Turkish lira: What is Erdogan's new economic model for Turkey?

The Turkish lira has been in freefall ever since the Central Bank started a string of interest rate cuts earlier this year. It has lost more than 50 percent of its value to the US dollar, while annual inflation passed 21.3 percent last month.

Turkish President Recep Tayyip Erdogan insists that lower interest rates will be very beneficial for his country's economy, and says patience is needed to see the results of this new, uncharted and highly controversial policy.

But what exactly does Erdogan want out of this situation?

The answer might lie in a presentation submitted to Erdogan and written by his chief economic adviser, Cemil Ertem.

Titled "New Economic Model: Reasons and its Benefits," the presentation, obtained by Middle East Eye this week, focuses on the chronic economic problems Turkey has faced in the past few decades, caused by high borrowing costs and lower exchange rates.

The main message given by Ertem's presentation is economic independence. Over and over, he emphasises that it is impossible to be economically independent while carrying out a financial policy based on high interest rates or International Monetary Fund recommendations.

Ertem asserts that a policy of high interest rates has triggered a vicious circle of low exports, lower employment, high imports, growing external debt and a country with an external dependence, which again requires higher interest rates, completing a full circle.

"As a result, the country is posting a high current account deficit and depending on short-term hot money inflows and raising the external debt," he says in the presentation. "This economic model, due to its external dependency, is laying [the] ground for economic attacks."

