'Olive oil has become gold': Middle East demand skyrockets amid European drought

The Middle East has a sizzling new commodity: olive oil.

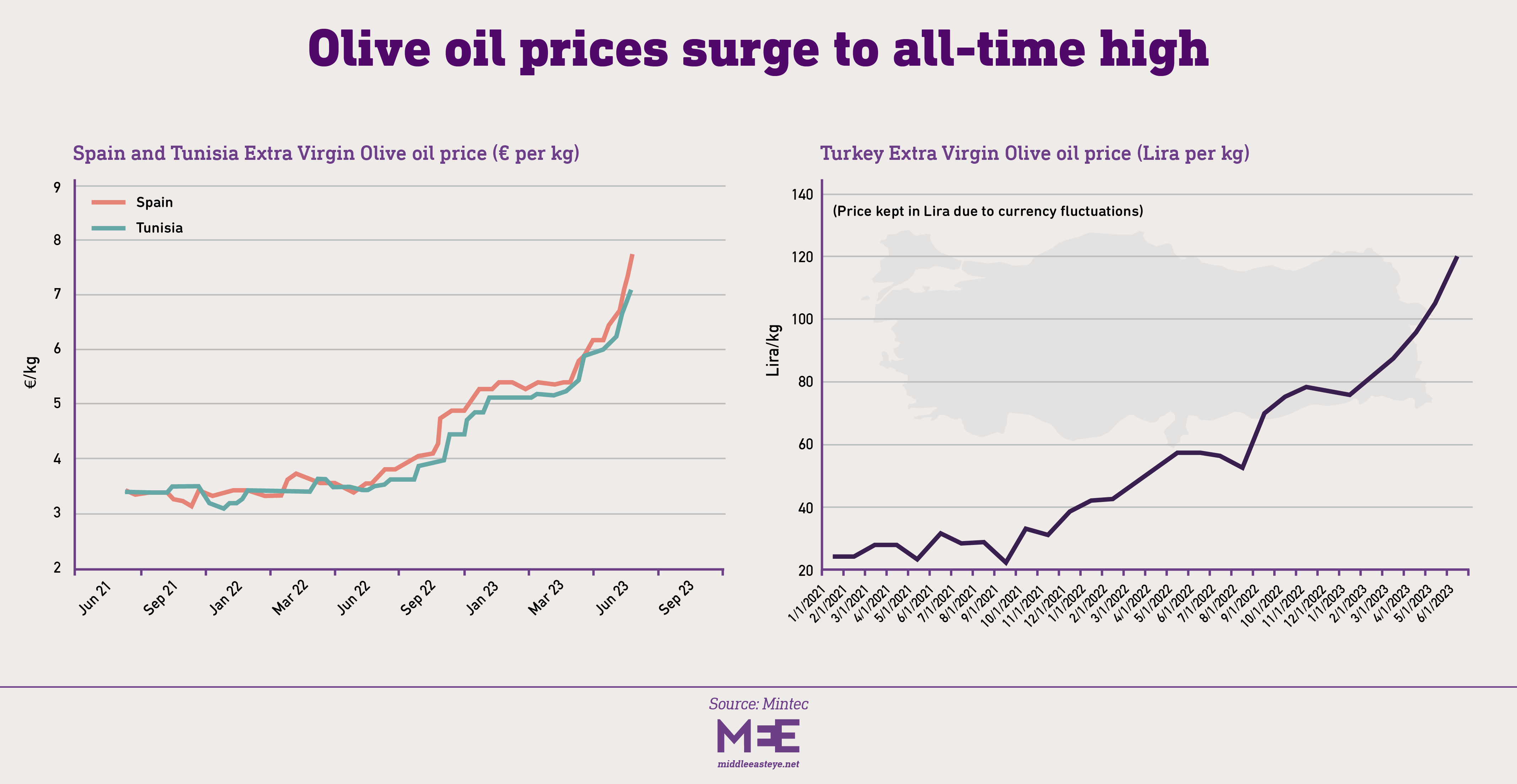

In Tunisia, the price for a kilo of extra virgin is up more than 100 percent from a year ago and demand for bulk olive oil in Turkey is so high that the government just rolled out a tax of $.20 cents for every kilo exported abroad.

The market is so tight that even small producers like Lebanon are seeing unprecedented demand for their olive oil. Earlier this month, a Spanish company arrived in the crisis-wracked Mediterranean country and bought up all the local wholesale reserves, prompting worries about shortages for Lebanon’s own branded label exports.

“If I had a big order today coming from the US or Europe, I wouldn’t be able to fill it. The Spanish have emptied Lebanon out of olive oil,” Christian Kamel, a project director with Fair Trade Lebanon, told Middle East Eye.

Soaring temperatures in southern Europe are causing prices to skyrocket. Spain - where half of the world’s olive oil is made - is suffering an acute drought. It produced just 620,000 tonnes during the 2022-23 harvest, down from the 1.5 million it normally churns out.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

European producers have already turned to Tunisia, the Arab world’s biggest olive oil producer, to fill the gap.

Tunisia sells 90 percent of its olive oil in bulk to heavyweight producers like Spain and Italy. There it is mixed with other oil and sold abroad under Italian or Spanish labels.

Crop yields during the 2022-2023 harvest were low by historic standards, but the tight market has supported export revenue, which is up about 37 percent. Exports are estimated to increase 30 percent to 200,000 metric tons for the 2023-24 fall harvest, compared to 155,000 metric tons last year.

