Qatar plans £5bn spending spree in UK as Brexit looms

The British government has welcomed news that Qatar will invest £5bnn in Britain, a day before Article 50 is triggered and Britain’s formal divorce process from the European Union begins.

The deal announced by Qatari Prime Minister Sheikh Abdullah bin Nasser bin Khalifa al-Thani on Monday will see the emirate focus investments in energy, infrastructure, real estate and services within five years across the UK, including Scotland.

The announcement came as the UK's prime minister, Theresa May, said she hoped a new trade deal could be struck with the Gulf states in the wake of the UK's exit from the EU.

Speaking shortly after appearing at the Qatar-UK Business and Investment Forum in London, which represents some 400 Qatari businesses, al-Thani said: "Over the next three to five years Qatar will invest £5bn ($6.23bn) in the UK economy through various investment funds and relevant parties - which will constitute another addition to its already successful investments in the UK.”

UK Trade Secretary Liam Fox said the deal would lift the mood of uncertainty surrounding Britain’s post-Brexit future.

"Qatar's emir has given a strong vote of confidence and faith in our economy,” Fox told a Qatar-UK investment conference in Birmingham on Tuesday.

Prime Minister Theresa May, speaking at the same conference, also announced plans on Tuesday to deepen the UK's relationship with Qatar in areas including defence, education, healthcare, energy and financial services as well as a post-Brexit regional trade deal.

"I hope we can pave the way for an ambitious trade agreement for when the UK has left the EU, including exploring whether we can forge a new trade agreement for the whole of the Gulf area," she said.

Post-Brexit natural gas

Qatar senses an opportunity to make up for a potential shortfall in liquefied natural gas (LNG) when Britain - the world’s fifth largest economy - exits the European Union, and is open to investment in British energy assets, Qatar's energy minister said.

"The UK will have a new era post-Brexit ... The negotiations will start among Europeans and nobody is extremely clear about where the negotiations will lead to," Energy Minister Mohammed bin Saleh al-Sada said in an interview with the Reuters news agency on Monday.

"However, we can sense the possibility of the UK's manufacturing power going higher, and with that the need for energy. For that, Qatar will always be there to supply the energy required. Certainly we can contribute to the UK's need."

Britain has been receiving LNG from Qatar since 2008. As the Gulf state moves to stave off rising competition in Asia from other LNG producers, it will focus on expanding contracts in Europe.

"Europe is an important market. The UK is a very important market," Sada said.

But like other Gulf economies, Qatar is also trying to restructure its economy to rely less on hydrocarbons.

Qatar has invested some £40bn in the UK and is already the largest landowner in London with a property portfolio three times larger than the Queen’s

"There is pressure from my board to diversify in terms of geography and asset class, but we are still looking, even after Brexit, for opportunities," Abdullah Bin Mohammed Bin Saud al-Thani, chief executive officer of the Qatar Investment Authority (QIA), told the forum.

The QIA boss also announced plans to open a Silicon Valley office by the beginning of next year as part of a drive to wean the economy off oil and into more sustainable sectors, such as the knowledge economy.

London's biggest landowner

According to data from the property research firm Datshca, Qatar has invested some £40bn in the UK and is already the largest landowner in London with a property portfolio three times larger than the Queen’s.

Canary Wharf Group Investment holding, which is co-owned by a subsidiary of QIA and American investment group Brookfield, is the capital’s largest property owner, surpassing even the Corporation of London which has historically owned large parts of London’s main financial district.

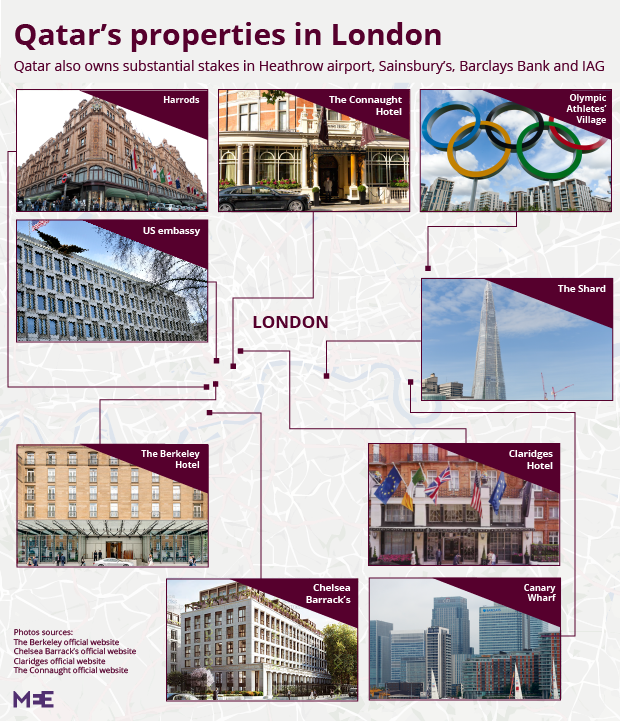

Other Qatari investments include iconic London real estate such as the Harrod’s department store in London, London’s Shard and Canary Wharf, which contains some of the city’s largest buildings. The country also bought the Olympic Village following the London 2012 Olympics and it was given planning permission last year to turn the US embassy building in London's West-End into a luxury hotel.

Dubai and Kuwait’s sovereign wealth funds have also made significant investments in Britain in recent years. The Kuwaitis have assembled a sizeable 3.65m sq ft of real estate in a short period of time. London City Hall, the seat of the Mayor of London, forms part of Kuwait’s property portfolio.

As the UK prepares to leave the EU it is also seeking a new trading relationship with Israel. Government ministers from the UK and Israel will chair the inaugural meeting of the new UK-Israel Trade Working Group on Wednesday that was announced in February by May and Israeli Prime Minister Benjamin Netanyahu.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].