Turkish lira: Risk of spiralling inflation as government seeks growth at any cost

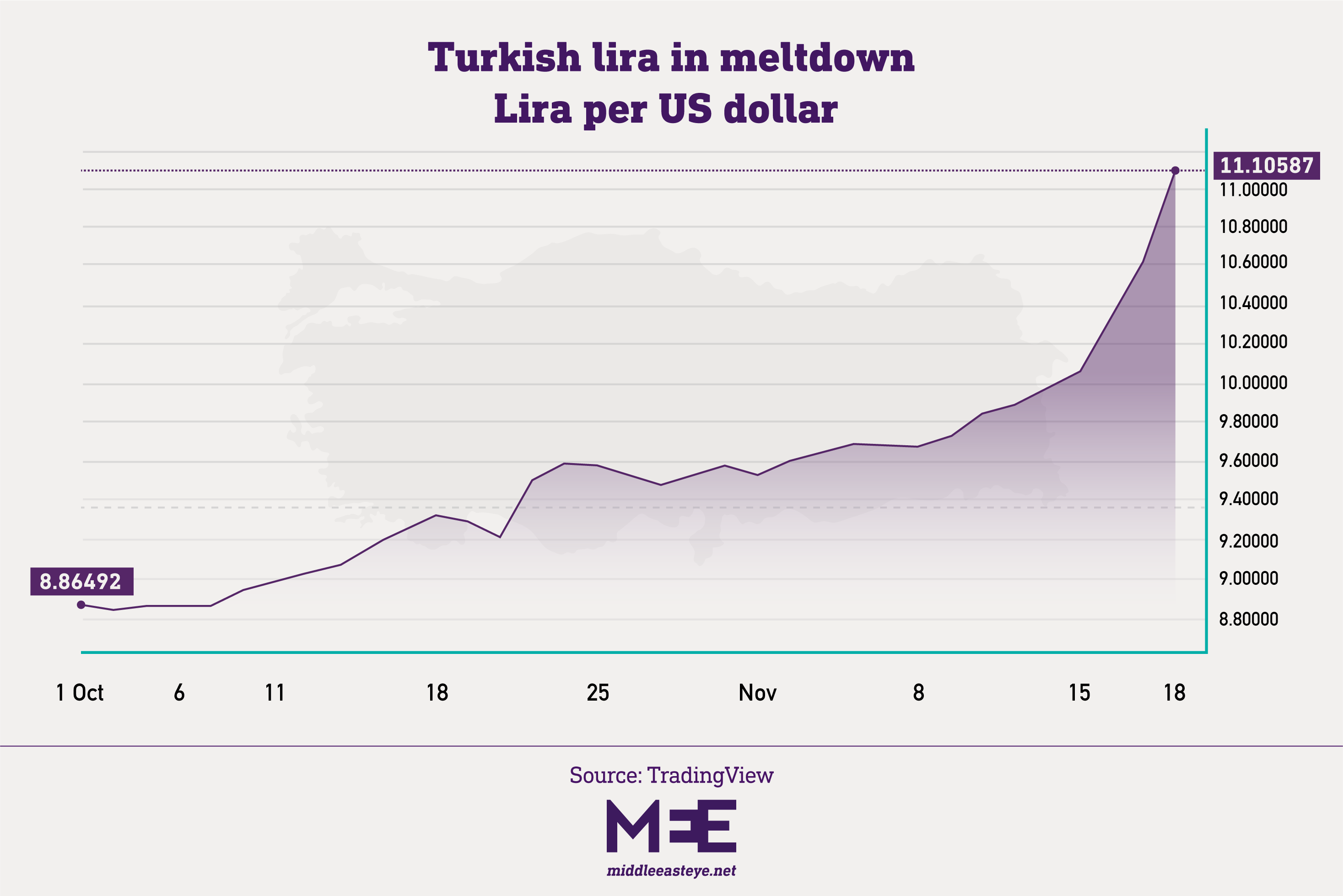

The Turkish Central Bank’s latest interest rate cut on Thursday upended markets and dealt a huge blow to the country's currency, weakening it to a record rate of more than 11 lira to the US dollar.

The move to cut the rate by one percentage point to 15 percent had been expected, yet many investors were still in disbelief amid the country's soaring inflation, which officially stands at more than 20 percent annually.

The bank’s current chief, Sahap Kavcioglu, is a Recep Tayyip Erdogan loyalist who believes in the president's unorthodox theory that high interest rates result in high inflation.

