Saudi economy out of recession and 'gathering pace'

Saudi Arabia’s economy has emerged from its second recession since the 2008 financial crisis and is likely to keep growing as oil production increases and a multi-billion dollar stimulus package kicks in, analysts said on Monday.

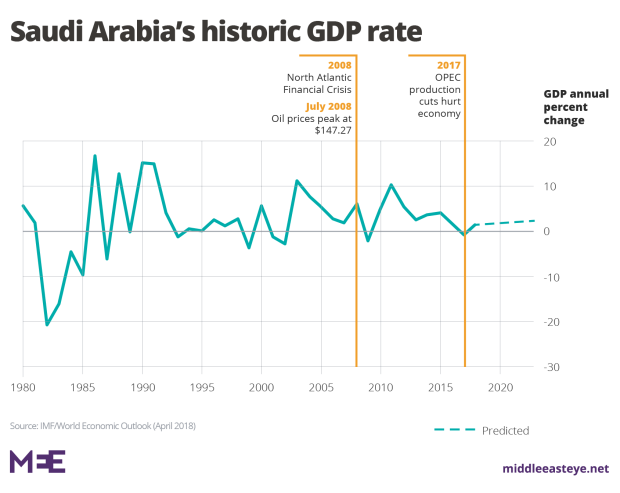

The Saudi economy grew 1.2 percent in the first three months of the year, the government’s statistic agency said on Sunday. Gross domestic product (GDP) shrank 0.7 percent in 2017, and by 1.2 percent in the fourth quarter of last year.

But last month’s agreement among oil exporting countries to increase production by one million barrels a day and Saudi Crown Prince Mohammed bin Salman’s $19bn plan to revive the economy, announced in December, have raised hopes among market watchers that growth in the first quarter may not be a blip.

"The Saudi economic recovery will gather pace over the coming quarters," Jason Tuvey, senior emerging markets economist at Capital Economics, said in a note to clients.

"Fiscal stimulus should support a further pick-up in growth in the non-oil economy."

"Meanwhile, the revised OPEC agreement is likely to result in a sharp jump in Saudi oil output in the coming months. By our estimates, this will directly boost year-on-year GDP growth by around two percentage points," Turvey added.The oil sector, which represents 40 percent of the economy, expanded by 0.6 percent in the first quarter of 2018 after contracting 4.3 percent in the last three months of 2017.

This was mainly due to last year’s OPEC agreement to cut production to help boost oil prices coming to an end. Saudi Arabia bore the brunt of the cuts.

As the world’s largest oil exporter, Saudi Arabia may increase production to pick up the slack left by Washington’s sanctions on Iran.

US President Donald Trump tweeted on Saturday that Saudi Arabia’s King Salman had agreed to increase production by two million barrels, although the White House later rode back on the claims.

Oil prices fell sharply on Monday following Trump’s tweet. In mid-afternoon trading in London, Brent crude, the international benchmark, was down 1.4 percent at $78.14 a barrel. West Texas Intermediate was down 0.7 percent, at $73.62 a barrel.

Despite austerity measures to cut the government’s budget deficit and the introduction of five percent value added tax, the non-oil sector grew 1.6 percent in the first three months of the year. That was up from 1.3 percent in the fourth quarter of 2017.

“The VAT was impactful on businesses and consumers in the first month of the year when it was introduced. But the government did a great job in telegraphing the introduction. Inflation will fade away as people adjust to the VAT and fuel hike. If the VAT was more than five percent then it would have had a bigger impact," Bryan Plamondon, chief Middle East economist, at IHS Markit, told Middle East Eye.

But Plamondon said the construction industry numbers were “disappointing”, with no sign yet that the stimulus had boosted the sector.

"Construction was down for a ninth straight quarter, we had expected a turnaround, it is likely to do so in the coming quarter when the spending shows up," Plamondon said.

Boosting spending on housing by $5.6bn and $600m on broadband are just some of the measures the country announced in a $19bn package in December. The government also set aside $210m for small and medium size businesses, which have been overlooked for loans by the big banks.

The Saudi government plans to sell a stake in Saudi Aramco, the country’s oil giant which it values at $2trillion, to help pay for a series of projects overseen by Mohammed bin Salman, the 32-year old heir apparent, to transform the economy.

Known as Vision 2030, the plans include building Neom, a hi-tech mega-city and business zone from Egypt to Jordan that may cost as much as $500bn.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.