Russia-Ukraine war: All eyes on Opec amid soaring oil prices

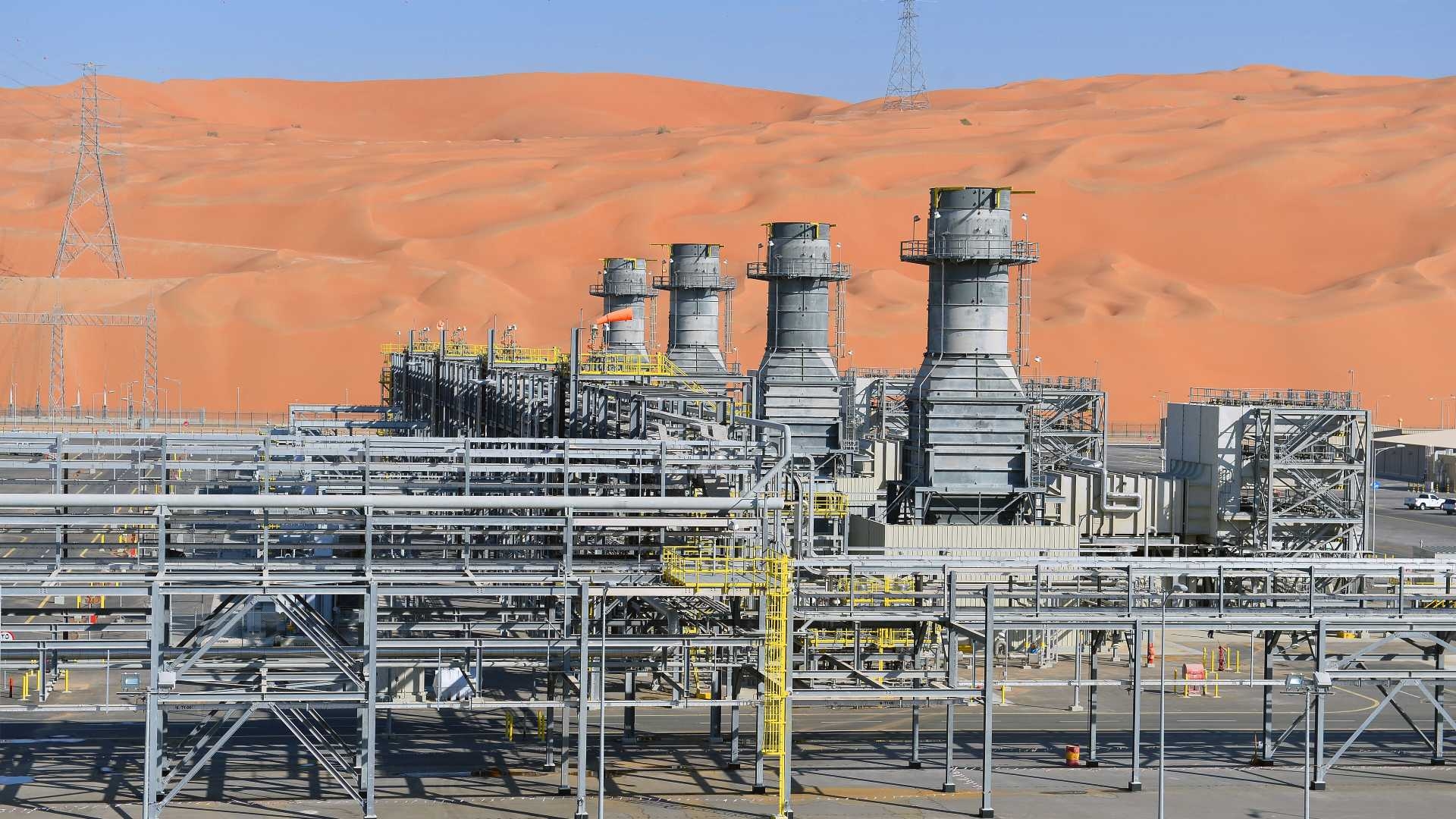

Russia's invasion of Ukraine has led to a global surge in energy prices, with Europe looking towards Gulf states - particularly Opec members - to fill any potential shortfalls should Moscow decide to turn off the taps, or if supply is disrupted.

The world's second-largest oil producer, and responsible for 40 percent of Europe's natural gas imports, Russia has not indicated it would take such drastic steps, but earlier this week, anger over Moscow's offensive saw Germany halt certification of an $11bn gas pipeline project that was set to relieve pressure on European consumers facing record-high prices.

On Friday, oil prices continued to climb - a day after US President Joe Biden said Washington was working with other countries to coordinate the release of supplies from strategic petroleum reserves.

Energy analysts told Middle East Eye that, according to current trends, the price of a barrel of oil could reach as much as $120, some $15 above where it currently stands, creating a heavy burden for many countries already reeling from the economic impact of the Covid-19 pandemic.

Ben Cahill, a senior fellow at the Centre for Strategic and International Studies, told MEE that all eyes were squarely focused on Opec, and particularly on Saudi Arabia and the United Arab Emirates, who have the largest spare capacities within the organisation, meaning the volume of production that can be brought on within a month and sustained for at least 90 days.

