Aramco: Why Saudi Arabia is considering a new stock offering

Saudi oil giant Aramco is weighing a fresh stock offering that could allow the state-owned oil company to tap billions of dollars, as the kingdom ploughs ahead with mega projects designed to diversify its economy.

Saudi Arabia is working with advisors to study the feasibility of an additional stock offering on the kingdom’s Tadawul Index, Bloomberg reported on Tuesday, citing sources familiar with the plans.

In its initial public offering (IPO) in 2019, Saudi Aramco raised a record $25.6bn. The stock sale was a central feature of Crown Prince Mohammed bin Salman’s attempts to diversify the kingdom’s economy away from a reliance on oil.

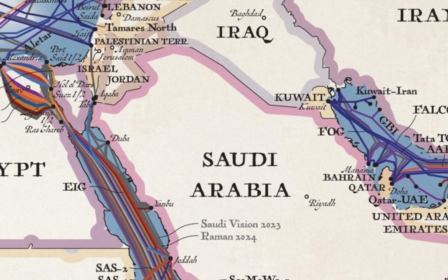

Saudi Arabia enjoyed an economic windfall after oil prices shot to $100 per barrel following Russia’s invasion of Ukraine. The price hike allowed Riyadh to lavish funds on mega-projects like the $500bn futuristic Red Sea city Neom and a new airline designed to service a growing capital.

Recently, however, the price of Brent crude has fallen amid concerns about the strength of the global economy and on Tuesday was trading at $74.65 a barrel. Over the last year, the kingdom has pushed for a series of oil production cuts from fellow crude producers, in a bid to shore up prices.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Aramco has been hit by the fall in oil prices and in May reported $31.9bn in net income for the first quarter, a drop of about 19 percent compared with the same period a year ago.

Aramco has also had to contend with a rewiring of the global energy trade as Saudi Arabia sells more oil to Europe, while Russia chips into the kingdom’s Asian market share with discounted crude prices as a result of western sanctions.

The kingdom has not set a precise timeline for the new offering, but it could take place this year. The sale would mark a test case of Saudi Arabia’s efforts to bolster the appeal of a company that is 90 percent owned by the Saudi government and eight percent held by its sovereign wealth fund.

“Saudi Aramco is very much the crown jewel of the kingdom,” Jim Krane, an energy expert and fellow at Rice University's Baker Institute, told Middle East Eye.

Who is buying shares?

Foreign institutions baulked at the lofty $2 trillion price tag the kingdom initially placed on Aramco in 2019, and the shares were mainly purchased by Saudi and regional investors.

In order to boost sales, Saudi Arabia launched a nationwide drive to solicit retail investors, offering loans to buy shares. Wealthy families caught up in the crown prince's 2017 corruption crackdown were reportedly pressured to buy into the company.

The kingdom also opted to list Aramco on its domestic stock exchange as opposed to a bigger western market. But the Tadawul listing also fed into foreign investors' concerns about the company’s transparency.

Aramco has made headlines since its IPO. Buoyed by rising oil prices last May, it overtook Apple as the world’s most valuable company. As of Tuesday, Aramco was trading up 6.54 percent since its December 2019 IPO.

While it has outperformed some western oil majors this year, since its IPO Aramco has lagged behind Exchange Traded Funds like XLE, which track energy-related stocks in the S&P 500.

The long game

Like other oil majors, Aramco has come under pressure to return more cash to shareholders amid the recent oil boom. In March, the company boosted its dividends and in May announced plans to roll out a “performance-linked” cash payout to shareholders.

Krane, from Rice University, said Aramco could see fresh foreign interest in its shares as a result of concerns by foreign investors about western oil companies and the energy transition.

Analysts say that while the energy transition may dent oil prices in the long term, Saudi Arabia is well-placed to gain market share because its oil is easier to drill.

Saudi Arabia's energy minister, Abdulaziz bin Salman, famously vowed the kingdom would be "the last man standing" in the oil market and extract "every molecule of hydrocarbon" it possesses before they become worthless.

“Long term, Aramco looks likes it's going to be in a more powerful position with a larger share of the market as the energy transition progresses,” Krane said,

“Oil prices might fall, but for those who want oil exposure, Saudi Arabia is a pretty safe bet”.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.