Oil price hits 11-year low, spelling trouble for exporters in Gulf

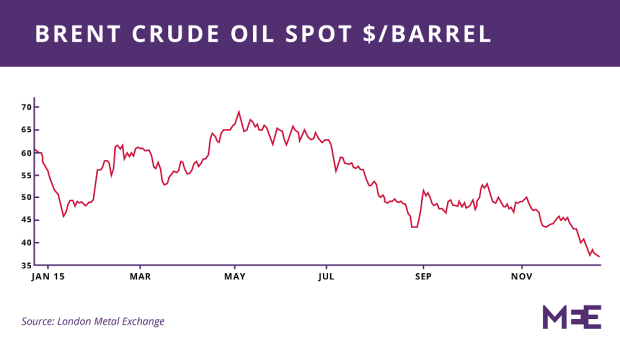

The price of Brent crude oil continued to slide on Monday, reaching 11-year lows amid ongoing issues of oversupply.

Earlier in the day, oil fell by more than 2 percent to a low of $36.05 a barrel, bringing it down to levels unseen since 2004. While it had recovered slightly by early afternoon, most analysts predict that downward pressures – which have seen oil lose a fifth of its value in the past month and a third since early October - will continue.

"Really, I wouldn't like to be in the shoes of an oil exporter getting into 2016. It's not exactly looking as if there is light at the end of the tunnel any time soon," Saxo Bank senior manager Ole Hansen said.

The persistently weak price is believed to be hitting many oil-producing countries in the Gulf hard, with the International Monetary Fund earlier this year warning of a growing fiscal deficit in Saudi Arabia due to the falling price.

The oil-rich kingdom is widely seen as being behind the Organization of the Petroleum Exporting Countries' decision last year to keep production levels steady despite downward price pressure. Riyadh, say analysts, has kept production high and therefore prices low to ward off investment in regional rival Iran and also in shale gas production in the US.

Since the decision by the Vienna-headquartered OPEC oil cartel, crude has fallen by more than 60 percent from $100 a barrel. The cartel once again voted to keep production steady in November, reportedly as a result of strong pressure from Riyadh.

Last week, US politicians lifted a 40-year ban on crude oil exports, threatening to push prices down even lower and further flood the market with cheap oil. Iranian oil supply is also expected to resume in 2016, after long-held sanctions are eased and lifted.

"The facts are clear: lifting the ban [in the US] is good for consumers, our economy, national security and energy security," said Senator Heidi Heitkamp a Democrat from oil-rich North Dakota.

"By opening up US crude oil to the rest of the world, we would not only provide our allies with a more stable energy trading partner, but we would also reduce the power of countries like Russia, Venezuela, and volatile regions of the Middle East that use their energy dominance to exert influence over our nation and our allies.”

Daniel Ang, an investment analyst at Phillip Futures in Singapore, told AFP that Brent crude could be testing its 11-year low because the US lifted its export ban, which has been in place since the oil crisis of the mid-1970s when OPEC banned oil exports to the US in retaliation for Washington's support of Israel during the Arab-Israeli war.

"However, at the end of the day, I would think that prices would face strong support as they move lower, and I would think that we would not see prices below $30," Ang said.

Analysts are split about how much longer the Saudi-led strategy can last.

Rosamund de Sybel, a director with K2 intelligence agency, said the policy could be maintained in the "medium and potentially into the long term".

"In spite of real fiscal challenges and a likely budgetary squeeze next year, Saudi is unlikely to implement a production cut to support prices anytime soon. While it’s true US production has remained resilient, there are indications that Saudi’s market share strategy is working - it is worth noting the number of projects that have been mothballed around the globe," De Sybel told Middle East Eye.

"Even if Saudi was seeking to change its policy, the chances of convincing other non-OPEC exporters such as Russia to cut output, especially given the current geopolitical environment remain slim. Both Saudi and Russia want to suppress new oil supplies around the globe. For now at least, Saudi's oil strategy remains fairly compelling."

But John Hulsman, a columnist at London-based business-focused newspaper City AM, on Monday slammed the ongoing Saudi pressure on OPEC to keep prices low, saying Riyadh was behaving like a "drunken gambler".

"If the Saudi strategy has become clear, its effectiveness has not," Hulsman wrote. "The short-term pain for Riyadh has been immense, with the country currently sporting a budget deficit amounting to an eye-popping 20 percent of GDP. However formidable are Saudi foreign reserves (and at $661bn at the end of September 2015, they surely are), this simply cannot go on forever.

"The Saudis, if they don’t change course, can continue their scorched earth policy for just under a decade, allowing for the present rate of reserve depletion. Of course, far before then, every other significant oil producer in the world would be utterly ruined, meaning that, in reality, Riyadh has much less time than this. At best, the Saudis can only double down into the medium term."

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.