Saudi Arabia’s ‘Programme HQ’: Can Riyadh rival Dubai as a business hub?

In the pre-pandemic days of globalisation, countries competing in emerging markets were often engaged in a "race to the bottom" to attract multinational companies, which typically involved offering them incentives such as tax breaks and favourable labour laws.

More recently, governments with large enough economies have opted for the stick-over-the-carrot approach in allowing companies to set up shop, often for political objectives.

Last year, for instance, Turkey passed a law requiring any social media platform based abroad with over one million daily Turkish users to set up a representative office in the country.

Saudi Arabia is taking a leaf from the same playbook as it grapples with the economic fallout of the Covid-19 pandemic and embarks on its ambitious Vision 2030 plans.

In mid-February, Minister of Investment Khalid al-Falih announced that any company seeking contracts with the government, state-owned firms and the Public Investment Fund (PIF, the sovereign wealth fund) will have to base its regional headquarters in the kingdom by 2024.

Saudi Arabia is hoping that the allure of being the Middle East’s biggest economy, with hundreds of billions of dollars earmarked for mega-projects over the coming decades, will force companies to comply.

“There was surprise at the announcement, and there are some merchant families that will not be happy,” said Theodore Karasik, a senior adviser to Gulf State Analytics, a Washington-based consultancy.

“But at the same time, others will see the benefit of such a regulation, and in how the city states of the Arabian peninsula interact with each other for recovery purposes. Because of Covid-19, they are rebooting and restructuring their economies."

The requirement, called “Programme HQ”, is still at the discussion phase, with “as many questions as answers. It is a reminder of the intense competition for investment within the Gulf Cooperation Council,” said Rachel Ziemba, a non-resident fellow at the Gulf International Forum, a Washington-based institute.

'The fact is they would put three people in Saudi Arabia, yet 95 percent are commuting from Dubai or Lebanon due to the lifestyle, like being able to drink alcohol'

- Martin Tronquit, managing partner at infomineo

Currently, the programme will give companies that move their headquarters to Saudi Arabia a 50-year tax holiday, and a 10-year waiver on quotas on the employment of Saudi nationals.

Analysts consider Programme HQ to be ambiguous in its definitions – does “regional” mean within the Gulf Cooperation Council (GCC), the Middle East and North Africa (MENA), or even Europe, Middle East and Africa (EMEA)? And how is “headquarters” defined – by the number of employees?

“My read is it’s the Middle East,” said Ziemba, “but you can also raise questions about EMEA offices, which might be in the UAE or somewhere in Europe. It’s not really clear what happens to a company that doesn’t have a regional office, or used to be somewhere else.”

The move also neglects to take into consideration potentially profound shifts in office work due to the pandemic, such as remote working and the downsizing of offices themselves, and trends towards the automation of industry and the adoption of smart technology - hailed by the World Economic Forum as a "fourth industrial revolution" - which might affect where companies are registered.

“We are moving towards a cloud-based economy and society, so a regional HQ could be on a cloud and you don’t need physical space. It depends on the corporation and their objectives, and how it fits within the Vision 2030 scope,” said Karasik. Programme HQ “is an idea set in stone, but the mechanics still need to be worked out”.

Riyadh versus Dubai

Some analysts are interpreting the move as direct competition with Dubai, which has had first-mover advantage to develop as a global business hub.

“It is not seen as direct competition across the GCC," said Ziemba, "but sending a message to firms that are going to see Saudi Arabia as a more important part of their market, and doing more business there.

"But I think they [Saudi Arabia] will have an incredibly difficult fight against Dubai’s first-mover and infrastructure advantage, and the legal system and processes.”

