OPEC will not cut output even if oil dips to $20 a barrel

Saudi Arabia's oil minister, Ali al-Naimi, has vowed to stay firm and not reduce oil production irrespective of oil price.

Speaking to the Middle East Economic Survey on Tuesday, he said that the Organisation of the Petroleum Exporting Countries (OPEC) understood the benefits of not reducing production and trying to push prices back up.

Since October, the price of Brent Crude Oil Futures per barrel has fallen from just under $100 a barrel, to around $60.

"As a policy for OPEC - and I convinced OPEC of this, even Mr al-Badri [OPEC secretary general] is now convinced - it is not in the interest of OPEC producers to cut their production, whatever the price is,” Naimi said.

"Whether it goes down to $20, $40, $50, $60, it is irrelevant," he said.

In November, reportedly largely due to Saudi pressure, OPEC said it would keep its target output at 30 million barrels per day, much to the annoyance of Russia and other oil exporters who have seen their budgets ravaged by the rapid price reversal.

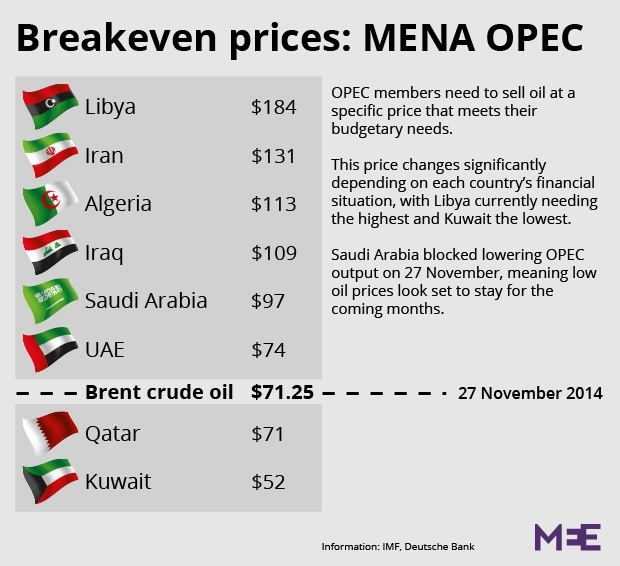

While Saudi Arabia, like many other Gulf countries, has a high breakeven price – the oil price must be enough to balance the budget – it also has the world’s third largest foreign currency reserves as is seen to be stable enough economically to be able to ride out a prolonged period of oil price depreciation.

Earlier this month, Saudi Arabia’s finance minister Ibrahim bin Abdulaziz al-Assaf announced that the kingdom would keep up its “massive” public spending plans despite a 50 percent drop in the price of oil.

The falling price is not thought to be exclusively linked to oversupply with the emergence of shale oil and gas, possible geopolitical rivalries with Iran and Russia as well as an economic slowdown in China as well as many so-called emerging economies driving the shift.

Danny Gabay of Fathom Financial Consulting told the BBC that the oil price fall was "overwhelmingly, predominantly, if not entirely, a demand shock. It's China slowing down. The supply element is more of a reaction."

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.