Palestinian gas: The Black Box

Palestinians could claim 6,600 square kilometres of maritime territory - five times the amount they currently hold, an investigation by the Middle East Eye has revealed.

Stretching 200 miles (320 km) into the Mediterranean, the potential Palestinian claim goes through the heart of the Levantine Basin, which the US Energy Information Administration estimates holds six times more natural gas than the current reserves of adjacent countries.

MEE can reveal that one of the fields, Mari-B, which companies, granted with Israeli licenses, exploited and depleted in 2012, could fall squarely within the Palestinian claim. Mari-B contained 1.5 trillion cubic feet of natural gas which is enough to supply Palestinians for at least 15 years.

Instead, Houston-based Noble Energy and Israeli company Delek Group sold the gas to the state-run Israel Electric Company, which, in turn, sells Palestinians 85 percent of their electricity, according to the World Bank.

The sensitivity of the potential Palestinian claim is so great that no company or government involved is prepared to state the GPS co-ordinates of existing gas fields, nor the estimated amount of the gas underneath. A well-informed geological source told MEE that Israel has done extensive mapping of the area, but much of that information has not been made public.

Despite this, no Palestinian plan has been published to stake a legal claim to this maritime territory.

Instead, the policy has been to buy gas from Israel, something that’s elicited protest from the Boycott, Divestment and Sanctions (BDS) movement. In March, a deal between the Palestinian Power Generation Company (PPGC) and partners in Israel’s largest gas field, Leviathan, was shelved. The deal would have seen Israeli gas supplied to Palestine Power Generation Company (PPGC) for 20 years.

Civil society groups say Palestinian leaders have been secretive about their gas strategy and dealings. In their only public statement when the deal was cancelled, Palestinian officials said the Gaza Marine field would supply the gas that would have been supplied by Israel in the suspended deal.

Discovered in 1999, Gaza Marine lies in 1,321 square kilometres of maritime territory off the Gazan coast, allocated to Palestinians under the 1994 Gaza-Jericho Agreement, before gas in the East Mediterranean had been discovered.

The field remains unexploited. One reason is that access to Gaza Marine, which lies between 17 and 21 miles (27 and 33 km) offshore, is impossible as Israeli forces impose a six-mile (10 km) limitation to all vessels in contravention of the Oslo Accords.

Making a claim

Under international law, experts say Palestinians could make a claim to boundaries that would give them five times more maritime territory than they currently hold.

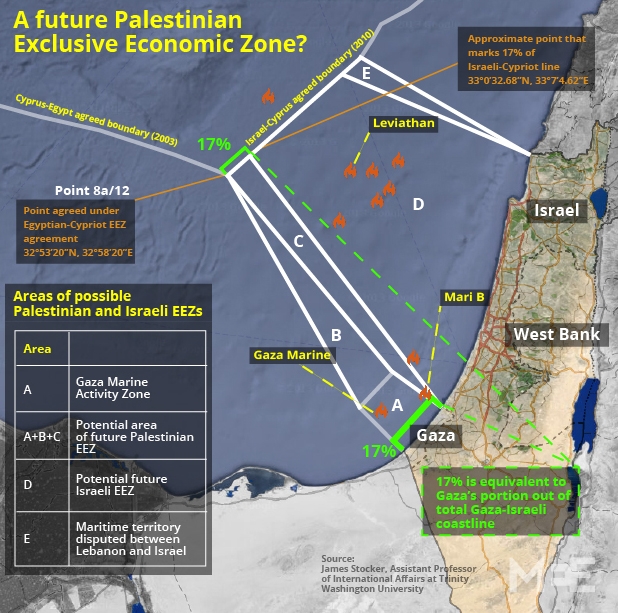

Using principles of the UN Convention on the Law of the Sea, the MEE is today publishing a map showing the potential extent of a Palestinian exclusive economic zone (EEZ), the area in which all coastal states have a right to explore and exploit natural resources. The map was drawn up by James Stocker, Assistant Professor of International Affairs at Trinity Washington University.

