Saudi Arabia: Panel advising sovereign wealth fund objected to $2bn funding of Kushner firm

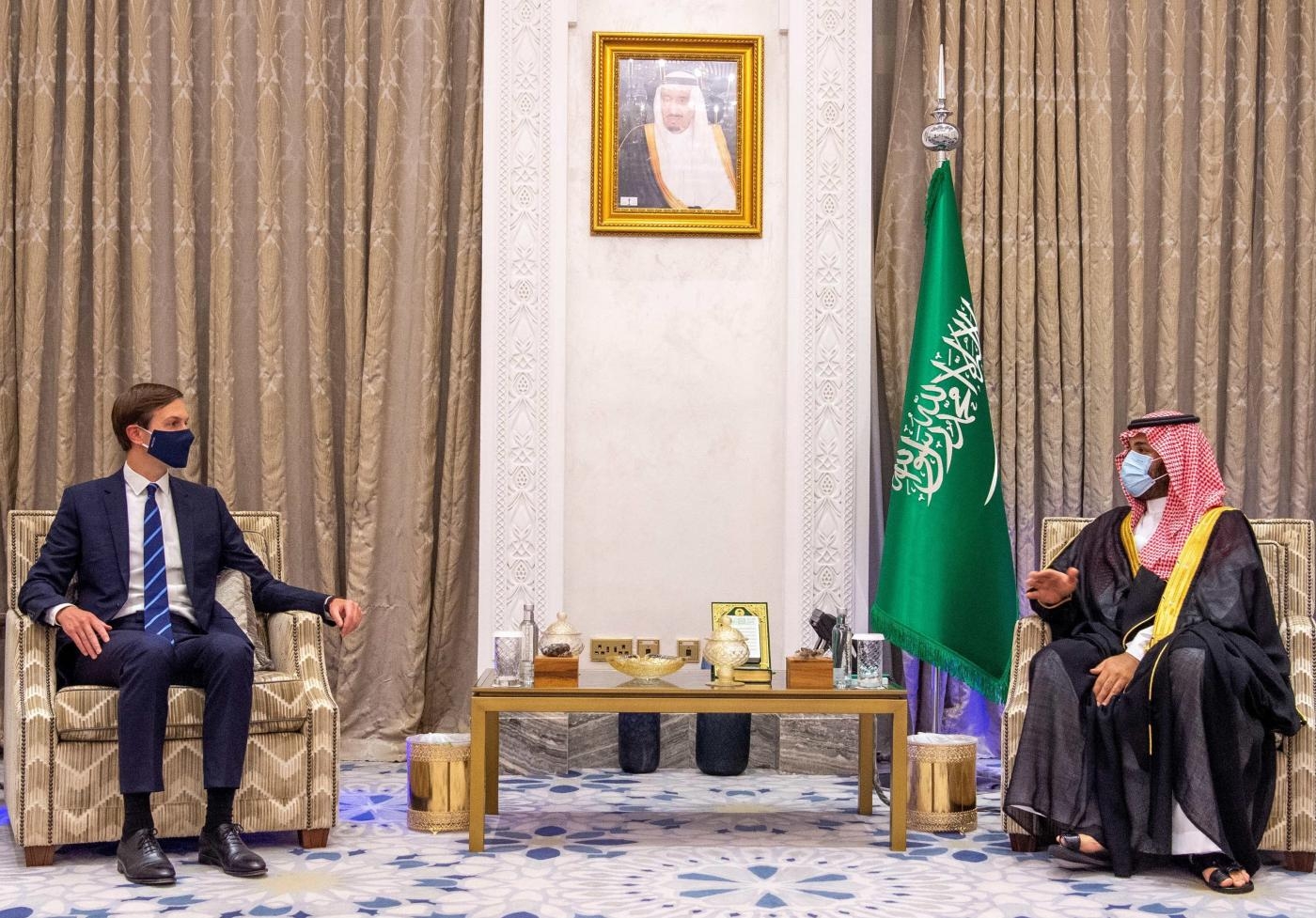

Six months after leaving the Trump administration, Jared Kushner secured a $2bn investment from the kingdom's sovereign wealth fund, led by the Saudi crown prince, despite objections from the fund’s advisers about the potential benefits of the deal, according to the New York Times.

Previously undisclosed documents show the panel that screens investments for the $620bn Public Investment Fund (PIF) cited concerns about the proposed deal with Kushner’s Affinity Partners, a newly formed private equity firm, the New York Times wrote on Sunday.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Objections cited by the panel included: the "inexperience" of fund's management; a proposed asset management fee that seemed: "excessive”; and “public relations risks” arising from Kushner’s previous role as a senior adviser to his father-in-law, former US President Donald Trump, according to minutes of the panel’s meeting in June.

Despite the objections, the full board of the PIF - headed by Crown Prince Mohammed bin Salman, a close ally and beneficiary of Kushner’s support when he worked at the White House - overruled the panel's objections.

Ethics experts told the NYT that the deal came across as potential payback for Kushner’s previous support of MBS, or as an effort to secure future favour if Trump were to become president again.

The journalism studio Project Brazen reported in October that Kushner would receive upwards of $2bn from Saudi Arabia for his private equity firm, with sources telling reporters that Kushner had been debating how to limit the impact of having the kingdom as a key investor in the firm.

Khashoggi's death

Kushner was the crown prince’s primary defender inside the White House following the murder of the Saudi journalist Jamal Khashoggi, who was killed by Saudi agents inside the kingdom's Istanbul consulate in 2018.

US intelligence agencies have concluded that the killing of Khashoggi, a former Middle East Eye and Washington Post columnist, was ordered by the crown prince, a charge the Saudi government denies.

While in the White House, Kushner helped negotiate a series of normalisation agreements between Israel and the United Arab Emirates, Bahrain, Sudan and Morocco.

The move came after MBS signalled that he was in favour of closer relations between Israel and other Arab nations.

In a column published in the Wall Street Journal in March last year, Kushner wrote that normalisation between Saudi Arabia and Israel was "in sight", proclaiming that "we are witnessing the last vestiges of what has been known as the Arab-Israeli conflict".

'Extremely troubling'

The concerns of the panel who advised against the Kushner deal were in direct contrast to their strong backing by the Saudis of a new fund created by former US Treasury Secretary Steven Mnuchin at around the same time.

However, despite Mnuchin's far greater experience and financial success, the PFI, whose other recent investment includes Newcastle United Football Club, agreed to invest twice as much and on more generous terms with Kushner's fund.

One of the panel members who advised against the Kushner deal had asked before its June 2021 meeting for a justification in investing Kushner’s fund.

“Why is the strategic benefit worth the risk?” the member asked, according to printed responses seen by the NYT.

The responses, apparently prepared by PFI staff, said that a new Riyadh office of Kushner's firm, which had agreed to be established under the deal, would help the Saudis “capitalize on the capabilities of Affinity’s founders’ deep understanding of different government policies and geopolitical systems”.

Robert Weissman, president of the non-profit group Public Citizen, told the NYT that Kushner’s relationship with Saudi Arabia was “extremely troubling”, arguing that his position as a senior adviser to the kingdom’s leadership “makes the business partnership appear even more to be both a reward to, and an investment in, Kushner”.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.