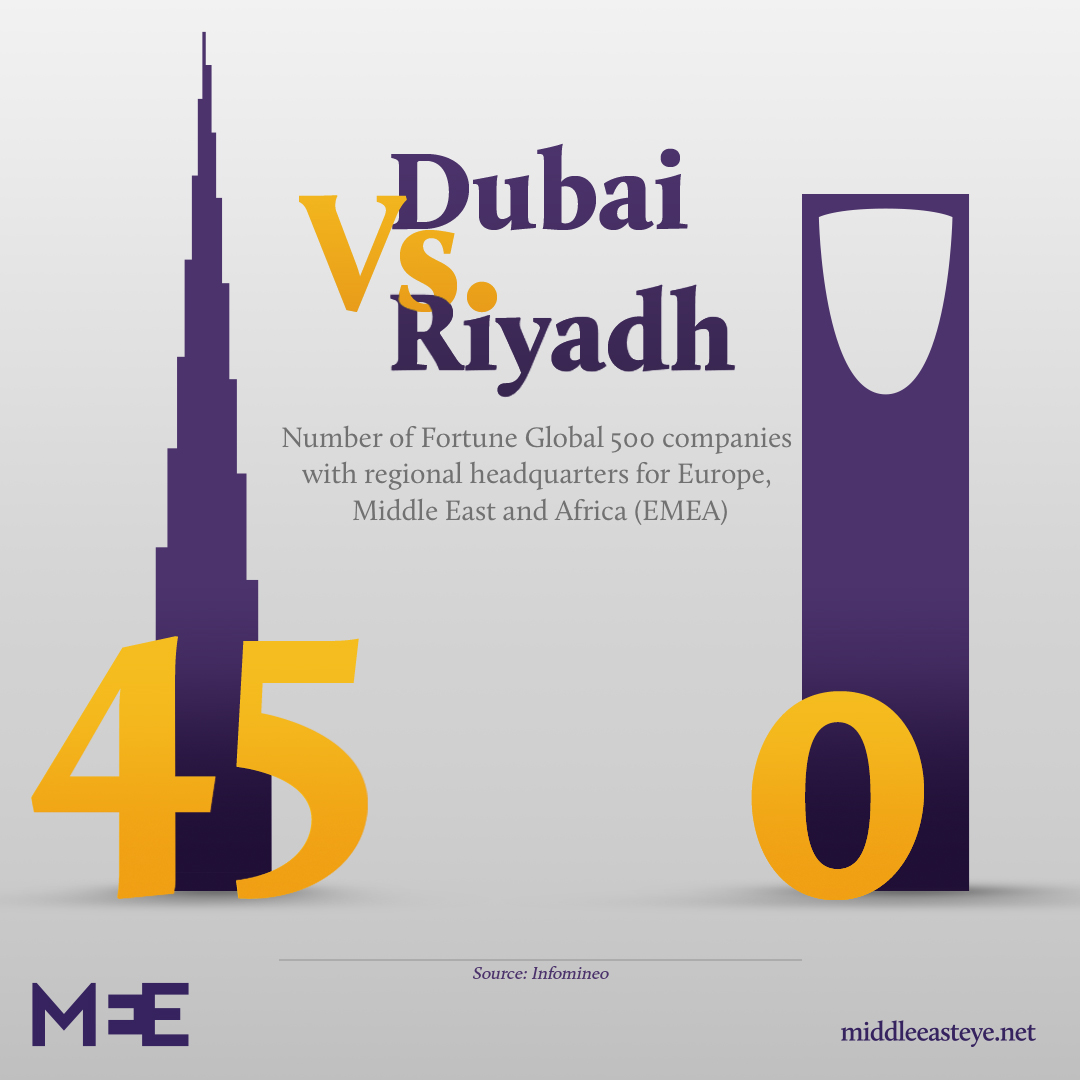

Dubai, which was forced to diversify due to its low oil reserves compared with other Gulf states, is the regional headquarters of 45 Fortune 500 companies, according to infomineo, a Dubai-based research firm that has assessed why companies establish headquarters in certain cities around the world.

Dubai has become popular not just as headquarters for the MENA region, but also Africa. “The business capital of Africa is not in Africa, but in Dubai,” said Martin Tronquit, managing partner at infomineo.

The firm estimates there are no regional headquarters currently in the kingdom. “A reason was that it was difficult to do business in Saudi Arabia, and that people don’t want to live there. It will change, but the question is if it will change on paper or if more senior executives actually move,” said Tronquit.

It may be a hard sell to convince senior executives to make the shift, as they are typically aged 40 to 60 and have children. “When you look at Saudi Arabia, it is putting in place infrastructure for business; but from the personal aspect, while it has improved dramatically, it will take years before healthcare, education and leisure get to the same level as Dubai,” he said.