Coastal states, under the Law of the Sea, have a right to 200 miles (320 km) of maritime territory from their coast or a baseline drawn off their coast. However, because of the concave shape of the Eastern Mediterranean, there is territorial overlap 200 miles (320 km) off the coast of each country which requires negotiation and compromise.Stocker takes the Gaza Marine Activity Zone, allocated to the Palestinians under the 1994 Gaza-Jericho Agreement, as a starting point, and extends its southern boundary to a point agreed upon by Cyprus and Egypt in 2003 (called Point 8a) and then by Cyprus and Israel in 2010 (called Point 12).

Stocker also extends the northern boundary of the activity zone to the Cypriot-Israeli line, but gives the Palestinians 17 percent of the line, which is consistent with the 17 percent of the Israeli-Palestinian coastline that Gaza comprises.

Stocker’s map is only a starting point for a Palestinian claim, one which, in the future, would have to be decided bilaterally with its neighbours or, if that proved impossible, through an international tribunal.

“The point is that there is this whole space off Israel and Palestine and it hasn’t properly been divided yet,” Stocker said. “So we don’t actually know what the boundaries are.”

By failing to make a claim, Palestinians may be forfeiting their rights to their lawful territory and the natural resources within, Stocker said.

“If you aren’t making claims about the boundaries of these zones, if you are not making claims to these resources, then, in effect, you don’t have a right to them. Unless you claim that they are yours, other countries can claim them and say, ‘Well, no one else claimed this so, of course, we took it’,” he said.

Palestinians could make an immediate claim to this territory through simply putting an advertisement in a newspaper, he said. Or letting Israel and Egypt know privately that they are staking the area.

Martin Pratt, director of research at Durham University’s International Boundaries Research Unit, however, questions the benefit to the Palestinians of making a full EEZ claim. Certainly, he said, if the Palestinians believe that Mari-B or any other area that they see as part of their future EEZ is being exploited, they need to speak up.

“It’s important to at least protest the activities and say this is taking place in an area we consider to be within our entitlement,” Pratt said.

But under customary international law, he said, all states are entitled to a 12-mile (19 km) territorial sea and a continental shelf that extends out 200 miles (320 km) anyway. The Palestinian position, he said, would likely be that because Palestinians are entitled to statehood, those principles should apply to the Occupied Territories.

“I wouldn’t necessarily see an advantage in publicising a claim where you know there is going to be a dispute and you’ve got difficult neighbours,” Pratt said.

“Once an element is published,” he added, “it’s very hard to come up with another claim even if a new government comes in and wants to make a different claim or make a more aggressive approach.”

Whatever course the Palestinians take, Donald Rothwell, professor of international law at Australian National University College in Canberra and an expert on the Law of the Sea, explained that their neighbours need to respect the potential entitlements of a future Palestinian state.

“Perhaps the better way to put it,” Rothwell said, “is that neighbouring countries are unable, under international law, to appropriate the resources within that area just because the Palestinian state hadn’t been able to properly proclaim an EEZ.”

What lies beneath

The exact amount of gas underneath the waters of a potential Palestinian EEZ and its value cannot be known until it is produced. But a definitive 2010 US Geological Survey report of the East Mediterranean’s Levantine Basin - where the EEZ would fall - estimated that there was at least 122 trillion cubic feet (tcf) of natural gas.

The current natural gas reserves of Syria, Jordan, Lebanon, Israel, Cyprus and the Occupied Territories, according to the US Energy Information Administration, are 18.2 tcf, meaning the basin’s reserves would increase the amount six-fold at time when gas is predicted to account for 25 percent of total world energy consumption in coming years.

When MEE asked Chris Schenk, a geologist and the lead researcher on the 2010 USGS Levantine Basin report, how much gas the area outlined in Stocker’s map likely held, he stressed that the USGS does not assess offshore areas by country or by political entity.

“We think there is a lot of gas in that basin. That’s where we have to stop, right there,” Schenk said.

Schenk said that the USGS made its assessment based on all information available on the basin, including reports by companies and governments that are often considered proprietary and not shared publicly. The Israelis in particular, he said, have published a lot of data on the basin. While the location of gas fields are not often public record, he said, they are not a mystery.

