Yemen war: The oil fields of Shabwa have become the new battleground

With its highly prized oil fields, the coastal province of Shabwa in Yemen’s south has moved centre-stage in the ongoing war in recent months.

The country's third-biggest province has largely stayed out of the spotlight during the course of the conflict, as major battles raged elsewhere. But after a bitter dispute erupted in Shabwa between fighters backed by the United Arab Emirates (UAE) and pro-government forces, the Houthi rebels made their move. Now, a counter-offensive has been launched to push them back.

“We fought on different fronts, but none are as important as this,” Abdulrahman al-Maini, a pro-government fighter, told Middle East Eye.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

“Our biggest losses in the past were either a desert, a mountain or a military camp,” Maini said. “But Shabwa is a red line, as there are many oil fields here.”

Maini is one of hundreds of fighters who have been redeployed recently from the western coast of Yemen to Shabwa to fend off an offensive by Houthi rebels.

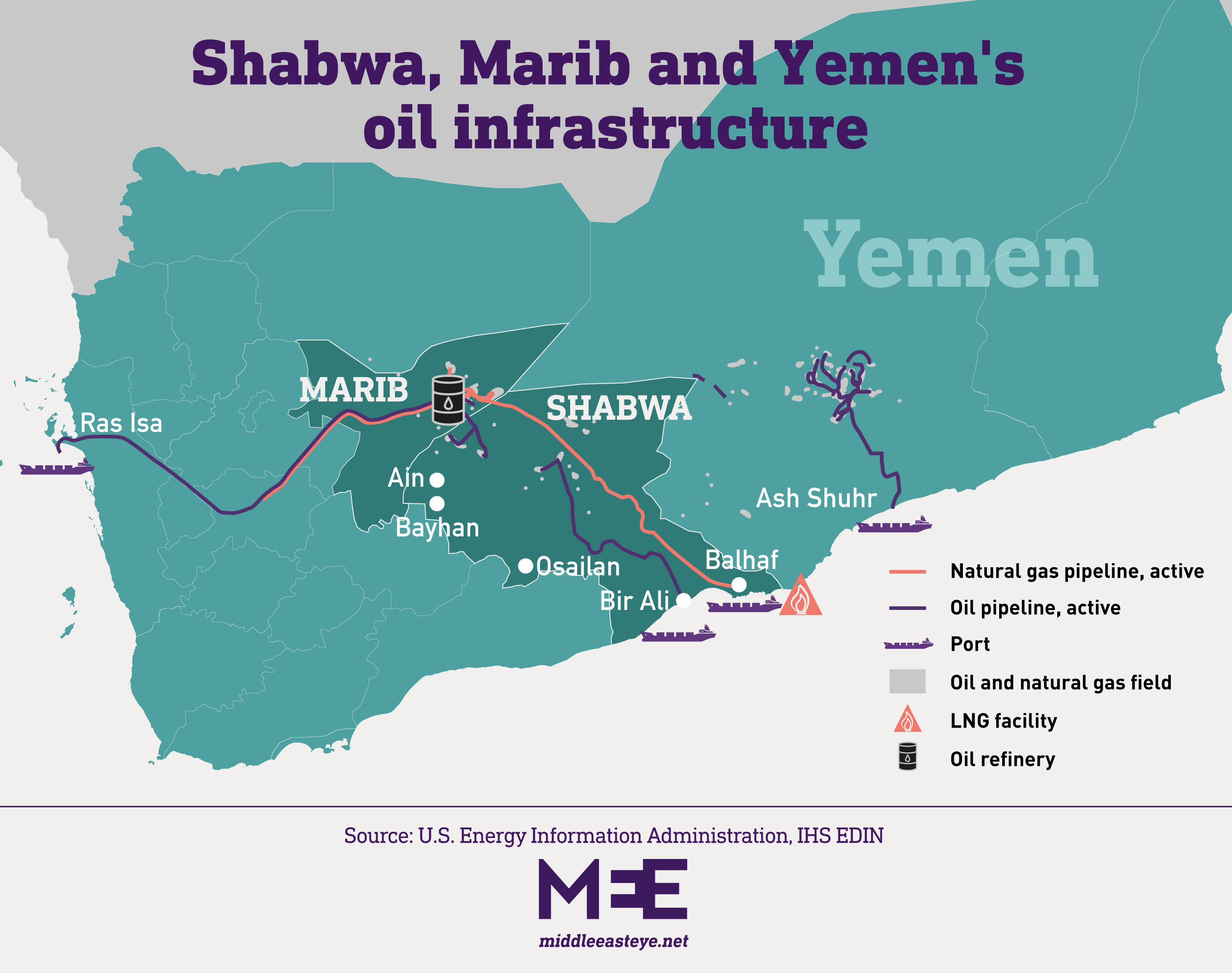

In September, the rebel group moved in on the northern districts of Shabwa, taking over Bayhan and Ain and briefly capturing Osailan.

