International energy consortium bids for offshore exploration in Lebanon

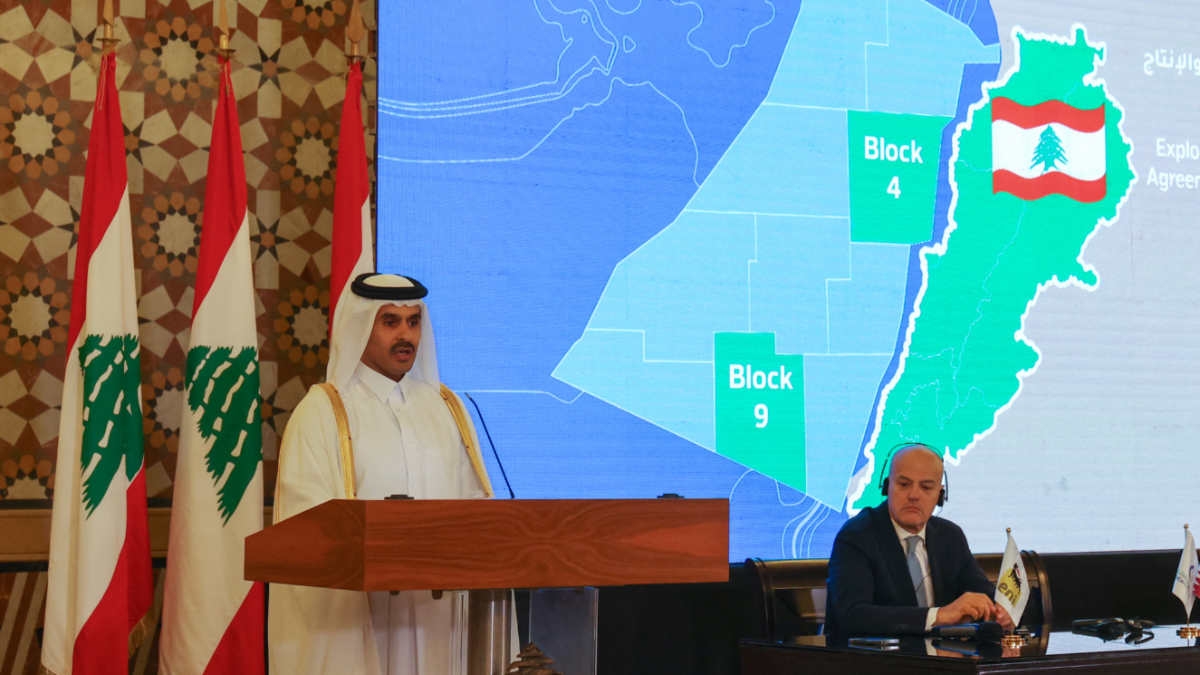

A coalition made up of Total Energies, Eni, and Qatar Energy made a last-minute bid on Monday to drill for oil and gas in Lebanese waters, Lebanon's energy ministry said.

The consortium made the bid for rights to explore blocks 8 and 10 in Lebanese waters. The move was welcomed by Lebanon’s energy minister as a “positive development” after the government had to regularly extend the deadline for the tender since it was offered in April 2019.

Lebanon first launched a licensing round for hydrocarbon exploration in its waters in 2013. But political gridlock, corruption, and infighting have dragged the process out.

Those efforts received a boost last October when Lebanon agreed to demarcate its maritime borders with Israel in a deal brokered by the US.

Last month, Total Energies, Eni, and Qatar Energy began drilling in block 9, which falls alongside the newly delineated maritime border. The area includes the Qana field, which was a point of contention with Israel during the negotiations.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

As part of the US-backed agreement, Lebanon received rights to the Qana gas field, with Israel enjoying a share in some of the profits of any gas discovered there.

While Qana is viewed as one of the more promising of Lebanon’s offshore fields, the US’s top energy advisor, Amos Hochstein, previously cautioned that it's "going to take a few years to get gas out of that [Qana] field”.

Any sign of interest in the offshore blocks by energy giants is likely to be welcomed by Lebanon’s caretaker government.

The Mediterranean country’s economy has collapsed, with GDP down 40 percent and the Lebanese pound losing 95 percent of its value against the dollar since 2019.

The financial implosion has been widely blamed on Lebanon's political class, which has refused to create a new government that can begin the reforms needed to unlock international aid.

Western officials have warned Lebanon’s elite against banking on the discovery of energy reserves in place of badly needed reforms. Meanwhile, energy experts have warned that Lebanon is still years, if not decades away from actually monetising any gas discoveries.

In April 2020, the same consortium of energy companies halted drilling in block 4 north, citing a lack of commercially viable gas to develop.

The maritime agreement, however, has buoyed Israel’s energy endeavours, with the Israeli government seeing a boost in natural gas royalties in the first half of 2023 after its Karish field became active.

Eastern Mediterranean countries have been eager to position themselves as alternate energy suppliers to Europe amid the war in Ukraine.

Israel and Cyprus are in talks over a pipeline, MEE previously reported, but Egypt also wants to receive more Israeli gas.

Prime Minister Benjamin Netanyahu said in September that Israel will announce its decision on the preferred route to Europe in 3-6 months.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.