Turkey lira: Currency crashes again after Erdogan stokes firesale

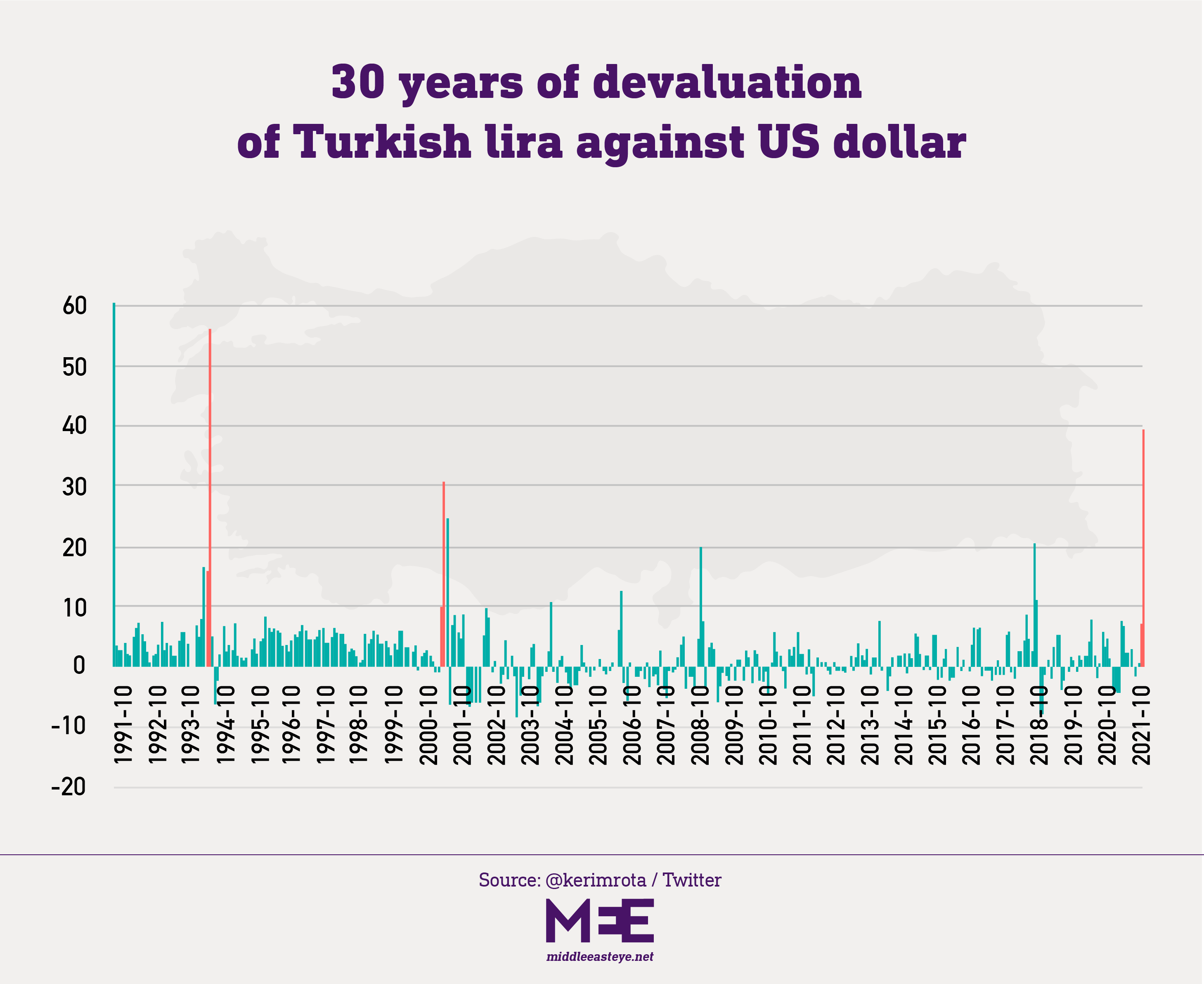

Turkey's lira nose-dived around 10 percent against the dollar on Tuesday after President Recep Tayyip Erdogan defended recent sharp rate cuts, and vowed to win his "economic war of independence" despite widespread criticism and pleas to reverse course.

The lira, which at one point was more than 13 against the dollar, crashed after hitting record lows in the last 11 straight sessions.

Erdogan defended the policy at a news conference late on Monday and said tighter monetary policy would not lower inflation.

"I reject policies that will contract our country, weaken it, condemn our people to unemployment, hunger and poverty," the president said after a cabinet meeting, prompting the slide in the lira.

Erdogan has applied pressure on the central bank to pivot to an aggressive easing cycle that aims, he says, to boost exports, investment and jobs - even as inflation soars to near 20 percent and the currency depreciation accelerates, eating deeply into Turks' earnings.

Former central bank deputy governor Semih Tumen, who was dismissed by Erdogan last month, called for an immediate return to policies that protect the lira's value.

"This irrational experiment which has no chance of success must be abandoned immediately and we must return to quality policies which protect the Turkish lira's value and the prosperity of the Turkish people," he said on Twitter.

The lira is by far the worst performer in emerging markets this year due mostly to what analysts call reckless and premature monetary easing.

'No liquidity'

Buyers appeared to dry up as volatility gauges spiked to the highest levels since March, when Erdogan abruptly sacked the former hawkish central bank chief and installed a like-minded critic of high rates.

"Spreads show there is no liquidity in the market," said one forex dealer, citing Erdogan's comments as the main driver.

The 10-year benchmark bond yield rose above 21 percent for the first time since the start of 2019.

Turkey's sovereign dollar bonds fell more than one cent in early trading, Tradeweb data showed.

As the lira plunged, the main share index jumped 1.5 percent due to suddenly cheap valuations.

The central bank cut its policy rate last Thursday by 100 basis points to 15 percent, well below inflation of nearly 20 percent, and signalled further easing.

It has slashed rates by a total of 400 points since September, in what analysts have called a dangerous policy mistake given deeply negative real yields, and given that most other central banks have begun tightening, or are preparing to do so.

Speculation over finance minister

Analysts said emergency rate hikes would be needed soon, while speculation about a cabinet overhaul involving the finance minister, Lutfi Elvan, has also weighed.

French bank Societe Generale said on Monday that the central bank would need to deliver an "emergency" hike as soon as next month and lift the policy rate to about 19 percent by the end of the first quarter of 2022.

"Risks are skewed for more depreciation," said Guillaume Tresca, senior emerging market strategist at Generali Insurance Asset Management, adding he expected Turkey's turmoil to have a limited impact on other emerging market countries and assets.

"We do not see value in Turkish assets yet. The main difference from previous market stress episodes is the limited push-back from authorities.

"There is a clear will for a weaker FX," he added in a note.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].