Red Sea vacation homes, Alibaba and Neom: Optimism rules growing China-Saudi Arabia ties

Charles Li has lived and worked in Saudi Arabia for more than a decade, but he has never seen business as good as it is today.

“Beyond your imagination,” is how Li, the smiling regional manager at Jiangling Motors, describes to MEE the speed at which Chinese commercial vehicles are being sold in the kingdom.

Saudi Arabia is enjoying a financial boom on the back of rising energy prices. This year, the IMF predicts the country’s growth rate will hit 7.6 percent, one of the fastest in the world.

Riyadh has been putting its newfound cash to use buying US stocks and ploughing ahead with mega-projects designed to diversify the kingdom’s economy away from oil. Li says vehicle sales have been buoyed by the spending on construction and infrastructure.

'All Chinese think the Neom project will happen. How can it not?'

- Charles Li, Chinese expat in Saudi Arabia

Li's brisk trade in cars is a small example of the growing economic ties between China and Saudi Arabia. Bilateral trade hit $65.2 bn in 2020 and the two are reportedly in discussions to price some Saudi oil sales in yuan.

While energy remains a foundation of the partnership with crude accounting for 74 percent of Saudi's exports to China, economic ties have expanded

Today, Beijing is the main buyer of Saudi Arabia's non-oil exports, mainly chemicals, and the kingdom is one of the top three countries for construction in Beijing's flagship Belt and Road initiative. Much to the consternation of Washington, China has also supplied Riyadh with surveillance technology and is helping it develop ballistic missiles and drones.

But the salesman has noticed an inconsistency. While western executives have been charting a path to Saudi Arabia’s door with the aim of joining in the kingdom’s growth, the Chinese have been notably absent despite their strong economic relationship.

“There are less here now than there were ten years ago,” he says.

Dongni Zhou, a Beijing-based travel agent who works in the Gulf, has grappled with a similar issue. When Saudi Arabia first opened itself up to tourists in 2019, visitors from China topped its list of arrivals.

From Beijing to Shanghai and Guangzhou, tourism offices promoting the oil-rich kingdom sprouted up across China. “We want the Chinese to come," Tourism Minister Ahmed al-Khateeb said in an interview with Chinese state media earlier this summer.

Chinese are “enthusiastic” about Saudi Arabia and “full of curiosity” to see the country, Zhou says, but they struggle to make the journey. Currently, just two direct flights connect Saudi Arabia to China each week and neither fly to Shanghai or Beijing.

Zero Covid

While most of the world has reopened despite the ongoing pandemic, China has kept stringent quarantine and travel restrictions in place on its citizens.

The dearth of business and leisure travellers to Saudi Arabia offers a glimpse into how China's "zero-Covid" policy has impacted Beijing's ambitions to expand its global footprint, including in countries like Saudi Arabia where it looks to compete with the US.

To be sure, the China-Saudi relationship has weathered the pandemic better than most. Despite Beijing scaling back its global investments amid a slowing economy at home, the kingdom has remained a key partner. In the first half of 2022, China signed $5.5bn of investments with Saudi Arabia, more than any other country.

Yet some deals have stalled. For example, a 2019 agreement for Saudi Arabia to build a $10bn refinery and petrochemical complex in China has yet to materialise.

'I believe Saudi Arabia is moving from a country that is more conservative and old-fashioned to more welcoming'

- Anfeng Wan, general manager J&T Express

“Because of Chinese zero Covid policy, progress has been very slow,” Shaojin Chai, an expert in Arab-Chinese relations at the University of Sharjah, told MEE. “Travel is necessary for joint operations.”

