Syria protests: Why is the lira in freefall?

As protests continue to erupt across Syria over the country's unrelenting economic crisis, with protesters demanding the removal of Syrian President Bashar al-Assad, the value of the Syrian lira has hit its lowest level on the parallel market.

The Syrian lira has dropped to around 13,800 pounds against one US dollar, sending the currency hurtling towards further collapse that began following the 2011 uprising against President Bashar al-Assad.

According to the country’s Central Bank, the lira’s official exchange rate against one US dollar stands at 10,700 as of Friday 25 August.

Since it exceeded 9,000 lira to one US dollar on 11 May, the lira’s value has been in free-fall for months. The most recent depreciation comes after the Syrian pound lost around 30 percent of its value in a two-month period since July.

So why is the Syrian lira constantly falling?

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

“The plummeting value of the Syrian currency has been instigated by the ongoing stagflation cycle gripping the country's economy,” says Hussein Chokr, a policy and political economy analyst for Syria and Lebanon.

“This cycle emerges when rampant inflation coincides with economic stagnation and a soaring unemployment rate," he adds.

"Currently, comprehending the precise genesis of this economic affliction proves challenging, particularly considering the Syrian context, which is uniquely intricate due to the prolonged convergence of economic, monetary, and political variables.”

According to Chokr, there are several domestic and international factors at play: heavy international sanctions, an already impoverished country, compounded by the damage of the February earthquake. Rapidly rising fuel prices and other factors have also contributed to the downward spiral of the lira.

Domestic instability

Apprehension within the domestic market, fuelled by the devaluation of the lira, has ensnared the currency in a cycle of depreciation and inflation, Chokr tells MEE.

“Regrettably, the central bank possesses limited tools to address this spiralling panic. Matters worsened as discussions regarding the reduction of subsidies for crucial commodities, particularly fuel, escalated, [which] thereby impacting the prices of items interconnected with fuel derivatives across the production chain,” he says.

The Syrian government’s loss of its northeastern oil-producing territories, and its “incapacity to oversee and capitalise on its oil and gas reserves as a means to fortify its foreign currency reserves, has exacerbated the country’s financial meltdown,” Chokr says.

“Especially that the reserves are under the control of the Kurdish-led Autonomous Administration and the United States forces,” he adds.

“The incongruous and occasionally conflicting policies adopted by the Money and Credit Council, coupled with the policies and regulations of the Ministry of Finance, have fallen short of resolving, if not exacerbating, the issue,” he says.

International sanctions

Since the anti-Assad revolution in Syria in 2011 that later turned into an armed conflict, the international community imposed strict sanctions on the Syrian government. Some of these sanctions targeted the banking sector.

“Unilateral sanctions have exerted pressure on the Syrian economy, hindering its ability to access the international market,” Chokr says. “This impedes the development of Syrian exports and the inflow of foreign direct investments into the domestic market.”

But it wasn't just the punitive international sanctions that impacted Syria’s economy.

The devastating 6 February earthquakes that hit Turkey and Syria compounded Syria’s socio-economic crisis and triggered a debate on international sanctions hindering the delivery of humanitarian relief and aid to Syria.

The earthquake caused an estimated $5.1 billion in direct physical damages in Syria, according to a World Bank Global Rapid Assessment report.

It caused Syria’s GDP to contract by 5.5 percent in 2023 because of the earthquake’s disruption of trade activity, its destruction of physical capital, and the subsequent spike in inflation that was driven by the increased demand for reconstruction materials, fuel shortages, a reduction in goods, and an increase in transport costs, according to the World Bank.

The Lebanese financial crisis

The financial crisis in neighbouring Lebanon has also contributed to the devaluation of the Syrian lira. The impact was felt tangibly in October 2019, when Lebanese banks stopped allowing customers, many of them Syrians, to withdraw or buy US dollars.

Of the more than one million Syrians living in Lebanon, the majority rely on cash for everything as they are not allowed to open bank accounts.

“The Lebanese economy formerly served as the primary supplier of foreign currency to the Syrian market,” Chokr says. “A reduction in the supply of foreign currency from Lebanon, coupled with the unrelenting surge in demand for US dollars, has precipitated a significant disruption in the foreign currency market.”

Since the 2011 conflict, Russia has remained the Syrian government's most steadfast ally. In 2015, it intervened in Syria to keep Assad in power.

The Russian invasion of Ukraine, in turn, has been supported by Assad’s government, the alliance going so far that Russia’s call for volunteers to fight alongside its army triggered a recruitment drive in Syria, according to an MEE investigation.

But the Russian-Ukrainian war has “incapacitated Moscow's financial support for Damascus,” Chokr said.

The prolonged Ukraine war has caused wheat prices, a staple import in the Middle East and North Africa, to rocket. Wheat prices soared in July following Russia's withdrawal from the Ukraine grain deal.

The war could push commodity prices even higher, eroding Syria’s position as a food and energy importer, according to the World Bank. Ultimately, the war in Ukraine has eroded Syria’s economy.

“The conflict has disrupted the global food market, further intensifying the inflationary pressures within the already delicate and fragile Syrian market,” Chokr says of the war’s impact on the Syrian lira.

Speaking at the People's Assembly about the economic upheaval in July, Syrian Prime Minister Hussein Arnous said in a statement posted to Facebook: “The hardest economic problem we face is how to manage the gap between limited resources and unlimited needs.

“As the government moves to adjust the exchange rate, restrict liquidity in markets to preserve the purchasing power of the national currency and maintain the general price level in the country, this trend will be accompanied by a decline in economic activity and restrict the movement of the business sector in one way or another,” he said.

The reality, Chokr says, is that the Syrian government's ability to effectively address both the domestic and international factors depreciating the lira is “severely constrained”.

“The government's tools are limited to attempting to curb devaluation by accumulating more foreign currencies and disrupting the supply chain of the illegal black exchange market,” he says.

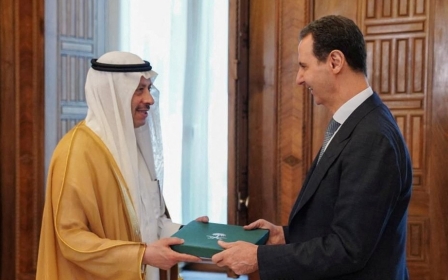

With Syria’s readmission back into the Arab League after 11 years of suspension, efforts championed by the UAE and Saudi Arabia that saw ties normalised with Assad.

After Syria was suspended in 2011 for its ruthless crackdown on mass protests and the ensuing civil war, there was initial optimism about some economic relief.

But the lira remains dangerously stagnant.

“The Syrian economy had pinned hopes on potential Arab intervention following recent diplomatic reconciliation and normalisation between Arab nations and Syria,” he adds.

“However, the inability to forge a consensus and agreement on interests, needs, and demands among relevant stakeholders has left the Syrian government disheartened.”

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.