Egypt 'still attractive to investors', finance minister claims

Egypt's finance minister Amro al-Jarhi said on Tuesday he remained confident that the country would continue to attract international investors despite its current economic malaise which has sent the Egyptian pound plummeting and depleted its foreign exchange reserves by more than half.

“We have confidence that investors are coming to our countries because of the ongoing reforms,” he said, referring to President Abdel Fattah al-Sisi’s 2015 economic plan that involved cutting costly fuel subsidies, increasing taxes and devising infrastructure projects.

“There are problems and challenges that we are currently facing such as foreign exchange and we are working to resolve them in a fast and efficient manner,” Jarhi continued. “Everyone knows that there is a historical decrease in the Egyptian currency, which reached a clear decline toward the end of last year up until now due to Egyptian returns from foreign exchange."

Egypt's foreign exchange reserves have fallen from more than $36bn in 2010 to about $16bn, despite some $20bn given in aid to Cairo by its powerful Gulf allies.

Jarhi attributed the Egyptian pound’s decline in part to an international wave of currency deterioration to which Egypt had been slow in responding.

“The US dollar was equal to about 5.5 Egyptian pounds at the beginning of 2011 but is now equal to 8.88 pounds," the minister said.

The minister also said the decrease of Egyptian exports was due to a decline in international trade, with the absence of sufficient currency playing a role in delaying the import of necessary raw materials for export factories.

He stressed the government was committed to supporting small and medium enterprises.

“We in Egypt are working on credible policies to stimulate growth, investment and employment with special attention given to economic and social justice,” he added.

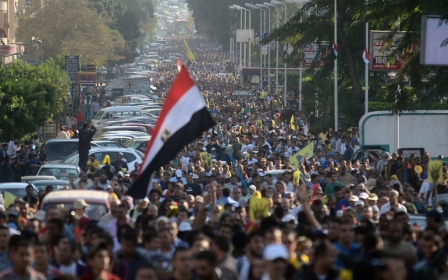

Egypt's currency crisis has been badly affected by the slump in tourism since the 2011 revolution that removed former president Hosni Mubarak and particularly since last October's Islamic State (IS) group-claimed bombing of a Russian airliner leaving the Red Sea resort of Sharm el-Sheikh.

Revenues from tourism slumped 15 percent year-on-year to $6.1bn in 2015.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.