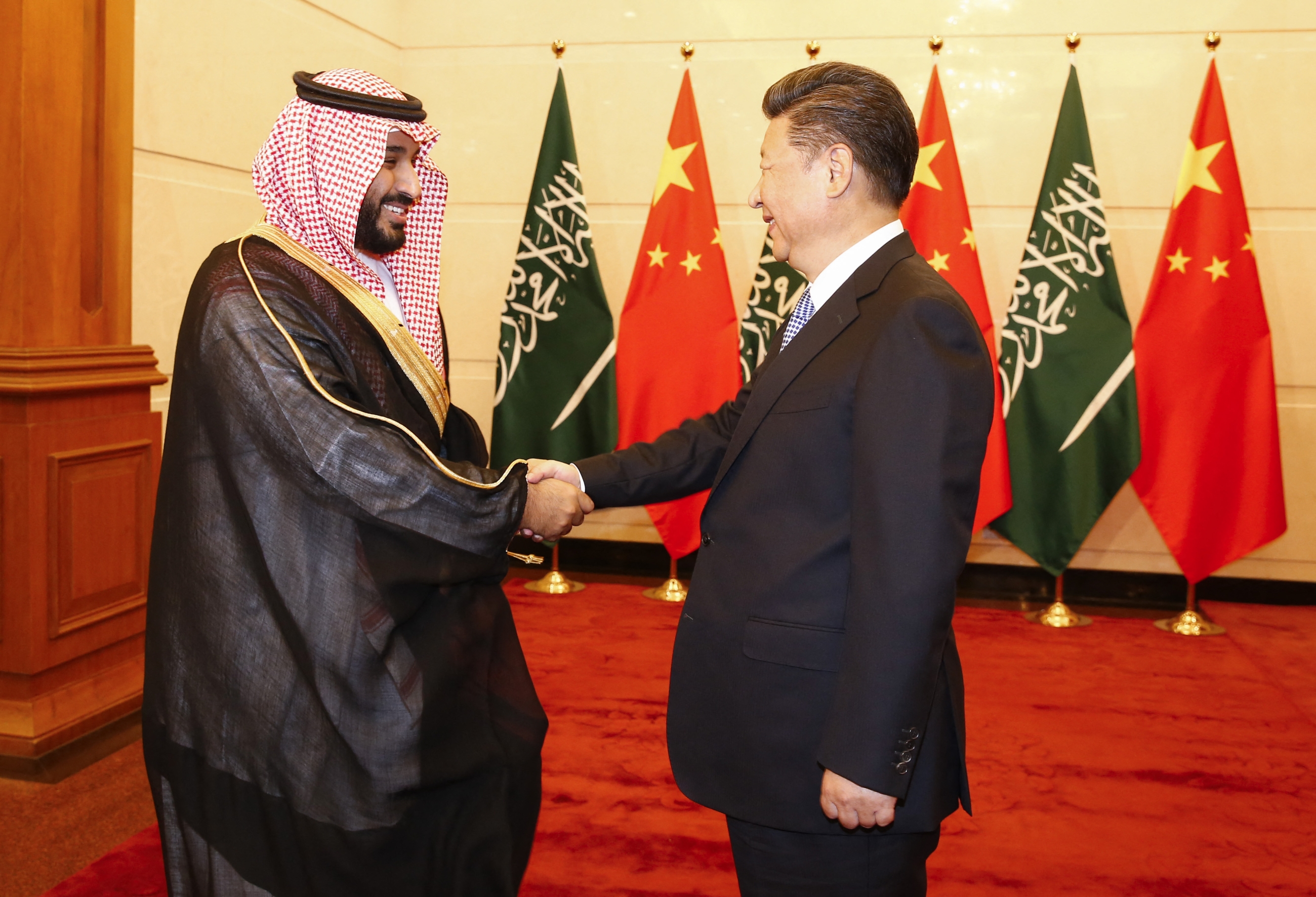

Reports that Chinese President Xi Jinping plans to visit the kingdom in the coming months have raised hopes that Beijing's long period of Covid isolation may be ending, and that some of the more tangible aspects of the relationship with the oil-rich kingdom could receive a boost.

For Charles Li at Jiangling Motors and tour operator Dongni Zhou, that means an easing of travel restrictions and an increase in flights between the countries.

Zhou believes that given the work Saudi Arabia has done to promote itself in China, once the borders reopen tourists will flood into the country: "I am very optimistic about the future of Saudi tourism."

She envisions a day when the Chinese look to Saudi Arabia for vacation homes on the Red Sea. "There is no doubt for this, as long as Saudi Arabia has a stable political situation [and] good policy for buyers," she said.

True believers

Whereas President Joe Biden’s visit to Saudi Arabia was overshadowed by debates over whether the American leader should even visit a country he pledged to make a pariah, Xi’s trip is being cast with a sense of optimism - and not just by the policy elite in China’s foreign ministry or the heads of powerful state-owned companies.

“China sees projects like Neom as an opportunity,” Ding Long, a Middle East expert at Shanghai International Studies University, told MEE. “Chinese companies are going to Saudi Arabia to have new contracts.”

Anfeng Wan is part of that movement. She arrived in Saudi Arabia last year as general manager of China's J&T Express Group. In February, the company announced a joint investment with Saudi Arabia’s Public Investment Fund (PIF) and e-commerce giant Alibaba to build a $2bn smart logistics industrial park in the kingdom.

Wan tells MEE she sees a “huge demand” for J&T’s logistics services as Saudi Arabia’s e-commerce industry develops. “We feel this market has a lot of potential and are excited about the changes the crown prince is trying to make,” she told MEE.

While the majority of Chinese companies in Saudi Arabia are state-owned, operating in energy and infrastructure, Wan says it’s only a matter of time until more private firms like J&T Express arrive, as the kingdom’s image changes.

“I believe Saudi Arabia is moving from a country that is more conservative and old-fashioned to more welcoming,” she says.

Crown Prince Mohamed Bin Salman has pushed through some reforms expanding women’s rights and relaxed the kingdom’s highly conservative social laws. But those moves have coincided with a severe crackdown on dissent that has drawn criticism in the West.

None of the Chinese businesspeople operating in the kingdom who spoke with MEE expressed any concern over human rights issues in the country.

“Some countries are always using human rights to blame China, but in fact, we know China, it is not like what they say," Eliana Ibrahim, Beirut-based president of the China-Arab Association for Promoting Cultural and Commercial Exchange, who also has business interests in Saudi Arabia, told MEE.

"Therefore, when they use human rights to blame other countries, we may ignore that."

As for Mohammad Bin Salman's flagship project, the eyebrow-raising $500bn mega-city in the desert, Charles Li, who is riding a wave of high sales in commercial vehicles, says the Chinese are believers.

“All Chinese think the Neom project will happen. How can it not?”

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].