For decades, companies – from consultancies and engineering firms to law firms and retailers – have used Dubai or Beirut as hubs for business in Saudi Arabia.

“The fact is they would put three people in Saudi Arabia, yet 95 percent are commuting from Dubai or Lebanon due to the lifestyle, like being able to drink alcohol,” said Tronquit.

Salaries are also expected to be higher in the kingdom. “When headhunters approach people to go to Saudi Arabia, offering salaries 30 to 40 percent higher than Dubai, they say no. You need to double salaries if they [recruits] are good, but if they’re in the second tier, you can get them,” said Khaled Abdel Majeed, a MENA fund manager at London-based SAM Capital Partners in Dubai.

“It will not be easy. Saudi Arabia is using a combination of carrots and sticks, but I’d wish they’d use more carrots and less sticks.”

Security is a further concern, with the Houthis having recently launched rockets at Jeddah and Riyadh. In a further escalation, the Houthis on Sunday claimed responsibility for rocket and drone attacks targeting oil facilities in the port of Ras Tanura and the eastern city of Dhahran.

“If Iran bombs anyone in the region it is probably Saudi Arabia, not Dubai,” said Tronquit.

Riyadh will also have to work on its foreign policy reputation, which has been sullied internationally by the six-year war in Yemen, the killing of Jamal Khashoggi, and the blockade of Qatar.

“The venture in Yemen and the embargo on Qatar were not smart ideas, and the Ritz Carlton affair was also not a smart idea, as the end result was a lot of capital flight,” said Majeed.

“In an atmosphere where the rule of law matters, how can they attract people to Saudi Arabia? If people get in dispute with the royal family there’s no way they can win.”

It also remains unclear as to whether Programme HQ will create “thousands of jobs for citizens”, as the minister announced, due to the waiver on Saudisation – the hiring of locals - for regional headquarters.

'In an atmosphere where the rule of law matters, how can they attract people to Saudi Arabia? If people get in dispute with the royal family there’s no way they can win'

- Khaled Abdel Majeed, SAM Capital Partners

If companies do make the move to the kingdom, it may be dependent on the sectors they work in, with construction a key area, given the kingdom’s plans to develop the likes of megacity Neom, and the recently announced $200bn project, the Line.

Currently, just two of the 45 regional headquarters of companies in Dubai are construction based, according to infomineo figures. US construction giant Bechtel, however, has seen the writing on the wall, announcing the move of its regional headquarters to Riyadh in January, before the requirement was announced.

Vision 2030

Saudi Arabia wants to bolster all parts of its economy in line with Crown Prince Mohammed bin Salman's Vision 2030 project, a "national transformation programme" that seeks to position the kingdom as an "investment powerhouse" and a "hub connecting three continents".

The crown prince's plans have been described as an attempt to shape a "fourth Saudi state", replacing the current oil-dependent modern state which was founded in 1932, succeeding earlier iterations of Saudi rule in the 18th and 19th centuries.

“They are still creating this fourth Saudi state, that is advanced in terms of logistics, energy, and business,” said Karasik.

Riyadh is expected to attract most of the headquarters, as well as the King Abdullah Economic City, near Jeddah – the only one of four proposed economic cities announced in 2005 to have come to fruition by 2020.

The Neom project is expected to be another contender, but it has its own separate legal regime to the rest of the kingdom. Some 20 companies have pledged to PIF that they will establish regional headquarters at Neom if contracts are forthcoming.

“There will probably be more headquarters, but it depends on the sector, and the legal issues, which still need to be codified,” said Karasik.

He sees the HQ plan as part of a broader one to clean up corruption and have more transparency to attract investors, which the kingdom sorely needs, with net inflows of foreign investment just $4.2 billion in 2018, and $4.6 billion in 2019. The UAE by comparison attracted foreign investment of $10.4 billion in 2018, and $14 billion in 2019.

If Programme HQ starts to backfire amid weak foreign investor sentiment, Riyadh may be forced to negotiate with companies and investors rather than use the stick approach.

“Saudi Arabia needs six percent or more non-oil GDP growth to maintain youth unemployment at what it is, which is a big number [28.7% as of 2021]. And the economy can no longer be driven by government spending, so there needs to be a sense of urgency,” said Majeed.

This article is available in French on Middle East Eye French edition.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.