“Tunisian [olive tree] varieties are more resistant to drought compared to the Spanish,” Fahd Ben Ameur, marketing manager of the Tunisian olive oil exporter, Bulla Regia, told MEE.

But with Europe baking under a record-breaking heat wave, and the autumn harvest just a few months away, fears are growing of a global olive oil shortage.

“Come October and November, we could see a complete shortage of Spanish olive oil. That’s why these companies are going elsewhere in the region. They are looking for olive oil anywhere they can find it,” Kyle Holland, an oilseeds and vegetable oils analyst at commodity data firm, Mintec, told MEE.

“The lack of production in Spain has opened up a lot of opportunities for other players,” Holland said.

'Europe has to water and we don’t'

The turn to Lebanon for bulk supplies shows just how desperate times are. Olive groves account for about 23 percent of Lebanon’s total agricultural land, but unlike Tunisia, production tends to come from smaller, family-owned farms. In 2021-2022, Lebanon produced just 15,000 metric tons of olive oil.

But Lebanon’s crop hasn’t been impacted by the drought conditions striking the rest of the Mediterranean. “The species that we have in Lebanon is very resilient. It’s adapted to climate change,” Assaad Saadeh, a fourth-generation grower, who runs Maison Mazak Olive farm in Chabtine, Lebanon, told MEE.

Saadeh started exporting his family’s olive oil three years ago, with the UAE becoming his primary market.

Lebanon is in the midst of an economic meltdown with its currency losing 95 percent of its value to the dollar. The country is plagued by blackouts and its infrastructure is crumbling. The crisis has pushed up bottling and production costs, Saadeh said, but he has one advantage: “Europe has to water and we don’t.”

Mazak sells its 75ml bottle of extra virgin olive oil in Dubai for about $20. Saadeh says shoppers can still find a Spanish alternative blended with different olive oils 40 percent cheaper, but he thinks the price gap will narrow. “We haven’t had to raise retail prices at all in the last three months”

“There is an opportunity for us, because our costs are staying the same and the Spanish prices are going higher.”

'Europe needs us'

Lebanon belongs to a region known as the Levant, or Bilad al-Sham in Arabic, which includes, Syria, Jordan, Palestine, and Israel. Syria’s olive oil industry was ranked fourth in the world before its civil war, and some of its crop - Syria produced 143,000 metric tons of olive oil in 2020-2021 - continues to be sold into Turkey, regional growers tell MEE.

But few of the other Arab countries in the Levant managed to carve out an export footprint in developed markets, despite producing olive oil for thousands of years. Most farms are family run and they lack the economies of scale to compete with Tunisia or Spain. They also don’t have the branding appeal to go up against the likes of Greece or Italy.

'In Jordan, the hummus is just drenched in olive oil'

- Adnan Khodari, Jordanian exporter

The same is true for olive oil exporters in Turkey, which enjoyed a record harvest last year, with oil production hitting about 420,000 metric tons.

“When I send my olive oil abroad, I know I need to put my product at a more competitive price on the shelf. My profit margins will remain below Greece or Italy,” Duygu Ozerson Elakdar, who owns 60,000 olive trees in Izmir province, told MEE.

She has also seen demand for bulk Turkish product soar.

“All the Europeans are coming here to buy in bulk. We know that in Europe there are no olives on the trees now. We are keeping the prices at the highest level because they need to buy from us,” said Elakdar, whose Hic label olive oil is sold at Whole Foods stores in the US.

The price for a kilo of Turkish olive oil has more than doubled since the beginning of the year, with July prices reaching 185 Turkish lira per kilo ($6.88), Elakdar said.

“Olive oil has become gold.”

'Sometimes Allah smiles on you'

The skyrocketing prices are coming at the perfect time for Jordanian producers, where a consortium of four major farms - one of which is owned by King Abdullah II - plans to launch a private label in the US.

“In Jordan, we are swimming in olive oil. The hummus is just drenched in it,” Adnan Khodari, a Jordanian food exporter helping the consortium enter the US market, told MEE.

Jordan’s average production is small, at around 25,000 metric tons per year, and most of it is consumed by the domestic market. Khodari says the consortium, which has already received pre-orders for 50,000 bottles for next year’s harvest, aims to market the surplus 3,000-5,000 tons left over in the West.

“Jordanian olive oil sells for a very high price. It’s all premium. So definitely, diminishing quantities in Europe are an advantage for Jordan. It’s great for us because we are aiming at the top shelf. Sometimes Allah just smiles upon you.”

Nidal Samain, who owns Aljood farms in Jordan and is one of the region’s leading olive oil experts, says Jordan’s olive oil industry is well placed to capitalise on climate change. The country is one of the most water-scarce in the world.

The local Nabali olive tree is “perfect for drought conditions. It thrives in the desert,” Samain told MEE. “The best quality olive oil in all of Jordan is produced in the desert with no watering.”

Any boom in olive oil exports is likely to be a rare bright spot for countries whose economies are in dire straits. Jordan faces sky-high unemployment and basically sustains itself with aid from the US. Meanwhile, Turkey is coping with a currency crisis and inflation hitting near 40 percent.

“We have hyperinflation, so Turkish olive oil is cheap globally compared to other producers,” Elakdar said. “But we aren’t seeing a big gain in profit margin. Producers are struggling to keep up with the lira’s devaluation.”

The Turkish government is also looking to boost its coffers and encourage more private-label exports amid the buying frenzy.

Elakdar supported the new tax on bulk olive oil exports, adding that she wants to boost sales overseas of her private label in the hot market.

“Right now 70 percent of sales are local and 30 exported. My goal is to switch that."

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.