Iran sanctions spotlight opaque brokers and middlemen behind oil trade

Middlemen and shell companies that form the backbone of Iran’s oil trade, along with the countries they call home, are in the crosshairs as prospects for a nuclear deal fade and the Biden administration looks to target Iran’s most lucrative source of revenue.

On Monday the US rolled out its third batch of sanctions on companies facilitating the sale of Iranian oil and petrochemical products in less than two months. The US has already targeted what it describes as a network using Gulf-based shell companies to help Iran evade sanctions. The new measures add another UAE-based company and several more East Asian firms to that list.

Behind the sanctions rollout lies the increasingly bleak prospects of a nuclear deal. “At this point there is a race between sanctions and expansion of the nuclear program,” Sina Azodi, an Iran analyst at the Atlantic Council in Washington, told MEE.

“The US will race for more sanctions and the Iranians will race for more leverage which comes in building out its nuclear capabilities,” he said.

'Sanctions have segmented the Iranian energy trade'

- Rachel Ziemba, Center for a New American Security

August marks sixteen months since the start of negotiations to revive the nuclear deal, known officially as the Joint Comprehensive Plan of Action (JCPOA). The last indirect talks between the US and Iran held in Doha, Qatar, failed to yield a breakthrough.

While both sides have refrained from describing the current impasse as an outright collapse, last week the EU’s foreign policy chief said the space for “significant compromises has been exhausted" and the EU put forth what he said was the best deal possible.

The Biden administration’s move to ramp up sanctions comes as it has faced criticism from opponents of the nuclear deal for not doing enough to exert pressure on Iran, with critics pointing to oil sales to China, Iran’s biggest market, as an example.

Since Biden took office, Iran’s oil sales to China have soared, hitting upwards of 700,000 barrels a day in June, well above the numbers recorded in 2017 before the US reimposed sanctions on exports following the Trump administration’s decision to unilaterally withdraw from the nuclear deal.

“The Biden administration is signaling that the sanctions enforcement arm is coming back and that the status quo they granted the Islamic Republic through this period is not going to be infinite,” Sanam Vackil, deputy director at Chatham House’s Middle East and North Africa programme, told MEE.

Middlemen

Iran is no stranger to sanctions. The county weathered the Trump administration’s “maximum pressure campaign”. Russia has even turned to Iran for lessons on coping with western sanctions imposed over its invasion of Ukraine.

The sanctions unveiled on Monday hit firms in Hong Kong and the UAE, reflecting what Rachel Ziemba, a sanctions expert at the Center for a New American Security, said is the increasing importance of middlemen and opaque brokers for Iran's oil trade.

Despite efforts by countries like Russia, Iran and China to diversify the mediums of their economic transactions, the US dollar still underpins much of global trade. US sanctions carry heft because they can lock firms out of the world's financial system, in addition to freezing assets the entities might have in the US.

But many of the firms involved in Iran's oil sales have limited exposure to the US. "Extensive sanctions have already driven a lot of the trade underground and into smaller entities," Ziemba told MEE.

According to the treasury department, Iran’s Persian Gulf Petrochemical Industry Commercial Co (PGPICC) engaged the firms sanctioned on Monday, including a UAE-based company called Cactus Equipment and Machine Parts.

PGPICC is one of Iran’s largest petrochemical brokers and is itself a subsidiary of Persian Gulf Petrochemical Industry Co, which accounts for half of all of Iran’s total petrochemical exports; but the Emirati company facilitated just several million dollars of monthly turnover in sales for PGPICC, a small portion of its revenue, Ziemba says.

“[The newest sanctions] are likely to raise the costs further for a portion of Iranian oil and oil product exports, but unlikely to choke off the bulk of the flow,” Ziemba said.

“Sanctions have segmented the Iranian energy trade, meaning that individual actors are each taking on smaller shares of the trading volume,” she added.

