Pandora Papers: Lebanon's power players tied to vast offshore wealth

Some of Lebanon's most powerful political and economic leaders, including Prime Minister Najib Mikati and Central Bank Governor Riad Salameh, have had their secret offshore wealth highlighted in a major new leak of financial documents.

A massive leak of more than 11.9m confidential files to the International Consortium of Investigative Journalists (ICIJ) has revealed the secret offshore holdings of more than 300 politicians and public officials from over 90 countries and territories.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

The Pandora Papers consist of financial and legal records that expose what the ICIJ called a "system enabling crime, corruption and wrongdoing, hidden by secretive offshore companies".

World leaders from the king of Jordan to former British prime minister Tony Blair are implicated in the latest exposure of secret documents relating to offshore dealings.

While establishing offshore companies in territories such as the British Virgin Islands or Panama is not necessarily illegal, it is a common tool for tax evasion, money laundering, and other secretive financial practices.

Mikati and his predecessor Hassan Diab are among the 35 current or former world leaders included in the Pandora Papers leaks. Also prominent among the revelations is Marwan Kheireddine, a powerful Lebanese banker and the minister of state from 2011 t0 2014, and Riad Salameh, the governor of Lebanon's central bank.

The publication of the Pandora Papers came as Lebanon resumed "interactions" with the International Monetary Fund, with a view to agreeing an "appropriate recovery programme", the country's finance ministry said on Monday.

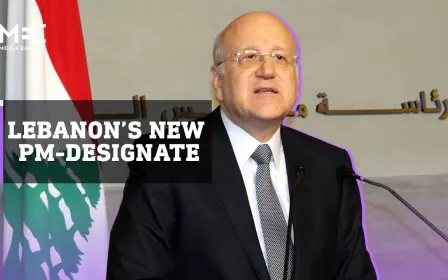

Najib Mikati, prime minister

Worth more than $2bn, Mikati is currently charged with leading Lebanon out of one of the worst economic crises the world has ever seen. The Pandora Papers reveal him to have wealth hidden in offshore tax havens, at a time when ordinary Lebanese people cannot access their bank savings.

According to the ICIJ, Mikati is the owner of Hessville Investment Inc, a company created in Panama in 1994. Hessville was used to buy a property in Monaco, a tax haven, for more than $10m.

Mikati launched the M1 Group, an investment company with assets across the world, in the 80s. The Pandora Papers show that M1 Group was linked to two companies based in the British Virgin Islands (BVI), in which Mikati's son Maher was a director. The companies were used by the M1 Group to own an office in central London.

Responding to an email, Maher Mikati told ICIJ and its media partner Daraj that "it is very typical to own real estate through companies rather than directly.” He added that most of the family’s personal real estate is owned by companies.

Maher told the ICIJ and Daraj that such companies, which are usually based in offshore tax havens like the BVI and Panama, offer “flexibility,” including potential tax advantages, inheritance planning, and “liability ring-fencing, if you decide to rent the property.”

The prime minister's son said that Lebanese nationals use Panama and BVI companies “due to the easy process of incorporation”, and not to evade taxes.

Hassan Diab, former prime minister

Diab, who resigned as prime minister in the aftermath of the Beirut port explosion in August 2020, is part-owner of a shell company in the British Virgin Islands.

After leaving his position as Lebanon's education minister in 2015, Diab set up eFuturetech Services Ltd. According to records from the Pandora Papers, the company's purpose was "general trading and consultancy", but there is no other web presence for it.

According to the leaks, Diab’s co-owners were Nabil Badr, a paper and construction mogul who ran for parliament in 2018, and Ali Haddarah, the chief financial officer of a Beirut-based investment company, Chedid Capital.

Diab, Badr and Haddarah did not respond to ICIJ’s repeated requests for comment.

Marwan Kheireddine, banker

Veteran banker and longtime privatisation advocate Marwan Kheireddine has been dubbed the "head of the gang" by Daraj, after the Pandora Papers reveal he owns two companies in the BVI.

Kheireddine, who is the chairman of Al-Mawarid Bank (AM Bank) and was minister of state in Mikati's government from 2011 to 2014, co-owns Oakwood International Holdings Limited with Huda el-Khalil and Waseem Kheireddine, his brother and long-term business partner.

The banker took over BVI registered company Driftwood Limited after the resignation in 2019 of former director Yahya Mawloud, chief operating officer of Middle East Power and self-styled poet.

According to Daraj, Kheireddine used Driftwood to purchase a yacht for $2m in April 2019. A few months later, Lebanon's economy was plunged into a crisis from which it has not emerged.

Kheireddine's AM Bank, which is owned by his family, has assets worth over $2bn, a network of 17 branches and over 400 employees.

Riad Salameh, central bank governor

Lebanon's powerful central bank governor is now thought to have amassed a fortune worth hundreds of millions of dollars, with the Pandora Papers revealing new details on a company called Amanior, which is fully owned by Salameh, and another company, Toscana, which is owned by his son Nadi.

As reported by Daraj, the Pandora Papers reveal more information on Forry Associates Limited, which is owned by the governor's brother Raja. Forry was at the heart of a Swiss investigation into the possible embezzlement and money laundering of $300m of Lebanese central bank funds.

Salameh is the target of several ongoing investigations, including a French one launched in July, which is looking into money laundering. Last year, Salameh was reported to be linked to offshore companies with almost $100m worth of assets.

Salameh, who has been in post since 1993, making him the longest-serving central bank governor in the world, usually dismisses such accusations as "politically motivated".

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.