On Friday, pro-opposition news outlets unanimously criticised the Central Bank’s decision, with one daily writing that the lira was becoming just a piece of paper that had no more value than a postage stamp.

The government-aligned Sabah newspaper also, surprisingly, published two columns blaming the Central Bank for harming investors and markets.

Dilek Gungor, an economics columnist at the paper, said the markets could not afford the volatility caused by the rate cuts.

“People who have money can avoid investments in this unpredictable environment,” she wrote. “The high foreign currency could be seen as positive for exporters, but they cannot trade without stability in the exchange rate."

Gungor added that the fluctuations in the lira could also affect regular tradespeople - who are unable to take orders due to the ever-changing costs in commodities - as they would further increase the costs of production.

“Exporters, industrialists, small businesses, and citizens want to see predictability,” she added.

Erdogan’s popularity melting away

Turkish officials, who spoke anonymously to the media, said on Friday that the government was well aware of the impact the rate cuts have on society. They said that the main drive behind the move was to increase investment, decrease unemployment and provide relief to those with lower incomes, referencing strong growth and increasing exports to support their case for the cuts.

“The government doesn’t want to enter the 2023 [presidential elections] with high inflation and high unemployment,” the Hurriyet daily reported, citing the officials.

Polls indicate Erdogan’s popularity is melting away amid Turkey's economic woes, decreasing his chances of re-election.

Ibrahim Turhan, a former senior Central Bank official, told Middle East Eye the government finds itself in a conundrum and "was caught between a disaster and the impossible. It is impossible for them to maintain high rates, and therefore lower inflation, because it would mean too high a cost for them,” he said, referring to the negative impact of high rates on economic growth and employment. “Therefore, the second option is applied: cutting the interest rate, which will increase consumption and facilitate higher production with cheaper loans. It is a deliberate choice.”

'Economic growth will be in double digits, but this will be accompanied by annual inflation of 30-40 percent'

- Ibrahim Turhan, former senior Central Bank official

Turhan also said he believed things would become worse before getting better.

“We will see the side effects of this policy; high inflation and rapid depreciation of the lira will continue,” he said. “Economic growth will be in double digits, but this will be accompanied by annual inflation of 30-40 percent, and an increasing loss of value of the Turkish lira against the US dollar.”

'Their credibility has already gone'

Hakan Kara, former chief economist of the Central Bank, told MEE that Turkey has entered a risky period, taking unpredictable monetary steps.

“Planning for companies and individuals has become very difficult,” he said.

Veysel Ulusoy, an economist and head of the Inflation Research Group, an independent group of academics, told MEE: "When we consider the turmoil the Central Bank has created for the past few days, which is disconnected from economic realities, their credibility has already gone.”

The Central Bank’s decision also raises question marks around Turkey's external debt. According to Central Bank data, at the end of September the country’s short-term external debt stood at $168bn. Meanwhile, the private sector has a maturing foreign loan of $13bn to be paid by the end of the year – $8bn to be paid in November.

Besides the external debt, there is the vital question of energy imports. Turkey is dependent on foreign sources for natural gas and oil, at a rate of 99 percent and 93 percent respectively. According to foreign trade data, Turkey paid $41bn for energy imports in 2019. In 2021, as Turkey's consumption continues to increase, global oil and natural gas prices have seen rises exceeding 100 percent.

The net minimum wage, which was 2,826 lira ($382) in January 2021, had fallen to the equivalent of $254 by Friday, due to the lira’s depreciation

When the rapid depreciation of the lira against the dollar is added to the increase in such commodity prices, it presents a double whammy for the Turkish economy.

Minimum wage debate

There is another group negatively affected by the course of the dollar, namely minimum-wage workers. Nearly 50 percent of workers in Turkey are on the minimum wage, making the rate of the new minimum wage in 2022 a vital issue.

The net minimum wage, which was 2,826 lira ($382) in January 2021, had fallen to the equivalent of $254 by Friday, due to the lira’s depreciation.

Similarly, inflation, which was 15 percent at the beginning of the year, according to official figures, has increased to 20 percent.

According to government statements, a rise of 30 to 40 percent in the minimum wage is being considered for 2022.

However, the question mark remains as to how long such a hike in the minimum wage will shield the purchasing power for Turks, if the depreciation of the lira and the increase in inflation continues.

Considering the swift decline in the value of the lira this month, it would appear that the purchasing power for those on the minimum wage will continue to rapidly depreciate.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.