Egypt devalues currency in attempt to revive flagging economy

Egypt devalued its currency on Monday by 14 percent, prompting a rally in the stock market which soared 6.7 percent on the news.

The devaluation – which saw the Egyptian pound devalued to 8.85 Egyptian pounds per US dollar from 7.73 pounds – is designed to to eliminate a black market for dollars that has flourished as a foreign exchange shortage stifles business activity, the Central Bank said.

The bank has been battling an acute US dollar shortage over the past few months, with the local currency often trading at a rate of almost 10 pounds to the dollar on the black market.

"This will resolve the exchange rate irregularities, resulting in a more regular and continuous flow of foreign currency," the bank said in a statement.

The move would also help face "challenges from a noticeable decline in foreign currency inflows from tourism, direct investment and remittances from Egyptians living overseas".

The hope is that the readjustment will boost Egyptian exports by making goods cheaper abroad and make Egyptian businesses more competitive globally.

The EGX 30 Index, which has been rallying in recent weeks after hitting lows in January, rose further on the news to levels not seen since July 2013. It has now risen 23 percent above January's low.

While in principle a devaluation should also boost tourism by making it cheaper to visit Egypt, many European tour operators are imposing travel restrictions on Egypt due to security concerns.

Tourism has long been a key source of revenue in the country, but the sector was hard-hit by the uncertainty following the 2011 uprising against president Hosni Mubarak.

In October, the Islamic State (IS) group claimed the downing of a Russian plane over the Sinai that killed all 224 holidaymakers on board.

Revenues from tourism slumped 15 percent year-on-year to $6.1bn in 2015.

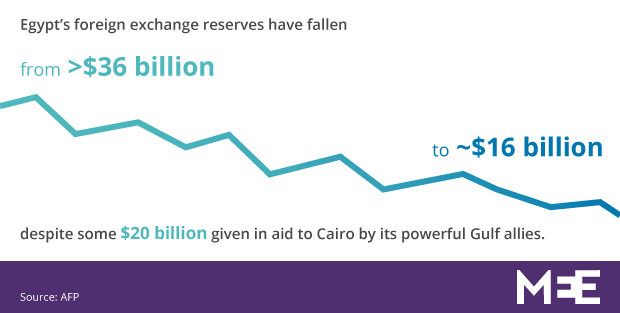

Egypt's foreign exchange reserves have fallen from more than $36bn in 2010 to about $16bn, despite some $20bn given in aid to Cairo by its powerful Gulf allies. Reserves have been rising for five months in a row but continue to be less than half their December 2010 level, Bloomberg reported.

The bank says the reserves would reach $25bn by the end of 2016 on the back of "foreign investments and an increase in the competitiveness of the Egyptian economy".

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].