"Effective spare capacity in Opec+ is limited to Saudi Arabia, the UAE, and marginal amounts from other countries," he said.

The Organization of the Petroleum Exporting Countries and its allies led by Russia (Opec+) is due to meet next week to decide on output for the month of April. Earlier this month, they agreed to a modest increase of 400,000 barrels a day for March.

The cartel has kept tight control of oil production during the pandemic as demand has slowly grown, but has in recent months fallen short of its commitments to make incremental increases in production.

Some countries in the organisation, including Saudi Arabia, the UAE, Iraq, Kuwait and Russia, are due to produce higher allocations beginning in May, however, western countries are looking for a production boost in the immediate term to stabilise markets.

Why won't the Saudis pump more oil?

Saudi Arabia, the world's third-largest oil exporter, is currently pumping out around 10 million barrels of oil per day (bpd), and has the capacity to produce nearly 12 million bpd.

David L Goldwyn, who served as a State Department special envoy on energy in the Obama administration, told MEE that Saudi Arabia, the UAE and Kuwait were sitting on close to five million bpd in spare capacity, and it was time that they put "more barrels onto the market".

'Saudi Arabia doesn't want to be in a position where it has to choose between its allies'

- Amena Bakr, Energy Intel

So far, Riyadh has shown no interest in ramping up oil production when it is a key player, alongside Russia, in the Opec+ alliance that has strictly controlled output to buoy prices in recent years.

"The Saudis and UAE have been reluctant to go beyond their allocation, as they want to keep cohesion within the group and keep Opec+ together," Cahill told MEE.

But the decision also has to do with Saudi Arabia's burgeoning relationship with Moscow, which has risen in the time since Saudi Crown Prince Mohammed bin Salman became the kingdom's de facto ruler.

These ties have resulted in Russia joining Opec+, as well as recent military cooperation agreements and high-level meetings between Moscow and Riyadh.

In contrast, US President Biden has refrained from meeting MBS and released an intelligence summary saying the US believed the crown prince was ultimately responsible for the death of journalist and MEE columnist Jamal Khashoggi.

"Saudi Arabia doesn't want to be in a position where it has to choose between its allies," Amena Bakr, chief Opec correspondent at Energy Intel, said on Friday during a Twitter Spaces panel.

"It has a relationship with Russia and it has a relationship with the US. And oil policy is really dictated by fundamentals and they don't see a need to add more supply."

Iran nuclear deal to the rescue?

While Opec+ continues to keep a lid on oil production, prospects of a nuclear deal between Iran and world powers in the next week or two could see oil prices fall, Cahill said.

If an agreement is reached and the embargo on Iranian oil is lifted, crude from Tehran could flood the market and help alleviate global oil prices.

"An Iran deal would have a material impact and could provide some much-needed relief to the market," said Cahill.

"No one knows how fast Iran could raise production and exports if sanctions are lifted, but it’s possible output could rise by 500,000 barrels per day to one million [barrels a day] within six months."

Cahill noted that Iran has around 100 million barrels of crude and condensate in floating storage, according to an estimate from the analytics firm Kpler, which could swiftly find its way to markets if a deal is secured and finalised.

In preparation for a completion of the negotiations and a finalised agreement, Tehran has for the past several months been loading oil into shipping tankers - a move that could speed up exports should the deal be completed.

"All things being equal, bringing Iran back to the oil market would remove a lot of market tightness, though how fast they could ramp up production would seem to me to be an open question," said Oliver John, a non-resident scholar at the Middle East Institute and president of Astrolabe Global Strategy LLC.

Iranian oil could bring the price down by about $10 a barrel, Goldwyn said, although he added that the negotiations would likely not be impacted by the current crisis in Ukraine.

"I don't think the US is going to make any major strategic concessions in order to get that supply," he told MEE.

MENA countries face the brunt of high prices

While the conflict in Ukraine could be a boon for major oil-exporting Gulf nations, other countries in the region are set to face significant blows to their economies if prices continue to rise.

'This is about Saudi Arabia acting as a responsible global supplier of a market it hopes to supply for the next decades'

- David L Goldwyn, former State Department special envoy on energy

Tunisia has already said that rising oil prices will have "major effect on public finances".

The north African country, which subsidises domestic fuel prices, was already seeking a foreign rescue package to help it avert a looming crisis in its public finances before the crisis in Ukraine led to a major increase in global oil prices this week.

In war-torn and economically battered Syria, the government of President Bashar al-Assad announced this week that it would cut spending over concerns that oil and wheat prices could sharply increase.

Goldwyn, who also serves as president of Goldwyn Global Strategies, an international energy advisory consultancy, said allowing prices to skyrocket was going to "inflict significant pain on Opec's future market", which includes the developing world and Asia.

"This will have a significant effect on the perception of the reliability of Opec as a supplier if they sit on that spare capacity now.

"It's not all about the US making concessions to Saudi Arabia so they can act as a responsible global supplier. This is about Saudi Arabia acting as a responsible global supplier of a market it hopes to supply for the next decades to come."

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.