Ras Ghamila: Saudi Arabia offers to buy Egyptian premium Red Sea area using deposits

Saudi Arabia has presented Egypt with an offer to purchase Ras Ghamila, a prime Red Sea tourist destination, including pulling its deposits from the Central Bank of Egypt, and the acquisition of several government companies, according to an Egyptian government source.

The source, who works in the Ministry of Public Business Sector, the entity tasked with negotiating the deal, told Middle East Eye that Saudi officials offered to use the kingdom's deposits with the central bank (CBE), which amount to $10.3bn, an option favoured by the Egyptian side which will allow immediate access to foreign currency.

During the negotiations, the source said that the Egyptian government cited the $35bn Emirati Ras el-Hekma deal which included $11bn in existing deposits.

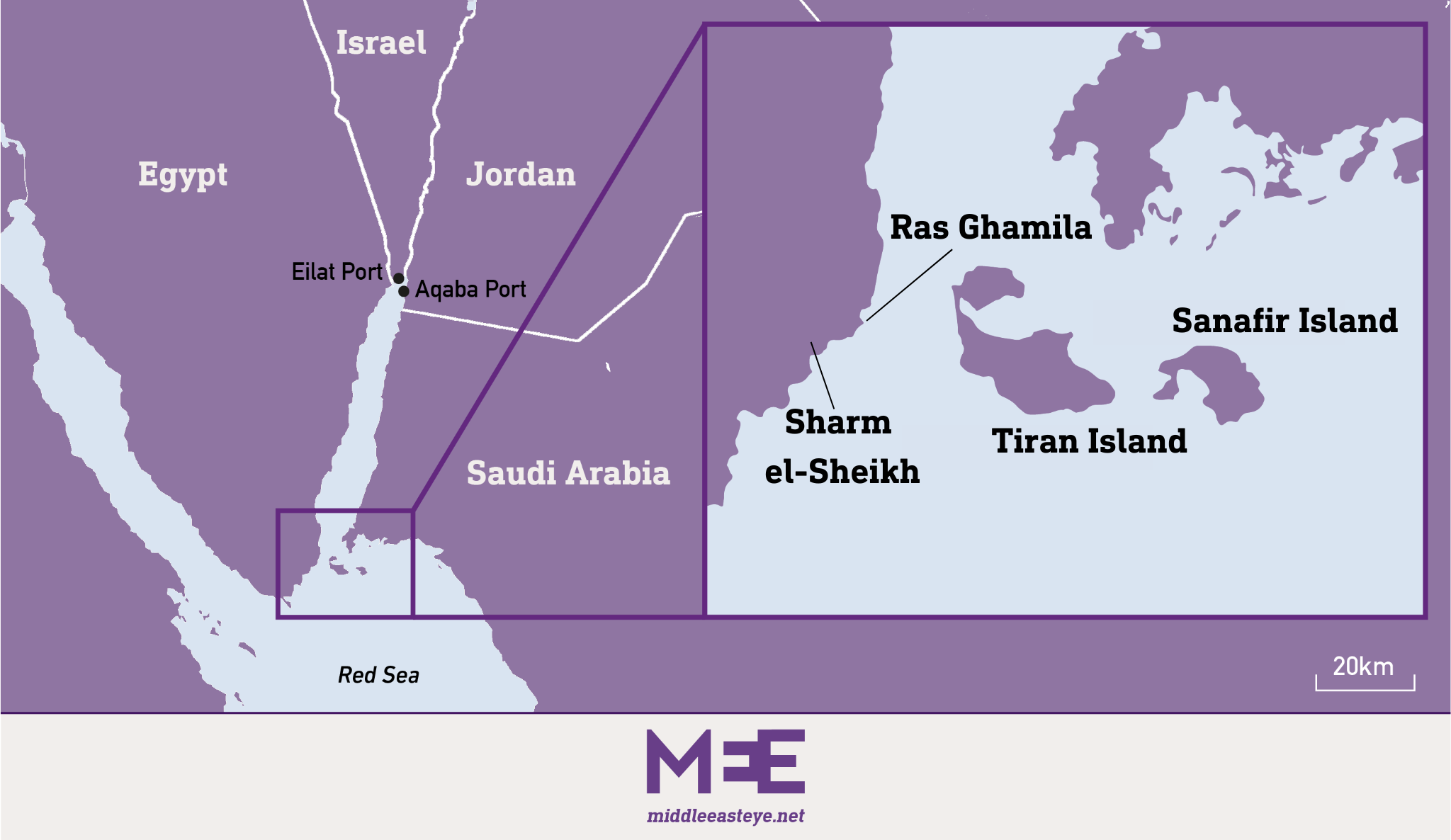

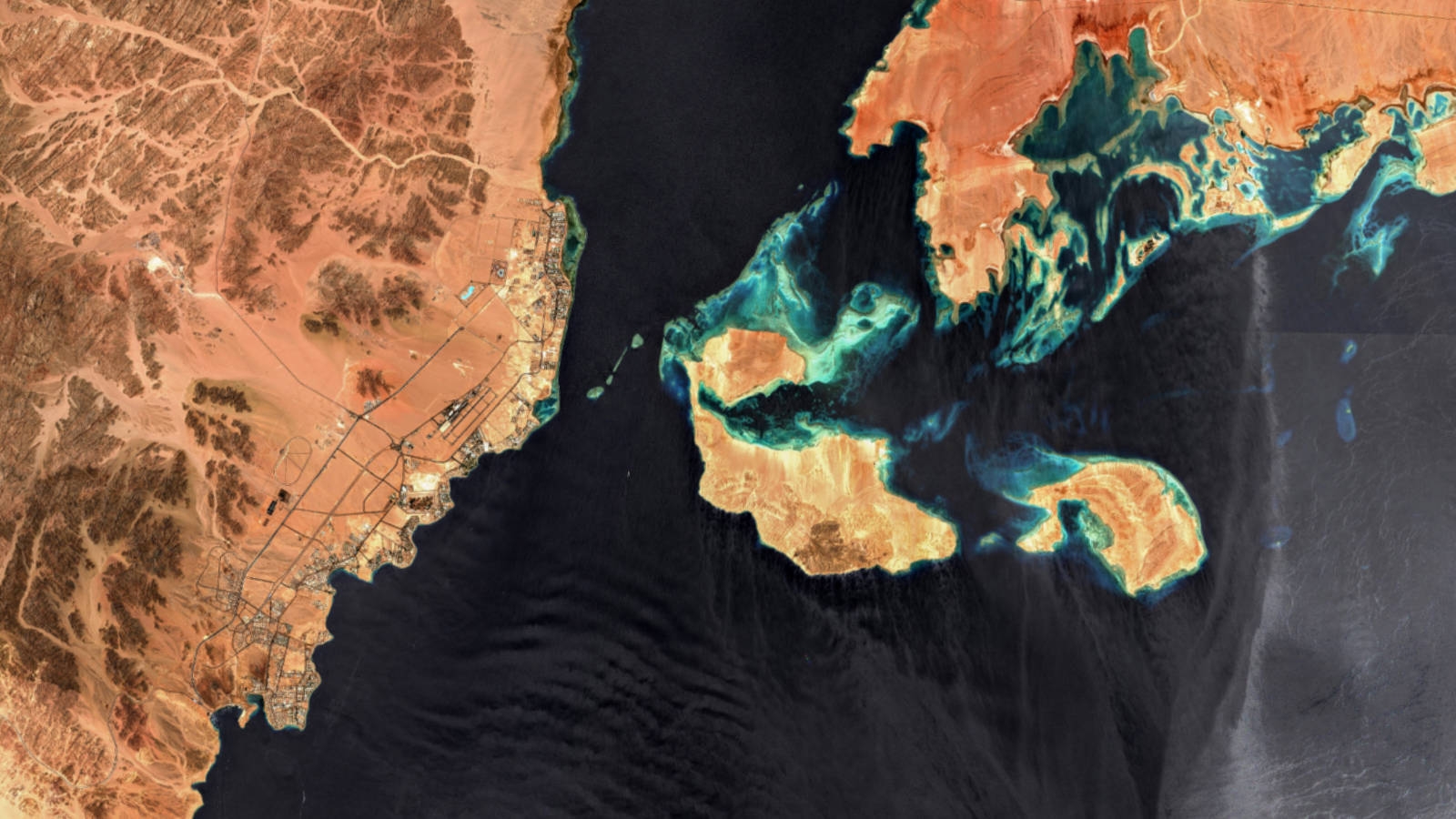

Ras Ghamila, a popular diving destination, is located around 11.5km from Sharm el-Sheikh international airport in South Sinai governorate.

It is also opposite Tiran Island, one of two Red Sea Islands that Egypt ceded to Saudi Arabia in 2016 after a deal that drew significant popular backlash.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

News about the Ras Ghamila deal was reported by Saudi media in February and confirmed by MEE, amid little official information from the Egyptian or Saudi governments.

Saudi investors are keen to secure this deal due to Ras Ghamila’s proximity to Tiran and Sanafir Islands, and its potential to boost tourism between Sharm el-Sheikh and Neom in Saudi Arabia.

Mahmoud Esmat, Egypt’s minister of public business sector, announced plans earlier in February to offer the area for investments.

He said the area is around 860,000 sqm and has a high strategic value.

Sale of public assets

Since 2018, as part of the government’s efforts to alleviate the economic crisis, Egypt has been selling off assets to Gulf states.

The Egyptian government is heavily indebted mainly due to a spending spree on megaprojects and weapons deals by the government of President Abdel Fattah el-Sisi since he became president in 2014.

