Saudi sovereign wealth fund to invest billions to tackle soaring joblessness

Saudi Arabia is moving to tackle soaring unemployment and a Covid-19-triggered economic downturn by investing $40bn annually in the domestic economy from its sovereign wealth fund over the next five years, the crown prince said Sunday.

The Public Investment Fund (PIF) "will invest at least 150 billion riyals ($40 billion) annually in the domestic economy until 2025," Mohammed bin Salman said in a speech carried by state media.

The PIF, the main engine of the kingdom's efforts to diversify its oil-dependent economy, has previously been focused on investing in major global companies - from ride-hailing app Uber to US carmaker Lucid Motors.

The PIF intends to boost its assets to 4 trillion riyals ($1.07tn) and directly or indirectly create 1.8 million jobs by 2025, the crown prince added.

The crown prince's speech coincided with a royal decree on Sunday which declared the sacking of central bank governor Ahmed Al-Kholifey.

Fahad al-Mubarak was named as his successor, in what will be his second stint as the governor of the Saudi Arabian Monetary Authority (SAMA).

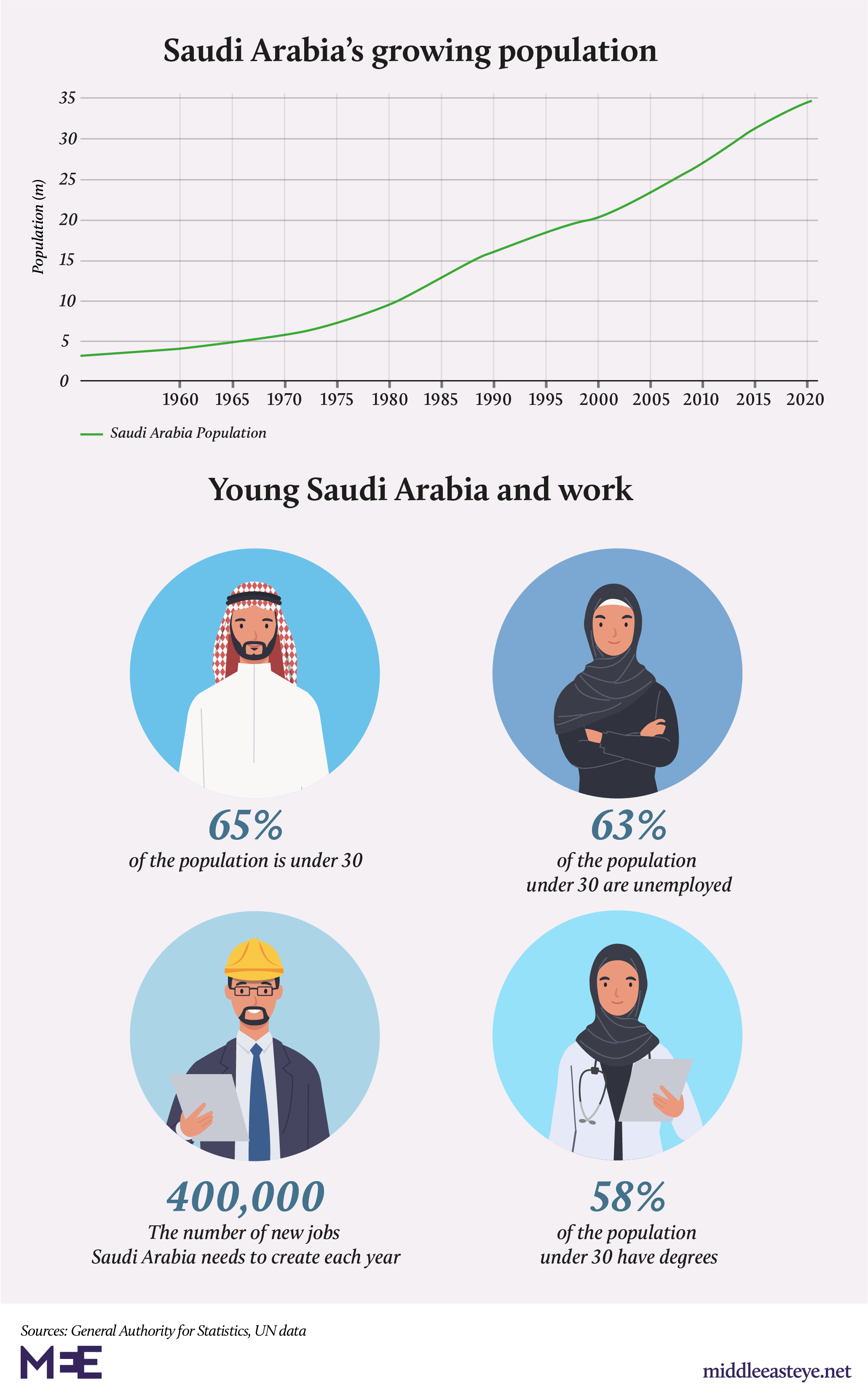

The announcements come as the petro-state battles high unemployment and a sharp economic downturn.

Joblessness in Saudi Arabia touched 14.9 percent in the third quarter of 2020, dipping slightly from an all-time high of 15.4 percent in the second quarter, official data showed last week.

"The impact of Covid-19 pandemic continues to affect the Saudi labour market and the economy," Saudi Arabia's General Authority for Statistics said in a statement last week.#

Last year, the twin shocks of the novel coronavirus pandemic and a drop in oil prices prompted the top crude exporter to triple its value-added tax and suspend a monthly allowance to civil servants to rein in a ballooning budget deficit.

The highly unpopular austerity measures were implemented even as the kingdom continues to boost spending on a slew of megaprojects, including the planned $500bn Neom megacity on the kingdom's Red Sea coast.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.