MEE reached out to a pro-Houthi source, who said the focus of their attacks is determined by recent developments in the conflict, without giving more details on the movement’s strategy.

In response to the internal disputes within Shabwa, and the Houthi assault, a pro-UAE group known as the Joint Forces has been shifting its fighters to the oil-rich province. Al-Amaliqa Brigade, which is part of the Joint Forces, followed suit in late December, moving a large number of its fighters from Hodeidah and Taiz to Shabwa.

For now, pro-government forces and UAE-backed fighters have put their differences aside to stop the Houthi advances. With the air support of the Saudi-backed coalition, the anti-Houthi alliance has managed to regain control of Osailan district, as the fighting now moves to Bayhan.

'Dream for the Houthis'

In the past seven years of war, Houthi rebels and the internationally recognised government, backed by Saudi Arabia and the UAE, have fought mostly in Hajjah, Hodeidah, al-Bayda and Marib. The warring sides traditionally vied for control by tussling over military camps, city centres and public institutions.

While the Houthis control most of Yemen’s north, including the capital Sanaa, they have yet to capture any oil-rich provinces in the country.

Shabwa is of particular value to both sides not only for its oil fields, but because it’s home to the port of Balhaf. This southern sea port, which has been under the control of the UAE since 2016, is equipped with a liquefied natural gas (LNG) plant, a key asset in the export of gas.

In the neighbouring Marib province, located northwest of Shabwa, another fight is ongoing to control this oil-rich region.

“Marib is a dream for the Houthis,” Abdulqudoos, a fighter in Marib who didn’t reveal his last name for safety reasons, told MEE. “They want to take over oil fields, but we will not allow them to advance towards that.”

Abdulqudoos has fought in other provinces, including Taiz, and says the major flashpoints in the conflict nowadays are different from last year's.

'Taiz used to be a hotspot, but this year the focus is on Marib, as the Houthis realised that the real wealth of the country is in Marib and not Taiz or Hajjah'

- Abdulqudoos, pro-government fighter

“Taiz used to be a hotspot, but this year the focus is on Marib, as the Houthis realised that the real wealth of the country is in Marib and not Taiz or Hajjah,” Abdulqudoos said.

Before the war, income from oil production constituted 70 to 75 percent of the Yemeni government's revenues and about 90 percent of exports. But oil production came to a near complete halt in 2015, when war erupted between government forces and the Houthis.

The Yemeni currency has since collapsed in government-controlled areas, from 215 to around 1,000 rials against the dollar; it collapsed to 600 rials to the dollar in Houthi-controlled areas.

An estimated 80 percent of Yemen's population - 24 million people - require some form of humanitarian or protection assistance, including 14 million who are in acute need, according to the United Nations.

Yemenis pay the price

Residents of Marib and Shabwa are well aware of the potential economic benefit of their oil fields.

Mushtaq, who works for an oil company in Shabwa, says locals have long been waiting for oil production to resume, after years of war.

“Many oil companies left Yemen in 2015 because of the war, and the production and exporting isn’t like before,” Mushtaq told MEE.

He fears the current wave of fighting could devastate the economy further and drag the region into an “economic war”.

“Each side wants to control the oil fields and this isn’t ideal,” he said. “This may have a negative impact, as each side could use their control of oil fields and sea ports as a threatening tool.”

The escalation of fighting has forced many of Mushtaq’s colleagues to flee the country, as work became increasingly dangerous. And unless the warring parties can come to the negotiating table soon, Mushtaq fears the interests of Yemenis are what will be harmed the most.

“The United Nations should intervene and neutralise the oil fields and the incomes from oil,” he said. “This will ensure the whole country benefits and not just one side over the other.”

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.