Money for nothing: Riyadh's cash injection does little to revive Yemen

TAIZ, Yemen - Abdul Salam Faisal stands outside a school in Taiz, selling sandwiches and drinks to students to earn a thousand rials a day to feed his own family. His takings have remained static for years, but food prices in war-torn Yemen have doubled, and he cannot make ends meet.

The 39-year-old has little education and knows nothing of economics. But he does know that everything is more expensive, his earnings are worth almost nothing and, even despite Saudi Arabia's promises to save the country's economy, there is no end in sight for his family.

"In 2015 I used to buy 25kg of flour for 2,600 rials and today it costs more than 5,000," Faisal told Middle East Eye.

I cannot provide for my family. I know many others who cannot

- Abdul Salam Faisal, sandwich seller

"I cannot provide for my family. I know many others who cannot buy food and they do not have any source of income after their breadwinners lost their jobs. They just pray to God to help them."

Yemen's economy and currency has crashed in three years of war. Millions of jobs have been lost or go unpaid, everything costs more, and the Yemeni rial has nosedived against the US dollar, making imports in a famine-threatened country hugely expensive.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

The crisis came to a head last Wednesday when the rial crashed to 520 to the US dollar - pre-war rates were about 215. Riyadh's promises were kept, as it injected $2bn into Aden's central bank to prop up the currency amid warnings of impending catastrophe.

But the move appears to have failed - while the rial initially rallied to 400 to one US dollar, it soon began falling again and stood at 450 on Thursday this week.

No trickle-down effect

And food prices remain as high as ever - the Saudi cash injection did not reach the street, and traders still cannot buy dollars for imports and must pay inflated black market prices for their foreign currency.

Yousef al-Aghbari, a food trader in Taiz, told MEE that the black market rate for one dollar was still hovering around 500 rials.

"Banks refuse to sell us dollars because they still don't have enough," he said. "The black market still controls the situation - their rate is 500 rials, and that means food prices remain as high as they were before."

Officials in the Saudi-backed Yemen government announced the cash injection as a saving grace for their country.

The Yemeni prime minister, Ahmed Obaid bin Daghr, said: "If there are joint interests among alliances, saving the rial is the first among them. Saving the rial means saving Yemenis from inevitable hunger."

The president, Abd Rabbuh Hadi, sent a message of thanks to the Saudi king, Salman, although his pleas for the cash had begun as far back as last November.

But it soon became clear it was not enough.

A source in the Yemeni government told MEE that last week's move came after urgent appeals. "But this is not enough to solve the crash, we need other countries to help us."

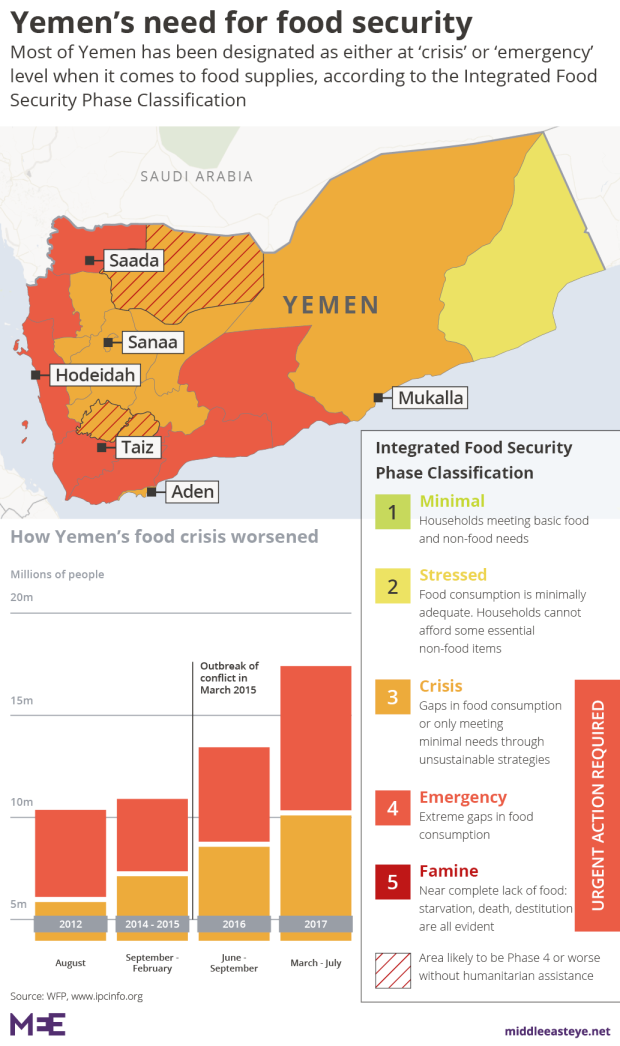

Millions of Yemenis remain reliant on donations and humanitarian aid - the latest UN estimates suggest 20.7 million people are in need, and half of cases are considered "acute".

An estimated 17 million people – 60 per cent of Yemen's population - are "food insecure" while seven million people do not know where their next meal is coming from.

Yemen's cash crisis is further complicated by the existence of two central banks - one in Hadi-controlled Aden, the other in the Houthi-controlled capital, Sanaa.

Aden's decision to float the rial in August to equalise official and black market rates was not followed by Sanaa.

Oil and gas products formed about 80 percent of Yemen's pre-war exports.

Since the war, many of the oil and gas fields have shut down as they are in conflict zones - meaning production has dried up to such an extent that the country now imports fuel.

Counting the cost

If the war continues, so will the economic crisis, and many Yemenis place the blame squarely on Saudi Arabia.

Naef al-Aswadi, a Taiz bus driver, is one of them.

"Nothing good has come from the Saudi coalition's war on the Houthis," he told MEE. "The war has stained this country, and the economic crisis is only one effect of the war.

"The Saudi coalition was part of the economic crisis in Yemen and they should be part of the solution, they must support the rial so we can get back to where we were in 2014."

If the Saudis got out of Yemen, there would be no death, and prices would fall

- Naef al-Aswadi, bus driver

Aswadi, like many other Yemenis, considers Saudi Arabia to be at fault in the Yemen war and responsible for the death of thousands, so believes it should help Yemenis.

"If the Saudis got out of Yemen, there would be no death, and prices would fall. Saudi Arabia has sinned against Yemen."

Houthi supporters say the Saudi cash was not given to help Yemen, rather it was handed over to divert attention and absorb anger directed against Saudi Arabia.

Mohammed al-Dailami, a political analyst aligned with the Houthi movement, said: "The deposit did not affect food prices. Commodities are expensive as ever as traders are still buying dollars on the black market.

"The deposit simply fell into the hands of Hadi and his corrupt government, and never reached local banks."

The long, sharp shock

Ahmed Saeed, an economic analyst for Yemen's central bank in Sanaa, which is controlled by the Houthis, said Yemen's economic prospects would not improve until it was able to export again.

The Saudi deposit may help shore up the rial, but "the problem of teachers not getting paid and the loss of the rial's value is because of the lack of exports".

Back in Taiz, Faisal has seen no change on the streets, and expects prices to rise even further.

"I heard that prices fell after the Saudis gave Yemen the cash, but I found no evidence when I went to the market," he said.

"During the last three years prices kept soaring and I fear that one day I will not be able to buy food for my family.

"Nothing is cheap in Yemen, and we have to pray God for help us as our government does not care about us."

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.