Was a London property dispute behind a Telegraph campaign against Qatar?

When the Telegraph newspapers ran a two-month long campaign last year accusing Qatar of funding terrorism in the Middle East, its owners were engaged in a fierce battle with the Gulf state for control of three five-star hotels in London, Middle East Eye can reveal.

The Telegraph’s “Stop the Funding of Terror” series targeted Doha for having allegedly provided material support for Al Qaeda and the Islamic State, among others groups – allegations the Gulf State has regularly faced in recent years.

In the same period billionaire British identical twins Sir David and Sir Frederick Barclay, who bought the Telegraph Media Group in 2004, were engaged in a jet-setting battle for control of luxury Mayfair hotels Claridge’s, The Berkeley and The Connaught. It was a battle fought in glamorous locations across the globe – including Los Angeles, London and Monte Carlo – and involved Irish rock star Bono, former British Prime Minister Tony Blair, and flamboyant Saudi Prince al-Waleed bin Talal.

The Barclays’ opponent in the hotel struggle was senior Qatari royal Sheikh Hamad bin Jassim bin Jaber al-Thani, who is popularly known as HBJ. It was a four-year long fight the Barclays ultimately lost, because at the end of April this year an arm of the Qatar Investment Authority finalised the purchase of the three landmark London hotels, in a deal thought to be worth more than £1bn.

Three non-Qatari sources involved in the dispute have alleged to Middle East Eye that the Telegraph campaign against Qatar and the hotel dispute did not coincide by chance. They said the Barclay family editorially influenced the newspapers to produce negative coverage of Qatar, allegations which have been denied by the paper.

Tug-of-war for the Maybourne Hotel Group

In 2004, Irish financier Derek Quinlan gathered together a group of his fellow countrymen – along with the billionaire Green family from the UK – to set up a company named Coroin, meaning Crown in Irish, and pay €950mn for the Savoy Hotel Group (SHG). Riverdance creators Moya Doherty and John McColgan, along with stockbroker Kyran McLaughlin, took small minority stakes, the Greens controlled a quarter of the company, while Quinlan and Belfast-born property developer Patrick McKillen each took a third of the shares.

In early 2005, SHG sold The Savoy Hotel to Prince al-Waleed bin Talal for an estimated $250mn, after Quinlan and McKillen – accompanied by U2 lead singer Bono for unknown reasons – held a meeting with the billionaire Saudi on his yacht in the south of France. With the Savoy out of the portfolio, the company was renamed to the Maybourne Hotel Group (MHG), with its assets reduced to Claridges, The Berkeley and The Connaught.

In 2008, the global financial crash plunged Quinlan and McKillen into a cash crisis, caused by sky high leverage finance packages. For the 2004 purchase of MHG, the two had borrowed some $1.2bn from Irish banks. In the post-crash era, Ireland set up the National Asset Management Agency (NAMA) to take control of property loans doled out by the collapsing Irish banks and the agency had its eyes on the large debts held by Quinlan and McKillen.

The two men scrambled, mostly in separate initiatives, to either sell off MHG or refinance their loans before NAMA could get their hands on the debts and, by consequence, take control of the valuable hotel assets.

NAMA seized Quinlan’s debts at the end of 2009 and the financier’s attempts to bargain his way out of bankruptcy fell on the Barclay twins, who had previously expressed an interest in the hotels to the Irishman. Sir Frederick and Sir David were blocked from simply purchasing Quinlan’s one third stake in MHG because of a pre-emption agreement in Coroin’s company documents that stipulated shareholders who wished to sell up must offer their holdings internally before approaching external buyers.

But by early 2011, the Barclays had found a way around the clause. They obtained the Green’s 25 percent stake in Coroin by purchasing the holding company that owned the family’s shares, which meant the stake did not have to be offered internally. They also bought Quinlan's loans from NAMA, against which the Irishman had put up his MHG stake as collateral, leaving the Irishman in the hold of the brothers.

This gave the Barclay twins effective control over two thirds of the hotel group, with only McKillen standing between them and complete ownership. But the Belfast property developer had managed to keep his debts away from the clutches of NAMA and cultivated – through Tony Blair’s mediation – the support of a powerful financial backer that could rival the Barclays.

Qatar sees opportunity

In 2012, the brothers agreed to a loan refinancing package for MHG that required shareholders to inject around £150mn of equity into the company. McKillen didn’t have the funds to put in £50mn to meet his share of the equity demands, leading the Barclay family to conclude that they had finally found a way to take control of the company.

However, former Qatari Prime Minister HBJ, who had held a long-term interest in buying up MHG, backed McKillen financially. Overnight, the Qataris stumped up a loan for the £50mn – they did this, according to sources involved in the deal, as they viewed McKillen as being a route to ultimately taking control of MHG.

The non-Qatari sources, who spoke on condition of anonymity, told Middle East Eye that when the Qataris bailed out McKillen, it appeared to enrage the Barclays.

