GCC exporters to lose $300bn due to falling oil price, IMF warns

Tensions among GCC countries are on the rise in the face of a sharp fall in oil prices that, according to a new International Monetary Fund report, will cost the GCC around $300bn during 2015.

Of the GCC countries, only Kuwait will manage to maintain a budget surplus this year, the IMF said. All other countries including oil-rich Saudi Arabia, Qatar and the United Arab Emirates will sink into deficits.

Bahrain and Oman, the poorest GCC states in terms of energy output, will be especially hard hit.

Speaking at an oil conference in Kuwait earlier on Wednesday non-OPEC member Oman lashed out at the Organisation of Petroleum Exporting Countries (OPEC) that controls around 80 per cent of global oil supplies.

"I fail to comprehend how market share became more important than revenue," Oman’s Oil and Gas Minister Mohamed al-Rumhi said, while accusing the larger oil producers of trying to knock prices in order to keep their share of global markets and discourage a rise in competition.

"When earnings dropped to $2.9bn, $2.8bn, they [the richer OPEC countries] got up to defend market share ... and as a result, revenues dropped to roughly $1.5bn," the Omani minister said.

According to Rumhi, before the decision, with oil trading at $100 a barrel, OPEC was earning $3bn a day from its output of 30 million barrels per day (bpd).

"This is politics that I don't understand. Business? This is not business," he said. "It is really a difficult time in Oman."

However, Saudi Arabia, which is the world’s biggest oil and energy producer, is seen as being behind OPEC’s November decision to not reduce production - a move which is partially attributed to the rapid fall in prices that have collapsed from around $100 a barrel in July to below $50 a barrel today.

The Kingdom has repeatedly stressed that it planned to keep production steady and would not intervene to maintain prices, in a drastic break with traditional OPEC policy of keeping prices high.

While some analysts have linked the move to political manoeuvring intended to hurt Saudi Arabi’s long-time regional rival Iran, or the fast-growing US shale energy sector, OPEC general secretary Abdullah El-Badri- a Libyan national – said on Wednesday that the move was purely business.

"It's not directed at the United States or tight oil. It's not directed to Russia ... It is a pure economic decision by our ministers and we supported it," Badri told a panel audience at the Davos ski resort.

"If we cut [supply] we will have to cut again. Because this non-OPEC supply will keep producing. They will replace us.

"We know the price will come down maybe to 40 or lower. It’s a problem for us to decide on how much we're going to cut," he added.

“Whether it goes down to $20, $40, $50, $60 is irrelevant,” he told the Middle East Economic Survey, adding that the world may never again see oil prices of $100 a barrel again.

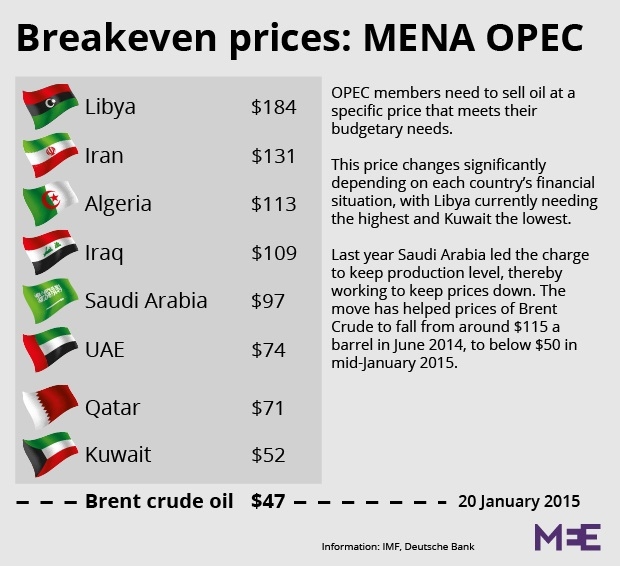

The decision has sent shockwaves throughout the region, with the IMF warning that smaller oil and gas exporters in the region, notably Iran, Iraq, Algeria and Libya, will also be hard hit by the price fall that will push nearly all OPEC countries into deficit in 2015.

"Most oil exporters need oil prices to be considerably above the $57 (a barrel) projected for 2015 to cover government spending, which has increased in recent years in response to rising social pressures and infrastructure development goals,” the IMF said.

Iran has issued officials warnings that it may have to introduce a raft of spending and investment cuts in next year’s budget, which will be based on $72-a-barrel crude, significantly higher than current forecasts estimate.

In December, the Saudi oil minister Ali al-Naimi went as far as to say that it was not in the interest of “OPEC producers to cut their production, whatever the price is.”

OPEC has grown increasingly divided over the move, with poorer members, most notably Venezuela, lobbying for a policy reversal.

Venezuelan President Nicolas Maduro toured the Middle East and North Africa region earlier this month, when he warned that oil prices should not be used as an "economic and geopolitical weapon".

Non-OPEC countries, notably Russia, have also been badly hit. According to analysts Russia could see its economy contract by as much as 4.7 per cent this year based on an oil price estimate of $60 a barrel.

Even so, the IMF warned that the prices could curtail spending growth as countries adjusted to a possibly prolonged period of lower prices.

Kuwait, however, defied sceptic on Wednesday by announcing a $100bn energy spending spree over the next five years.

"We already have started the implementation of the 2030 strategy, and overall spending over the next five years is estimated to be at $100 billion," the emirate’s oil minister Ali al-Omair told an oil conference in Kuwait City.

The funds "will be spent on various projects related to production, refining, petrochemicals, as well as transportation," Omair said.

Kuwait plans to increase its crude production capacity to four million barrels per day by 2020 and maintain it until 2030 from the current level of about 3.2 million bpd. While Kuwait and many other GCC countries have made tentative steps to diversify their economies away from oil and gas, the energy sector still accounts for around 94 percent of Kuwait's public revenues.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.