Libyan oil tanker left stranded in Med after UN blocks 'illicit' crude sale

The United Nations on Thursday blacklisted an oil tanker bound for Malta with a shipment of crude that it says one of Libya’s rival governments was attempting to sell to a company based in the United Arab Emirates.

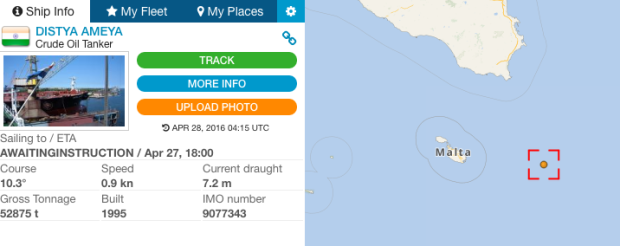

The Distya Ameya was added to the UN blacklist for “attempts to illicitly export crude oil from Libya”.

It is carrying 650,000 barrels of crude loaded from the Libyan oil terminal Marsa el-Hariga, and approved for sale by an eastern-based oil company, which is not internationally recognised as the legitimate authority to sell Libya’s oil.

The Tripoli-based National Oil Corporation (NOC) is the only official seller of Libyan oil, but the Tobruk-based House of Representatives (HoR) set up a rival company with the same name last year to try and generate funds from crude.

The HoR has also failed to approve the UN-backed unity government established in Tripoli in recent weeks.

The UN blacklisted the tanker after the Tripoli-based NOC informed the UN-backed Presidency Council in the capital, which then requested assistance from the international body.

A Security Council diplomat told AFP the tanker's final destination could be the UAE.

On Monday the Distya Ameya tried to sail to Malta, where it was due to sell its cargo to DSA Consultancy FZC, an oil company based in the UAE, a Gulf state that has provided material and financial support to the HoR.

But Maltese authorities refused to allow the Distya Ameya docking rights, and since then the tanker has remained in international waters in the Mediterranean Sea.

Open source maritime tracking software shows that the Distya Ameya is currently anchored off the east coast of Malta, and is “awaiting instruction” as to where to sail to next.

The UN said in its statement on the tanker that it is sailing under an Indian flag but that it “may have been sold recently to an unknown buyer and the vessel’s name may have changed to Kassos”.

The potential sale of oil by the eastern authorities of Libya prompted fears of partition among analysts should it go through.

Mattia Toaldo of the European Council for Foreign Relations told MEE: “If this shipment is not blocked, it would send a very powerful signal that the east of Libya can have its own financial resources and work towards de facto partition, on the lines of what Iraqi Kurdistan has been doing now for decades.”

UN envoy to Libya Martin Kobler told MEE on Saturday that he did not expect the eastern-based oil company to sell crude because “importers cannot afford to take illegal oil”.

The US State Department said on Monday that it was “very concerned” about the attempted sale and it reiterated that “all purchases of Libyan oil must continue to be through the Tripoli-based National Oil Corporation".

Libya has Africa’s largest oil and gas reserves, which provides 99 percent of government income. Since the NATO-backed 2011 revolution that overthrew long-time leader Muammar Gaddafi, oil production has plummeted from 1.6m barrels a day to just 360,000 barrels.

The dramatic fall in oil production has been the result of a civil war that has been fought since 2011 and which has seen various militias and governments battle for control of the country.

Since late 2014 Libya has been governed by two rival administrations, one based in the east, the HoR, and the other situated in Tripoli, the General National Congress (GNC).

United Nations-backed efforts to resolve the crisis have resulted in the establishment in Tripoli of an internationally recognised Government of National Accord (GNA) led by prime minister-designate Fayez al-Sarraj, which has started to assert its authority but has yet to start work officially.

The HoR has yet to vote on approving the GNA and continues to enjoy the backing of the Libyan National Army, headed by veteran General Khalifa Haftar.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.