Ertem's solution

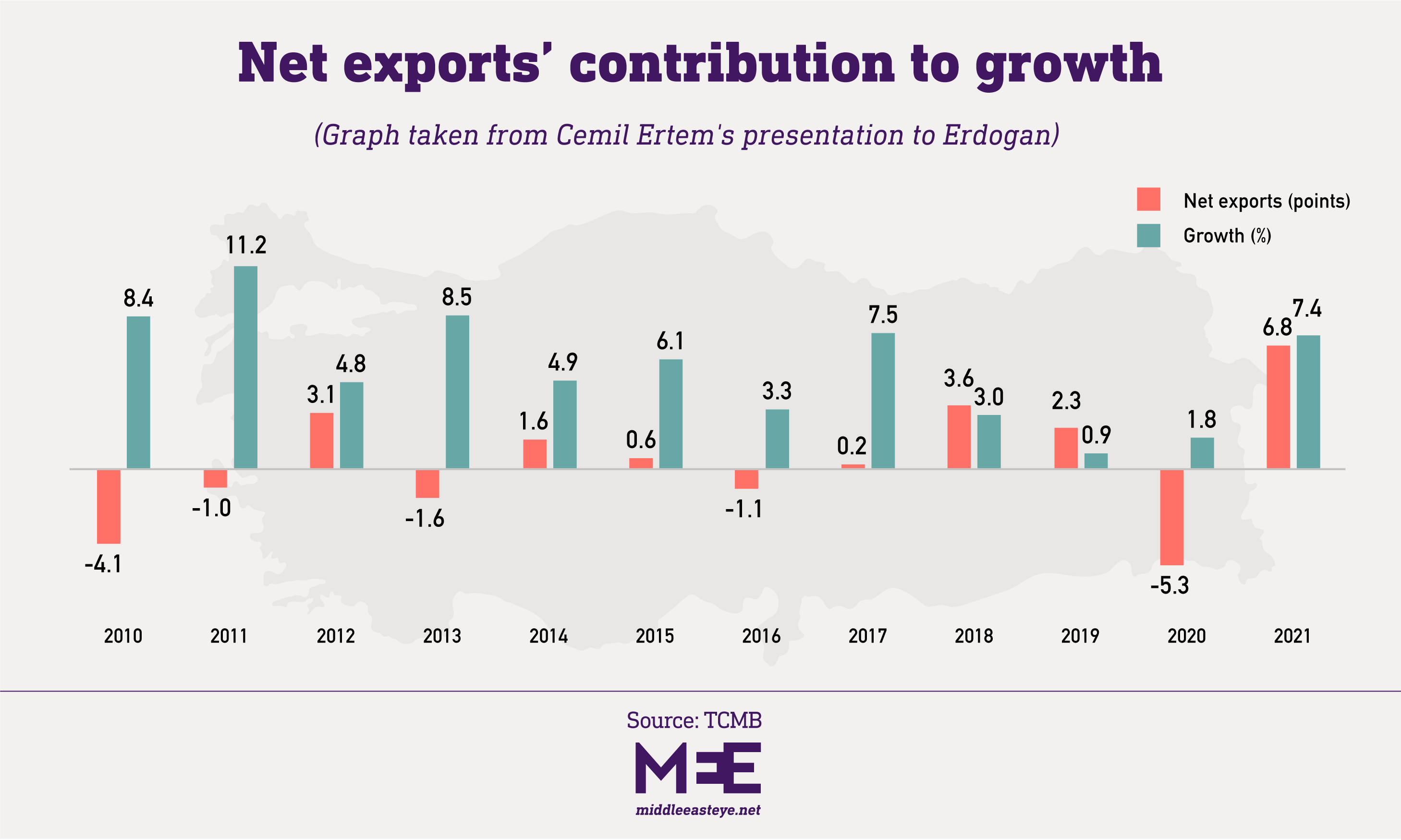

The chief economic adviser says his new model, based on lower interest rates, will increase exports and decrease imports, leading to a current account surplus and higher growth with high employment. He believes it will make Turkish exports more competitive with a depreciated lira.

'We will incentivise foreign direct investments instead of short-term hot money inflows and stabilise the foreign finances'

- Cemil Ertem, chief economic adviser

"We will incentivise foreign direct investments instead of short-term hot money inflows, and stabilise the foreign finances," Ertem says. "And that’s how we will become a stronger country that is protected from the external financial shocks."

Providing examples of when the lira has depreciated previously - such as during the 2013 Gezi Park protests, the 2016 coup attempt, US sanctions in 2018 over a pastor's arrest, and in 2019 due to a Turkish military operation in Syria - Ertem argues that geopolitical developments can be used as a tool to undermine economies based on foreign dependency.

People familiar with the Turkish government's thinking point out that there are tangible indicators that back the benefits of Erdogan and Ertem's lower interest rate theory.

Since August, the Turkish Central Bank has cut its policy rate by 500 basis points, from 19 percent to 14 percent. Meanwhile, exports jumped 33 percent in November, reaching $21.5bn, while the current account posted a $3.16bn surplus for October.

