Iran economic crisis: Foreign exchange chief arrested, new forex plan outlined

The Iranian central bank's top foreign exchange official was arrested as part of a crackdown on financial fraud, the judiciary said on Sunday. Ahmad Araghchi's detention happened one day after he was fired and as a new plan was revealed to ease forex rules amid a plummeting currency and rising prices.

Araghchi, who was a vice-governor at the bank in charge of forex, was arrested along with several other unidentified individuals including a government clerk and four currency brokers, said judiciary spokesman Gholam-Hossein Mohseni Ejeie in a statement, according to state broadcaster IRIB.

The arrests come amid heightened tensions in the run-up to the reimposition of US sanctions on 7 August, following Washington's withdrawal from the 2015 nuclear deal. Iran’s oil exports may fall by as much as two-thirds this year because of the US move.

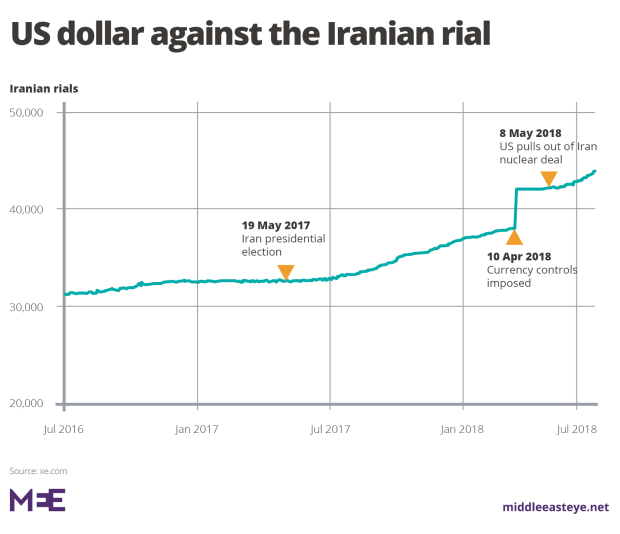

Iran’s government is struggling to quell anger at rising prices and assure the public that it can counter the economic crisis triggered by the sanctions, Bloomberg said. It is also fighting to stem the rial’s decline, which has slumped to record lows against the US dollar this year amid street protests.

Journalists reported a heavy build-up of riot police on Sunday night, including at least one armoured personnel carrier, in the town of Karaj, just west of Tehran. The region has seen days of often-violent protests, AFP reported.

New plans to help economy

On Sunday state television reported outlines of the plan to ease foreign exchange rules, including lifting a ban on the sale of hard currency at floating rates by exchange shops for purposes such as overseas travel, Reuters reported. Exporters would be allowed to sell hard currency to importers, and there would be no limit on bringing currency or gold into the country.

Hard currency will be made available at a subsidised rate for the purchase of basic goods and medicine, state television cited a government statement as saying, according to Reuters.

IRIB had reported earlier that the new policy may see imports of essential items, including medicines, remain at the official government exchange rate of 42,000 rials to the dollar.

The unofficial rate for the rial fell to a record 119,000 last week, before rallying in response to the government's efforts to address the crisis, and stood at 98,500 on Sunday night.

State media said protesters attacked and tried to burn down a seminary in the Karaj area on Friday night, and that at least one person was killed, allegedly by demonstrators.

There have been days of sporadic protests, including in key cities such as Isfahan, Mashhad and Shiraz - but severe reporting restrictions have made it impossible to verify social media footage and official accounts.

The government of President Hassan Rouhani has also faced heavy criticism from conservative opponents, who have demanded action on corruption and renewed efforts to rescue the economy.

On Saturday, Grand Ayatollah Hossein Nouri-Hamedani said "economic corruptors" must face justice.

"People are upset when they hear that someone has embezzled billions while other people are living in tough conditions," he said in a speech, according to the conservative Tasnim news agency.

Iran's rial has lost more than half its value since April, in part over fears of renewed sanctions, but also thanks to an ill-judged attempt to fix the value of the rial that month and make it illegal to trade at a higher rate.

That decision triggered widespread currency speculation on the black market, and accusations that individuals with political connections were abusing the system.Rouhani also sacked the governor of the central bank, Valiollah Seif, last week and replaced him with Abdolnasser Hemati, the former head of Central Insurance of Iran.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.