France: NGOs use tax-free donations to fund Israeli military equipment

Non-profit organisations dedicated to charitable activities in France illegally make tax-free calls for donations to finance military equipment for Israeli soldiers, a French media outlet revealed earlier this week.

In an investigation published on Tuesday, titled "How our taxes finance drones for the Israeli army", Le Media reported on how community associations break the fiscal legislation enabling charities to benefit from tax-free donations in order to help the army of Israel, which has been waging a devastating war on Gaza and Lebanon over the past 12 months.

In France, donations to non-profit organisations "of general interest" are tax-deductible up to 66 percent. This means that a donation of 100 euros allows the donor to reduce his taxes by 66 euros, thus paying only 34 euros.

This fiscal mechanism aims to encourage philanthropy for humanitarian, social or cultural causes. However, some organisations seem to be abusing it.

Le Media focused its investigation on Tipat Mazal, an organisation created in 2020 near Paris to work "voluntarily for the elderly, orphans and single women with children" in the region.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

However, for several months, Tipat Mazal has directed donations it receives towards the purchase of military equipment for Israeli soldiers, according to Le Media.

This includes helmets, tactical vests and dozens of latest-generation thermal drones used for field reconnaissance and currently being deployed in southern Lebanon.

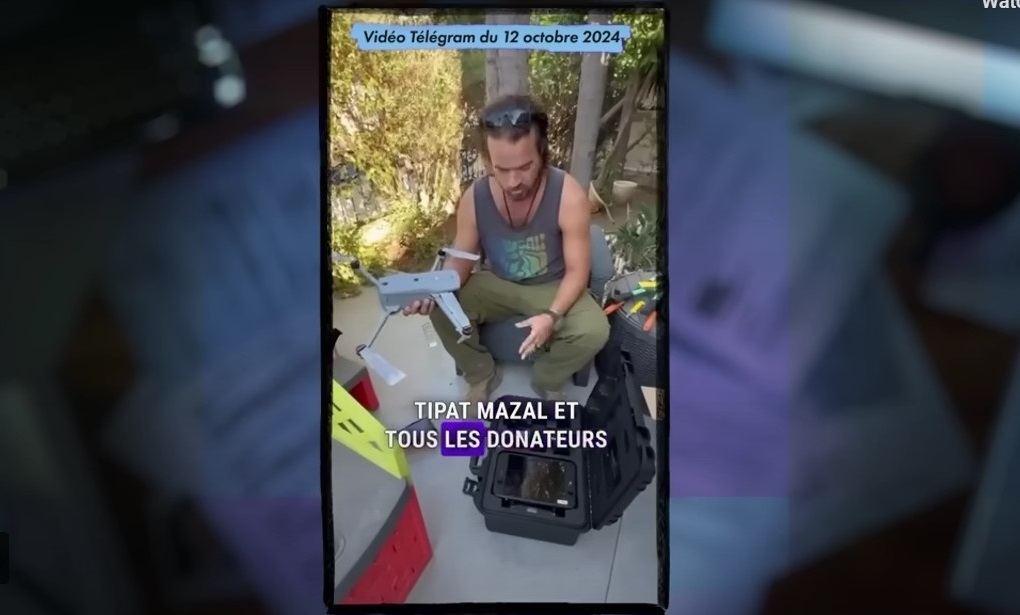

Le Media underlines the key role played in the process by a 49-year-old French-Israeli man named Yohan Sabatier, who has been active since 7 October 2023 providing assistance to Israeli soldiers on the ground, particularly to reservists whom he considers to be poorly equipped.

In an interview in May on a community YouTube channel, Sabatier explained that donations collected by French charities are intended to purchase equipment for Israeli soldiers. He admitted this aid is also illegal in Israel and explained that to circumvent customs laws, donors must claim that these funds are intended for civilians.

Tipat Mazal advertises its fundraising, whose objectives are unclearly termed, on its social media platforms and a Telegram channel totalling more than 49,000 subscribers. Presented as a news group on Israel's security, the channel is fed by announcements meant to help Israeli businesses and army.

Donors are assured of receiving a tax certificate allowing them to deduct their donations. However, the certificate does not mention any military purchases, and instead justify the donations as being intended for "destitute families", Le Media checked.

Videos broadcast on social media show Israeli soldiers thanking Sabatier and French donors for the military equipment they were able to acquire thanks to the fundraising.

According to Le Media, 50 drones worth 7,000 euros each were supplied to Israeli soldiers for a total of 350,000 euros. By applying the 66 percent tax exemption, French taxpayers thus contribute 231,000 euros, according to the outlet.

Following its investigation, the soldiers' thank-you videos were deleted and the fundraisings closed.

The French finance ministry and the local prefecture did not respond to Le Media's requests for comments.

'Taxpayers' money to finance death'

This is not the first time French non-profit organisations have been accused of such practices.

At the end of 2023, a few months into Israel's war on the Palestinian enclave, the French media already reported on a similar scheme aimed at supporting Israeli soldiers. At the time, the tax-exempt donations helped purchase food, clothing and hygiene products.

The finance ministry recalled at the time that these practices were illegal, stating that support for soldiers in a foreign army is not eligible for tax deduction.

Nevertheless, some organisations have continued to offer tax exemption for donations intended to support Israeli soldiers, as revealed by several media outlets earlier this year.

The ministry did not provide details on the measures taken to sanction those organisations, in the name of "tax secrecy". It also declined to specify how many tax audits were carried out to verify that charities abide by the law.

In France, the "general interest" statute, which allows tax reductions for donations, is self-attributed by organisations. There is no beforehand control, and subsequent tax audits are occasional.

"In the face of the lack of control and repression, this practice has developed to the point of passing a threshold. Not only do community associations continue to offer tax exemption to these donations that help the Israeli army, but in addition [...] the objective of some of these donations is now to provide tools for military and tactical purposes," Le Media wrote.

Alma Dufour, MP from the left-wing France Unbowed party, denounced these illegal practices of allowing the purchase of "weapons for a colonial and genocidal army".

"[The French government] is cutting 4,000 teaching positions and reducing the budget for health, ecology and justice. Letting taxpayers' money go to finance death is therefore a double scandal," she wrote on X.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.