Gas leak

As Palestinians delay a claim, Israel is poised to become its neighbour’s major supplier of gas, some of which may have come from the field thought to be in a future Palestinian EEZ.

“It’s not that they did it by accident,” said energy analyst Mika Minio-Paluello of the gas produced from Mari-B. The Israeli government, he said, will have known that the Palestinians could make a claim and moved quickly before they did it. “And then,” he said, “it will be too late.”

MEE asked both Noble and Delek, the two firms producing the gas from Mari-B, as well as the Israeli Ministry of Infrastructure, which licenses oil and gas companies, to comment on the allegations.

Noble did not respond; Delek said it had no comment and urged MEE to contact the Israeli government. The Ministry of Infrastructure referred the issue to the Ministry of Foreign Affairs.

MEE asked the Ministry of Foreign Affairs several questions, including whether it had considered the possibility that Mari-B was in future Palestinian maritime territory and how it evaluated whether fields were in Israeli territory.

Ministry spokesman Emmanuel Nashshon replied in an email only: “Israel's natural gas fields endeavour is conducted in full adherence with international law. No claim to the contrary was made."

“We would be very happy to cooperate on the issue with all our neighbours, including the Palestinians. Unfortunately, some of those neighbours seem keener to invest time, money and energy in terror and violence, rather than in the development of this region's natural resources.”

The Oxford Institute for Energy Studies reported in 2012 that Israel has found at least nine gas fields since 1999 which could hold as much as 42.17 tcf – or 34 percent of the natural gas resources that the USGS estimates are in the Levantine Basin.

With their natural gas discoveries, Israel and Cyprus are the Eastern Mediterranean’s rising gas powers and, currently, Israeli has gas deals in play with both Egypt and Jordan totalling around $16bn and encouraged by the US State Department.

And questions remain about whether the $1.2 bn deal, shelved in March, that would have seen Israeli gas supplied to Palestinians, is entirely off the table.

“We don’t know what is happening behind the scenes which is part of the problem,” said energy analyst Tareq Baconi who opposes the deals. “These deals are being pushed forward in secret precisely to avoid this kind of political backlash, so we don’t necessary know if there might be a way for the deals to go forward even if [the power generation company] seems to have pulled out.”

Silence in Ramallah

In Ramallah, home to the Palestinian Authority, basic questions such as what is the PA’s gas policy, who is in charge of it, and have officials attempted to claim an EEZ, has been deliberately obscured.

Responsibility is divided between the Palestinian Energy Authority (PEA), which oversees issues related to electricity, and the Ministry of National Economy, which is responsible for natural resources.

For three months, MEE asked Palestinian officials for comment including Deputy Prime Minister Mohammed Mustafa, who concurrently served as Minister of National Economic Affairs and chairman of the Palestinian Investment Fund (PIF) before he resigned on 31 March, and Omar Kettani, chief of the PEA.

Kettani refused to answer MEE’s questions by email or telephone, claiming that MEE misunderstood the role of the PEA.

However, MEE has obtained notes of a meeting that Kettani held within the past year with a Palestinian NGO, The Coalition for Accountability and Integrity (AMAN), in which Kettani appeared to speak in full knowledge of Palestinian policy.

He claimed that the deal to import gas from Israel for 20 years would lessen Palestinian dependency on Israel in the long run and did not preclude the development of the Gaza Marine field. However, he admitted that the field will “reap no benefit” to the West Bank because Israel controls the pipes that would take gas from Gaza.

Israeli gas, he told the group, was only one of several sources to diversify Palestinian energy sources. “The Palestinian market will be needing amounts of gas larger than the quantity agreed upon in this agreement,” the meeting notes indicate Kettani said.

In a telephone conversation, Tayseer Amro, Deputy Minister of National Economy, told MEE it was unlikely that he would know the specifics of Palestinian gas strategy, but he would attempt to answer questions sent by email. Amro has yet to respond.