Data released by the Central Bank on Thursday show that foreign debt has more than quadrupled over the past decade, reaching $168bn at the end of 2023.

The current Saudi offer, according to the Ministry of Public Business source, also included further acquisitions of at least six public companies.

The source added that some of the companies are owned by the Egyptian military, such as the National Company for Natural Water in Siwa (SAFI) and Wataniya Petroleum. One of the companies is Egypt's largest private education company, CIRA Education.

On 7 May, CIRA Education announced it is ready for an acquisition deal with the Saudi Egyptian Investment Company, which is the investment arm of the Saudi Public Investment Fund spearheading the negotiations.

According to a press release, CIRA said the Saudi Egyptian Investment Company seeks to acquire at least 75 percent with the intention of merging, and a maximum of 100 percent of the shares. CIRA owns more than 25 schools, which will be operated by the new Saudi investors.

The offer includes the optional delisting of CIRA Education shares from the Egyptian Stock Exchange after completing the acquisition procedure.

MEE has contacted the SPIF for comment but had not received a response by the time of publication.

The ministry source expects that other Gulf countries will follow the same pattern of connecting acquisitions of strategic areas and companies with deposits.

The independent Egyptian news website Manassa on Saturday cited official sources as saying that ten publicly owned companies will go public, including the Siemens power plant in Beni Suef, four water desalination plants, and two wind power plants in the Jabal al-Zeit and Zafarana regions.

Since the military coup led by Sisi in 2013, his allies have deposited a total nearing $30bn in the Central Bank of Egypt to support the government.

According to the bank, the UAE has deposited about $10.7bn, while Qatar has deposited around $4bn. Saudi Arabia has deposited about $10.3bn, while Libya has deposited about $900m.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.