“The loan upset the brothers, who seemed convinced that victory was near,” the source said.

The Qataris’ emergency loan to McKillen was a short-term fix: McKillen still had an €800mn loan with the Anglo-Irish bank which he had managed to keep away from NAMA, but was on the Barclays’ radar.

However, in March 2014, McKillen announced that US investment firm Colony Capital - who had sold the hotels to Quinlan back in 2004 - had agreed to buy his €800mn loans, which provided him with security in facing up to the Barclay brothers.

Colony Capital, Qatar and the Sark newsletter

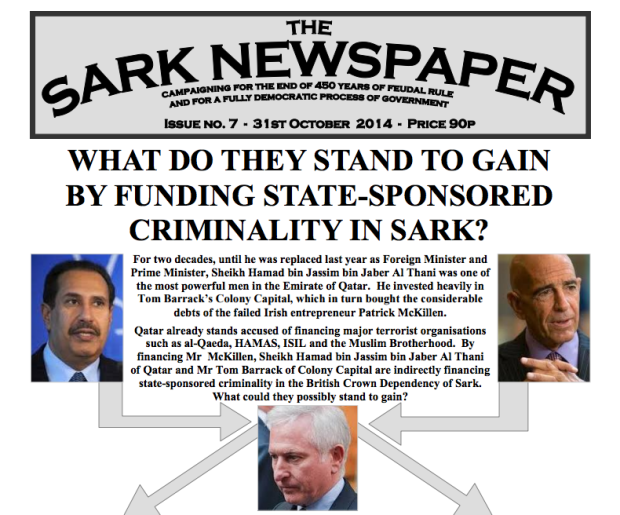

Around six months after the Colony deal, a newsletter, linked to the Barclay family through its editor and based on the Channel Island of Sark, began to write stories that said McKillen was being financed by Qatar’s HBJ through the American investment.

Sark is tiny and has a population of around 600 people. It has jurisdiction over the neighbouring island of Brecqhou, which is owned by the Barclays and home to their huge mock Gothic castle. The brothers have been engaged in a battle lasting several years to try and influence Sark, so as to remove its jurisdiction over Brecqhou, among other issues.

The Sark Newsletter is an A4 publication edited and written by Kevin Delaney, who until recently was head of the Barclay brothers’ business interests on the island.

The newsletter is almost exclusively filled with content that attacks the Sark parliament; however, in September and October last year it began running stories on Qatar.

One edition of the newsletter made the claim that Qatar’s HBJ was financing McKillen.

“Patrick McKillen is […] financed by Sheikh Hamad bin Jassim bin Jaber al-Thani through his investment in Tom Barrack’s Colony Capital, the company that bought Patrick McKillen’s debts of €800mn from the Irish banks,” the newsletter reported.

Later in the same article, Delaney wrote that Qatar has “used their wealth not for the betterment of mankind but for evil”.

The Barclays have said that they have nothing to do with the newsletter. Editor Kevin Delaney did not respond to numerous attempts to contact him via email and phone.

Qatar was rumoured to be involved in the Colony Capital deal because of joint investments Doha has with the American company that include ownership of the Miramax film company and the Fairmont Raffles Hotels.

McKillen publicly rejected Qatari involvement in the deal, but sources close to the Irishman, to whom he is known as “Paddy”, confirmed that Doha has always been involved in supporting him in the hotel battle.

“The Qataris have been friends and supporters of Paddy for a number of years,” the non-Qatari source said, asking to remain anonymous due to the sensitivity of the issue. The connection between Colony and Qatar, if any beyond their joint investments, remains a mystery.

But it proved to be the Qatar intervention, through the £50mn loan together with the Colony backing, which decided the future ownership of MHG, because by buying McKillen’s debts from the Irish Bank Resolution Corporation, an organisation set up to merge two state-owned banks in Ireland, the US company had insulated the Irishman from financial pressure by the Barclay family.

'Stop the funding of terror' campaign

At the same time as the anti-Qatar articles were published by the Sark Newsletter, a campaign was run by the Telegraph newspapers that targeted the Gulf state’s alleged involvement in supporting terrorist groups across the Middle East.

In the period between 20 September and 16 November, the Telegraph published 34 articles, including eight front-page headline stories and four newspaper editorials, all of which included broad allegations that Qatar has been intimately involved in the funding of terrorist groups including the Islamic State.

Articles described the Gulf State as a “Club Med for terrorists”, said that shoppers at the Qatar-owned Harrods department store in London were “buying into terror”, and included calls for the UK “to cut business ties” with Doha over alleged links to the Islamic State group.

The campaign coincided with a state visit by Qatari Emir Sheikh Tamim bin Hamad bin Khalifa al-Thani to the UK, and the Telegraph’s stated objective in writing the articles was to pressure British Prime Minister David Cameron into acting against those allegedly funding militancy in the Middle East.

Qatar has regularly been accused of funding groups viewed as terrorists in the West - allegations the Gulf state has rejected and claims over which have recently brought defamation proceedings in France.

