may yet be a tougher stance on Iran.

"If Pakistan wants further financial help from the Gulf, the Saudis will want them to do more," he said.

"And if you notice, Iran hasn't yet congratulated the new prime minister, as it sees the new government might tilt harder towards the Saudis."

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.