ANALYSIS: Political uncertainty and violence wobbles Turkey’s economy

ISTANBUL - The failure to form a coalition government in Turkey last week and the prospect of another election has dealt yet another blow to the local stock market and prompted a further decline in the Turkish lira. It also raised concerns about the long-term impact on an already sluggish economy, which has become a growing cause for concern among analysts.

The lira set a historical low of 2.83 against the US dollar on 13 and 14 August, while the Istanbul Stock Exchange BIST 100 index dropped 3 percent on 13 August and is trading at its lowest since March.

For Mustafa Sonmez, an economist, the currency depreciation does not bode well for Turkey since the country has $400bn of debt, 65 percent of which is private sector debt and 40 percent is short-term debt.

“Such depreciation will lead to import-related inflation and will have no benefit for Turkish exports since they are already decreasing due to the situation in the European Union and the Middle East,” Sonmez told Middle East Eye.

Despite falling oil prices, which has slowed down inflation globally, Turkey’s inflation rate remains at a stubborn 7 percent, eroding wages while leading to an increase in the price of almost all commodities.

The Turkish Central Bank intervened on Friday by tweaking policy tools, such as reducing the one-week dollar deposit rate from 3 to 2.75 percent and tightening liquidity by opening a 19bn ($6.7 bn) Turkish lira one-week repo auction to stem the lira’s slide, but its impact will be limited at best, according to economists.

The central bank really needs to take a tougher approach regarding interest rates, said Mehmet Kaytaz, a professor and dean of the faculty of economics and administrative sciences at Istanbul’s Isik University.

“It is very difficult to control exchange rates with the measures it [the central bank] is taking. But we should remember that the central bank also faces political pressure when it comes to raising interest rates,” Kaytaz told MEE.

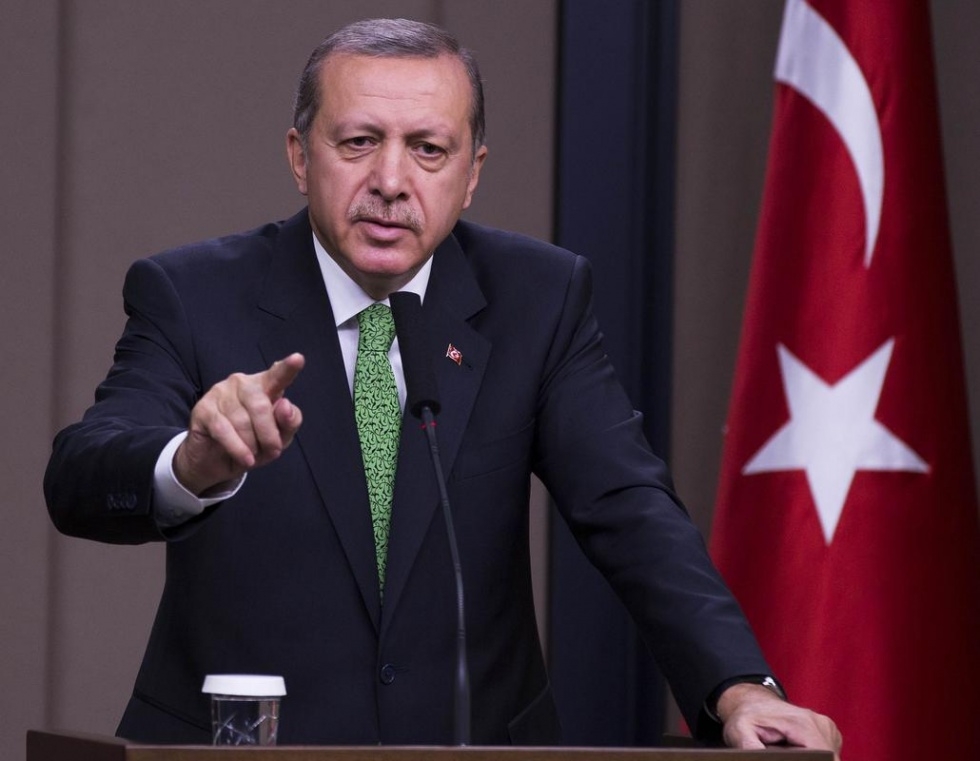

On many occasions during the past year, many top government officials, including President Recep Tayyip Erdogan, have publically directed criticism at the central bank and have pressured it to keep interest rates low.

Sonmez also said the central bank does not have sufficient means to bring this currency depreciation under control.

“The central bank’s reserves are not at a sufficient level, and the outflow of foreign capital means that the current account deficit is financed by the central bank’s reserves, so there is not much it can do when it comes to the exchange rate,” said Sonmez.

Ankara relies heavily on foreign capital inflows to finance its current account deficit, which in large part is down to the country’s reliance on energy imports. Capital flight adds pressure on the central bank’s meagre foreign currency reserves as they need to be channelled toward financing the country’s external debt, leaving it little manoeuvring space to have an impact in other areas.