While the Telegraph’s accusations against Qatar have been widely written about by many other newspapers, their “Stop the funding of terror” campaign attracted the attention of British satirical and current affairs magazine Private Eye.

The Eye claimed that the campaign was not a benign journalistic endeavour but was the result of direct editorial influence from senior management at the Telegraph Media Group (TMG).

A source involved in the battle for MHG, who has a predisposition against the Barclay family, said that through their own conversations with a Telegraph employee they have been informed that TMG chairperson Aidan Barclay, son of Sir David, was the person who drove the anti-Qatar campaign.

“The influence over TMG comes directly from Aiden,” said the non-Qatari source, who asked to remain anonymous due to the sensitivity of the issue.

A former Telegraph employee, who asked to remain anonymous, told Middle East Eye that while it was “way above [their] pay grade” at the newspaper, they can believe “there might well have been guidance” on stories relating to Qatar.

Seperately, this February, the newspaper’s chief political commentator, Peter Oborne, resigned over allegations that TMG advertisers were receiving preferential treatment in the newspapers’ coverage. Following Oborne’s resignation more than a dozen current and former Telegraph journalists told the BBC that they felt discouraged from writing negative stories about TMG advertisers and commercial partners.

Aidan Barclay and the conclusion of MHG battle

Middle East Eye could not independently substantiate the claims made against Aidan Barclay, who did not directly respond to requests for comment on the story.

A Telegraph spokesperson told Middle East Eye that all matters relating to Qatar and the hotel dispute were being handled by Brown Lloyd James, a public relations firm that has a contract with the Telegraph newspapers (and, incidentally, also has a contract with the Qatari government).

Brown Lloyd James issued a statement to Middle East Eye, in response to questions of editorial influence from the ownership regarding the anti-Qatar campaign.

“All decisions about editorial content are made by the editors,” the statement said. “The editors’ decision is final.”

Aidan Barclay has previously explained that he operates “an arm’s length principle” when it comes to managing his newspapers.

“I believe that people should be entitled to do their job correctly as much as possible, and so I tend not micromanage on a day-to-day basis,” he told the 2011-12 Leveson Inquiry, which looked into ethics and practices of the British media.

Barclay said that he ends all conversations with his editors by saying: “Listen, this is a matter for you. You’re in charge, you’re the editor. You do as you see fit.”

Private Eye referenced Aidan Barclay’s Leveson appearance in their commentary on the Telegraph’s anti-Qatar campaign, saying that the newspaper proprietor had sworn on oath that he does not interfere in editorial matters. This led the magazine to conclude that the timing of the campaign taking place at the same time as the hotel dispute was “clearly nothing more than a happy coincidence”.

Aidan Barclay holds a wide-ranging brief in the family’s business interests. On top of being TMG chairperson he also heads up the Barclay-owned Ellerman Investments. He has also played a key role in other significant deals for the family, including in the battle for control of MHG.

According to a judgment by Justice David Richards, given in August 2012 at the conclusion of a case between McKillen and the Barclays, Aidan oversaw the purchase of the Green family’s 25 percent MHG stake in January 2011.

Also included in the judgment is record of a text message sent by Gerry Murphy, an associate of Derek Quinlan, which extolls what he believes to be the benefits of having a business relationship with the Barclay family.

The message was sent by Murphy to McKillen in early 2011, after Quinlan had decided to pursue an offer for MHG from the Barclay family, rather than the Qataris.

“Don’t blow a gasket on this news. Talk to me. It might offer a compromise. You would have the power of the Telegraph behind you.”

The Telegraph’s series on terrorism funding came to an end on 16 November last year, without an explanation as to whether the campaign was finished or if it would return in the future.

Since then the battle for the three five-star London hotels has reached conclusion. At the end of April this year an announcement was unexpectedly made that Constellation Hotels, part of the Qatar Holding investment subsidiary of the Qatar Investment Authority, had purchased two thirds ownership in the hotel from the Barclays and Quinlan.

Shortly after that announcement reports emerged that McKillen had also sold his stake, leaving the Qataris with 100 percent ownership of MHG.

McKillen, as stipulated by a long-term agreement with the Qataris, retains a management role in the hotels.

He told MEE that he is delighted with the deal.

“It’s a bright new dawn and our total focus is on our guests, staff and carrying out the wonderful plans we have in place for the hotels,” he told MEE in an emailed statement.

“This [the Qatari buy-out] is part of a much bigger deal that offers me enormous new opportunities,” he added, without providing any further details.

MEE’s sources said that the Barclay decision to sell their stake in April had come after “finally realising they couldn’t win”.

However, a spokesperson for the Barclays said the hotel investment had been a prosperous one for the family.

“The business has performed strongly during the four years of our involvement and this has been a very successful investment for us,” Richard Faber said in a statement, at the time of the sale.

“We are pleased to have concluded this transaction.”

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.