Sanctions busting

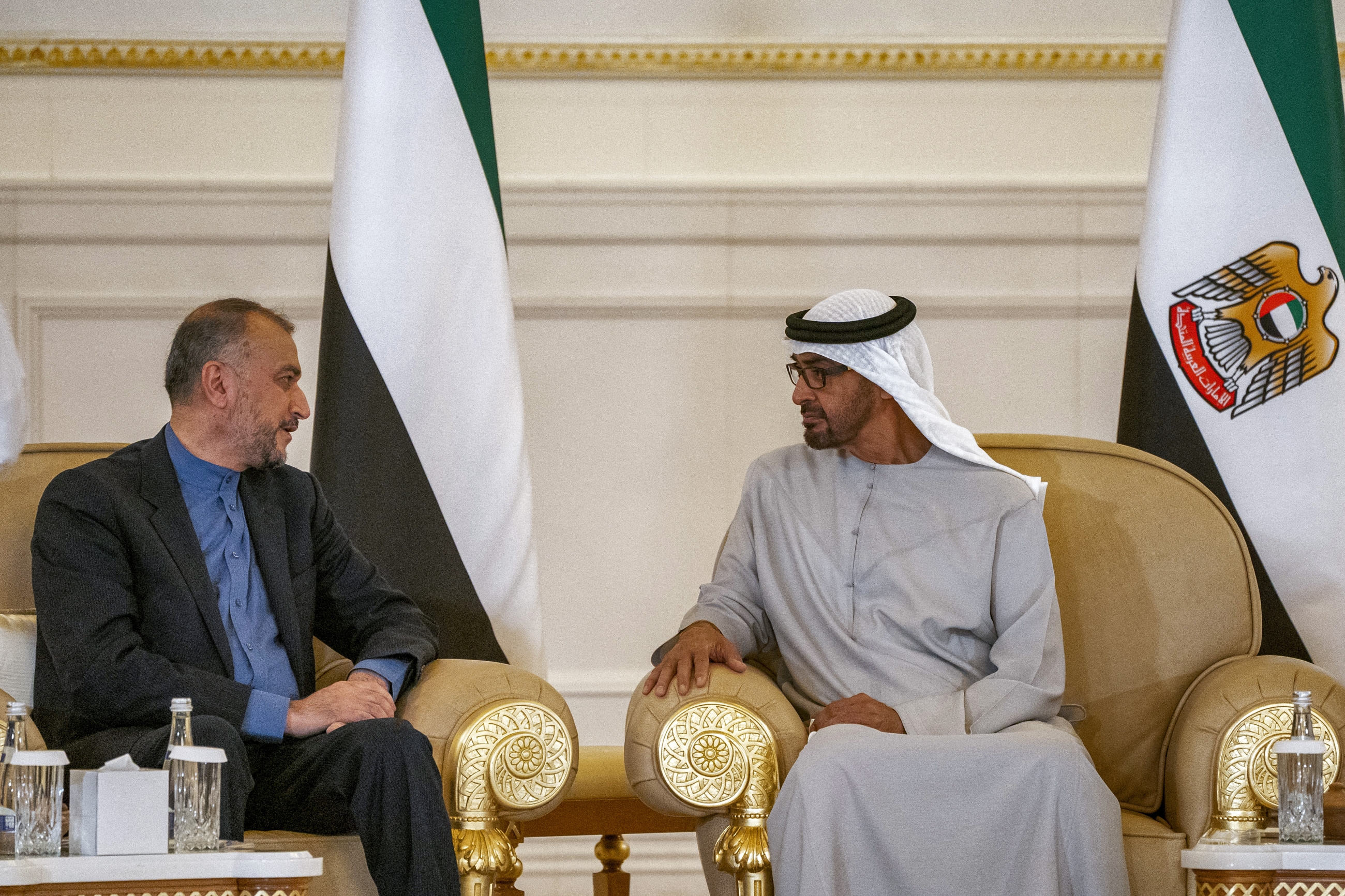

Tehran has not only been diversifying the companies supporting its oil trade. It has deepened economic ties with regional states. In March 2022, the UAE, a key US ally, surpassed China as the biggest exporter to Tehran. Meanwhile, Qatar and Iran have vowed to increase their growing trade to $1bn next year.

“The UAE is using their economic muscle and role in the supply chains to help the Iranians and thereby protect themselves from Iranian pressure,” Vakil said.

As hopes for a nuclear deal fade, regional states like the UAE that have been trading with Iran are likely to find themselves under more scrutiny with the US looking to squeeze Iran’s economy.

“A second layer impact of tougher US sanctions enforcement will be on Iran’s neighbors and trading partners that have enabled and supported its sanctions busting.”

The Biden administration has also been balancing stronger enforcement of Iran sanctions against measures targeting Russia and concerns about global energy prices, while still holding out hope for a return to the nuclear deal.

Ironically, Russia may be causing more harm to Iran's oil trade than Washington. Cut out of its traditional markets in Europe, Moscow is offering Asian buyers steep discounts on its crude, forcing Iran to slash its prices even further.

The willingness of India and China to gobble up cheap Russian crude despite western sanctions also underscores the challenge the US faces as it looks to deploy new measures targeting Iran's oil sales.

“The US may put more pressure on the UAE to rein in trade, but China is a different animal. It’s much more capable of undermining the US on Iran," Azodi, at the Atlantic Council, said.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].