Egypt achieves first primary budget surplus in 15 years - but austerity continues

Egypt has reported its first primary budget surplus in 15 years, amid tough austerity measures and price increases that have hit the the poor and middle-classes.

Finance Minister Mohamed Maait told a Cairo news conference on Thursday that Egypt achieved a 0.2 percent (of GDP) primary budget surplus, worth 4bn Egyptian pounds ($223mn) during the 2017-2018 fiscal year, which ran from July 2017 to June 2018.

"All indicators from the previous year show that the country is heading in the right direction," Maiit said.

All indicators from the previous year show that the country is heading in the right direction

- Mohamed Maait, finance minister

Achieving a primary surplus means that the Egyptian government's revenues exceeded its expenditure during that period, excluding interest on its outstanding debts, and that the Egyptian government will only need to borrow to pay back loans and interest.

The government is aiming for a two percent primary surplus of $5.5bn in the current fiscal year, which began this month.

Maait said that the government has forecast it will receive $55.3bn in revenues between now and next June, of which $45.6bn will be spent on debt interest and instalments.

The news was not all positive however. A report from the finance ministry said that the overall budget deficit was up by $419mn in 2017-18 compared to the previous financial year.

Primary surplus an 'illusion'

Reaction from analysts to the announcement was mixed.

David Butter, Middle East and North Africa programme associate fellow at Chatham House, said the primary surplus was "an important achievement," showing that the government has succeeded in generating more revenue through higher growth and increased taxation, especially sales tax, while keeping a lid on expenditure.

The government promotes the illusion of achieving what is called the 'primary surplus' and ignores the fact that the post-2013 regime is the main cause of the doubling of debt both internally and externally

- Ahmed Zekrallah, economist

But Ahmed Zekrallah, an Egyptian economist, said that using primary surplus as an indicator is misleading because it does not take into account the government's outstanding debts.

"The government promotes the illusion of achieving what is called the 'primary surplus' and ignores the fact that the post-2013 regime is the main cause of the doubling of debt both internally and externally," he said.

Zekrallah said government debt was about $139.7bn just before president Mohamed Morsi was deposed in July 2013; now it is double that at $279.5bn.

"Post-2013 authorities are the cause of the loans and interests that should be counted as part of the deficit, which is the outcome of the current government's actions and not a historical legacy for them as claimed."

He also said that much of Egypt's population had yet to reap the benefit of the surplus, with spending on education, health and other social services failing to increase in recent years.

Austerity hits hard

In 2016, Egypt struck a three-year $12bn loan deal with the IMF, intended to quickly cut Egypt's budget deficit by reducing government spending and boosting revenues.

But it has resulted in three waves of price hikes, the last of which coincided with the Eid holiday in June. A series of fuel subsidy cuts has also led to a sudden increase in transportation tarriffs during the same period.

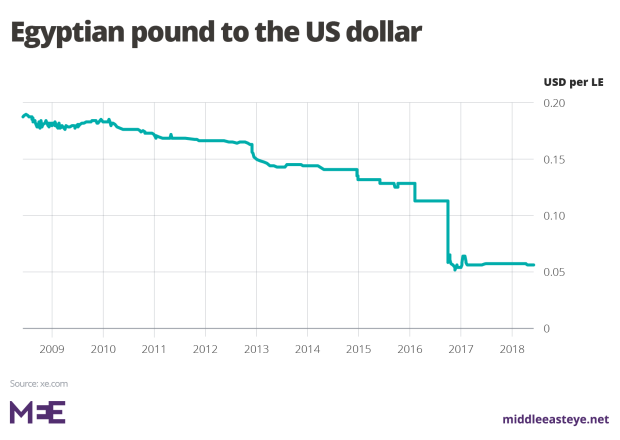

The pressure on much of the population has been exacerbated by the devaluation of the Egyptian pound, which has now seen a 150 percent drop against the dollar since 2016, leading to a sharp rise in the price of basic goods that has hit the poor and middle classes hard.The simultaneous and rapid approach in implementing the IMF reforms has sparked downward mobility for most Egyptians.

In some governorates in Upper Egypt, poverty rates in 2018 reached as high as 60 percent, according to the World Bank.

"The high inflation accumulated over the course of [2015-17] has lowered the purchasing power of households across the distribution, reducing the positive spillovers of economic growth; taking a toll on social and economic conditions," it reported.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.