Public in the dark

Palestinian analysts and civil society leaders – several of whom called the gas issue ‘a Black Box’ - say they are frustrated that the Palestinian public seems to be the last to know what is happening with their natural resources.

“To be frank, we haven’t been able to get information about it,” said Omar Shaban, an economist and chairman and director of the Gaza-based think tank, PalThink. “I would be more than happy to understand what’s going on.”

Shaban, however, said this is nothing new. When US Secretary of State John Kerry pushed his Israeli-Palestinian peace plan in 2013, Palestinians outside of the PA’s inner circle had no idea what was on the table, he said.

“Why don’t they reveal it to us? Why don’t they get us involved in it?” Shaban said.

Similarly, when a donor conference was held in Cairo this past October to raise funds to rebuild Gaza after last summer’s war, Shaban said no Palestinian civil society leaders were there.

“I’m so disappointed,” Shaban added. “I’m so angry about this because we are in the middle and we don’t have access to what is known in the international community.”

Firas Jaber, a co-founder and researcher of the Ramallah-based political, social and economic think tank al-Marsad, said he has tried repeatedly to obtain information about gas deals from the Palestinian Investment Fund (PIF).

Jaber pointed from his third-floor office window towards the PIF offices, down the street. Usually, he implied, he is quite resourceful at getting information. The gas has been different.

“I know someone working in there and they said, ‘I will be fired’,” he said. “No one wants to touch that contract. It’s very sensitive and it’s not like everyone has access to this contract.”

Jaber said his sense is that the contract on the Gaza Marine field is off limits because Palestinian officials are receiving commissions off gas deals.

“There is a lot of corruption there. This is why. We know that, but again, we can’t criticise without having such evidence,” he said. “So we are waiting to know more about the energy investments here in the West Bank and Gaza and we are trying to provoke them in one way that they will respond, but they are not doing that.”

Captive economy?

While Israel develops into one of the East Mediterranean’s top gas exporters, the occupied Palestinian territories - without an oil or gas refinery and only one power plant in Gaza that sustained significant damage in the 2014 war – remains dependent on imports for all energy resources.

The World Bank estimated in 2012 that 85 percent of Palestinian electricity is supplied by the state-run Israeli Electric Company (IEC). In the same statement in which he reported that the Israeli gas deal had been suspended, then-Deputy Prime Minister Mohamed Mustafa said that Palestinians pay $2.5bn annually – or $7 mn per day – to Israel for energy resources.

Essentially, the Palestinian energy sector is at Israel’s mercy, writes Omar Jabary Salamanca, an urban geographer and researcher at the Belgian-based Middle East and North Africa Research Group.

“With no production capacity, no control over Israeli cost of electricity, and still wired to the Israeli national grid,” Salamanca writes, “new [Palestinian] regional utilities can only become a replacement for municipalities in their traditional role as intermediary agents to collect and transfer bill payments to the IEC.”

For Gaza residents, whose electricity needs were only met by 46 percent supply ahead of last summer’s war, the UN’s Office for the Coordination of Humanitarian Affairs reported last March, the system has resulted in scheduled blackouts of 16 hours per day.

“If it can solve the electricity problems, I need it yesterday,” Abu Ramadan said. “Either take it or die. There is no take it or leave it.”

“People are suffering. People are living in tents. No electricity. No wood. Children are being killed,” Abu Ramadan said. “We don’t have the luxury to wait for gas or electricity. Let us live and after that, we can negotiate.”

“I will ask anybody who is with or against [the Israeli-Palestinian gas deal], come live in Gaza for three days,” he said.

At night, the former mayor said, he can see a glowing light off the coast which he, and many other Gaza residents, assume is a gas flare from a drilling rig.

“We suffer these cuts while we see our gas in the Mediterranean,” said Omar Shaban, the Gaza-based economist. “We see it every morning, every night. We can see the light and the flames in the sea. It’s unbelievable.”

But questions about how much gas there might be, where it will end up, and to whom it actually belongs remain as opaque as the night.

Hagar Shezaf, Lubna Masarwa and Simona Sikimic contributed to this report.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.