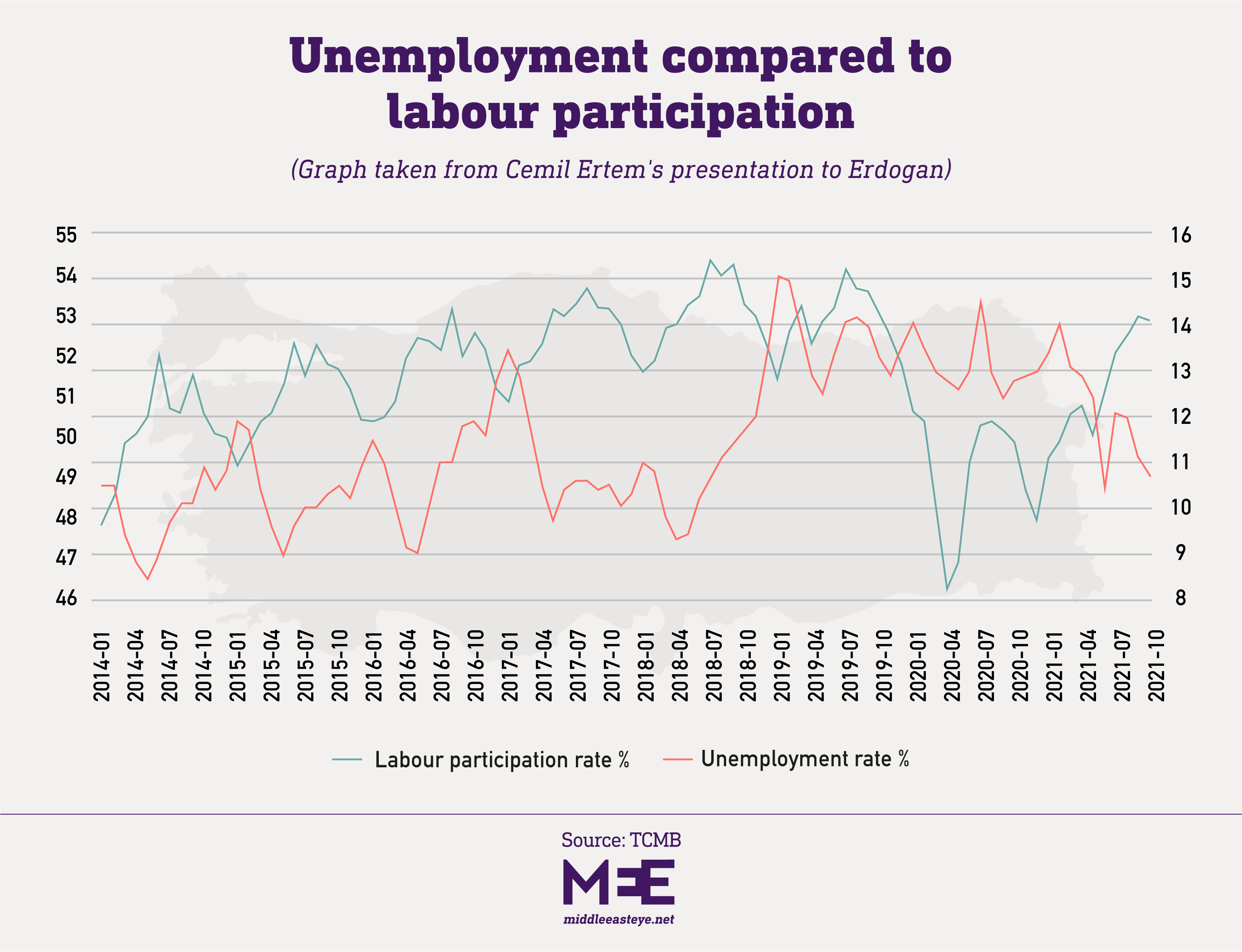

Unemployment has also decreased, by about two percentage points, from 13.1 percent to 11.2 percent in October year-on-year. GDP grew by seven percent in the third quarter of 2021.

However, the government's economic policy continues to be very unpopular with investors as it raises inflation, with expectations that this may hit 26 percent annually this year.

At 14 percent, Ertem says, Turkey has one of the highest interest rates in the world, with every country from Brazil to the United Kingdom remaining below 10 percent.

He believes that Turkey's policy interest rate can easily be below official inflation to keep cost inflation down.

Besides, Ertem says, Turkey's banking industry is robust, with a 3.5 percent non-performing loans ratio. The credit provided by the banks is mostly used by businesses that would increase growth and employment.

"The number of new company registrations has substantially increased compared to last year as fewer companies close down," says Ertem. The "dud cheque ratio is also historically low, with one percent in October".

The government is also betting on higher tourist arrivals and spending from March onwards, believing the Covid-19 pandemic's impact on travel will have largely lifted. Tourist arrivals increased by 143 percent in the third quarter of 2021 compared with last year, reaching 13.6 million people. Tourists spent $11.3bn in Turkey during the same period.

What's wrong with Erdogan's new model?

However, experts warn that the lira's depreciation puts a huge burden on the average Turkish citizen, who is now struggling to make ends meet amid soaring prices.

Bread prices have shot up by 25 percent in the past month alone, creating long lines of people outside subsidised bakeries owned by local municipalities.

Flour prices have jumped by 300 percent in a year, while other basic items such as milk and cheese have seen a 47 percent price rise due to increasing costs.

Even after Erdogan increased the minimum wage by 50 percent on Thursday, purchasing power is constantly dropping in US dollar terms in a country where many essential items are imported, including vehicles and fuel.

More than 42 percent of Turkish workers receive only the officially capped minimum wage.

Last month, it fell below $300 for the first time in the past decade. Currently it stands at 4,253 Turkish lira ($252). Estimates suggest that any worker earning below 13,000 lira is considered poor.

Meanwhile, house prices increased 40 percent in October compared with last year, and have been continuously increasing since, with prices changing almost daily.

Car prices have also gone through the roof due to the lira's constant depreciation and the global chip supply crisis. Though there is no available data indicating constant increases in the prices of new and used cars, some believe it to be at around 50 percent.

On top of that, Turkey has overall 12-month refinancing needs of nearly $170bn.

Excluding swaps with local banks, the Central Bank now has minus $37.9bn in foreign currency reserves. Some of its reserves were burnt through in the past month, as the bank intervened five times in the markets in an attempt to stabilise the lira amid high fluctuations.

Besides the external debt, there is the vital question of energy imports.

Turkey is dependent on foreign sources for natural gas and oil, at a rate of 99 percent and 93 percent respectively. According to foreign trade data, Turkey paid $41bn for energy imports in 2019.

In 2021, as Turkey's consumption continues to increase, global oil and natural gas prices have seen rises exceeding 100 percent.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].