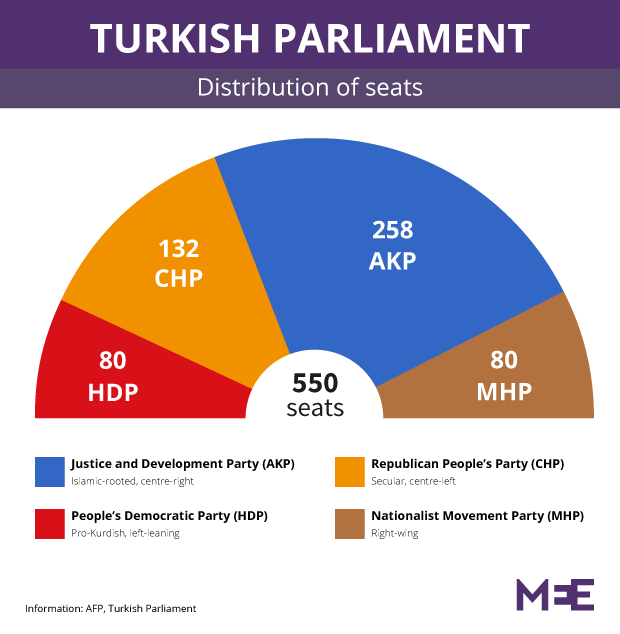

A caretaker government has run Turkey since the 7 June general election, when no single political party secured a majority to form a government. The failure to form a coalition took Turkish commentators by surprise as polls seem to suggest that new elections will not significantly change the outcome.

“All this political uncertainty is transforming into economic uncertainty. I am not sure how much longer the economy can withstand this, even though the Turkish economy is relatively resilient. If this political uncertainty continues for much longer, it will really slow the economy down,” said Kaytaz.

Sonmez said the continuing political uncertainty does not generate a viable climate for foreign investors. When taken into consideration alongside the strong possibility of the US Federal Reserve increasing interest rates this year for the first time in a decade, Turkey is being deprived of much needed foreign cash.

Turkey is no exception to other emerging markets when it comes to seeking foreign capital for infrastructural projects and other investments, and a higher FED rate would mean foreign investors will be less inclined to take a risk on more volatile emerging markets.

Climate of violence

Adding to concerns is the violence that has engulfed the country since the end of July after Ankara launched a major offensive against groups such as the Kurdistan Workers’ Party (PKK) and Islamic State. If the violence spreads to major urban centres and tourist resorts then the economy could nosedive.

Although growth surpassed the EU average last year, Turkey fell short of the OECD growth average. According to the World Bank the country has also seen growth fall from 9.2 percent back in 2010 to 2.9 percent in 2014. The downward trend continued into the first quarter of 2015, although at present the IMF is expecting a small uptick by next year and estimates that average growth for 2015 -2016 will be closer to 3.1 percent.

However, if this climate of violence and political limbo continues, and key EU economies as well as China fail to pick up steam, it could result in negative economic growth, Kaytaz warned.

Currency rates and tourism revenues are of vital importance for Turkey since it has a chronic current account deficit, which has weighed heavily on it for decades.

Tourism revenues for 2014 stood at US$34.3 bn, according to data from the Turkish Statistical Institute. Turkey relies on such revenue to attempt to balance its heavily-skewed current account balance. A balanced currency exchange rate is also vital for Ankara because although a weaker lira makes Turkish exports more competitive, its predominantly import-heavy economy means it also raises inflationary pressures.

“Tourism on the southern Turkish coastline has already suffered, with fewer visitors due to the situation in the region,” said Sonmez. “Also the Russian crisis [with growing rifts with the EU over the situation in Ukraine] has resulted in a drop in the number of Russian tourists. I hope violence doesn’t spread because then it will get worse and cities like Istanbul will also be affected.”

Attacks on the country’s oil and gas pipeline infrastructure could deal a potentially serious blow to Ankara’s aim of being a regional energy hub and transit route. Two have taken place this month, including one on the Shah Deniz pipeline carrying natural gas from Azerbaijan.

Kaytaz doesn’t think attacks on such infrastructure can carry on for long.

“The PKK is an entity that wants international recognition and exposure so hence these attacks. But oil is not just limited to Turkey. It affects the whole world and particularly Europe in this case, so no one is going to allow such attacks to go on in the long term,” said Kaytaz.

Another concern is also Iran’s decision to temporarily cut off gas supplies through its existing gas pipeline due to attacks on it in eastern Turkey. Reported attacks on the train service and buses plying the route between Iran and Turkey have also led Iranian officials to issue a travel warning to its citizens advising them to avoid land travel in the eastern regions of Turkey and a suspension of the train link.

The timing could not be worse since the prospect of tapping into the Iranian economy following its nuclear deal with the international community holds great promise for expanded trade ties between these two countries.

G-20 Summit and snap elections

Further adding to the pressure is the upcoming G-20 Summit, scheduled to be held in the tourist resort city of Antalya in November. This summit, which has been hyped as an event where Turkey would display its leadership qualities and vision to the world, might be overshadowed if a snap election is also scheduled for the same month.

The costs for security operations are likely to rise given current circumstances, and questions are also being asked as to whether the heads of state of the 20 most prominent economies in the world would be keen on attending a summit in such conditions.

“In terms of prestige it will be embarrassing for Turkey. I wouldn’t say world leaders won’t bother to attend, but they certainly won’t leave with a good impression,” said Kaytaz.

However he added that “the increased cost of security measures will be of no real significance for Turkey since it has a good medium-term budget and added security costs won’t be an issue.”

But even if this particular hurdle is overcome, analysts believe that long-term growth and stability could be hit hard by regional turbulence, as well as internal divisions, if the main political actors do not come to a compromise soon.

Both Kaytaz and Sonmez are of the opinion that putting an end to the political uncertainty that has gripped the country is the primary issue that needs to be addressed to prevent the economy, however resilient it may be, completely going off the rails.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].