Iraq: US dollar-smuggling crackdown leaves Baghdad struggling to pay wages

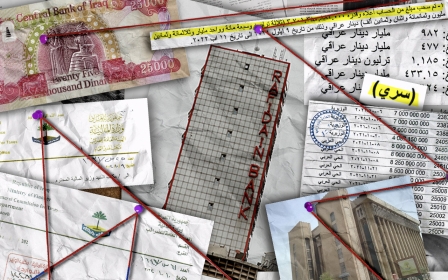

Iraq is facing a deepening hole in its public finances because of a crackdown on corruption and dollar smuggling by the US Federal Reserve since the “theft of the century”, Iraqi officials have told Middle East Eye.

The crisis, which is expected to worsen in the next few weeks, has been caused by a collapse in the daily trade in dollars through a currency auction run by the Central Bank of Iraq.

The Iraqi government depends on the auction to convert dollars, which it earns through oil revenues, into Iraqi dinars. Last year, about $200m per day on average was being sold through the auction to private banks and companies.

'The problem we are facing now in Iraq is the scarcity of the Iraqi dinar, not the dollar'

- Senior official, Central Bank of Iraq

But that figure dropped sharply in the final two months of the year, falling to a daily average of $56m by late December, according to data reviewed by MEE.

Now the government is facing a shortage of dinars, which has left it struggling to pay public sector salaries and meet its other monthly obligations.

A senior official at the Central Bank of Iraq, who spoke on condition of anonymity, told MEE: “The problem we are facing now in Iraq is the scarcity of the Iraqi dinar, not the dollar.”

Neighbouring countries, which depend heavily on the official foreign currency exchange markets in Iraq to obtain dollars, are also facing a liquidity crisis with Iran, Turkey and Syria all affected, according to officials in Baghdad.

The crisis has affected the wider economy, with the dollar exchange rate on unofficial markets rising from 148 dinars to 163 dinars since late November.

The price of consumer goods has increased. This week, the price of rice rose to 2,350 dinars per kilo (about $1.57), up from 1,850 dinars per kilo (about $1.25), while the cost of cooking oil has more than doubled, from 1,250 dinars per litre (about $0.85) to 3,000 dinars (about $2).

The Iraqi officials whom MEE spoke to denied any direct connection between the current crisis and the so-called “theft of the century”, in which about $2.5bn was stolen from Iraq’s tax authority through a state-owned bank between September 2021 and August 2022.

But they conceded that the US Federal Reserve had imposed more stringent checks on private banks buying dollars through the auction two months ago, just weeks after details of the theft were disclosed by the Iraqi Ministry of Finance on 10 October.

Iraqi Prime Minister Mohammed Shia al-Sudani said in October that most of the stolen money was believed to have been smuggled out of Iraq.

In November, Judge Haider Hanoun, head of the Federal Commission of Integrity (FCI), Iraq’s anti-corruption watchdog, said Iraq had sought help from friendly governments, international organisations and the United Nations to recover the stolen money.

One of Sudani's advisers, who spoke to MEE on condition of anonymity, said the Federal Reserve had started checking external financial transfers in November in an attempt to trace the stolen funds.

This had caused delays in the release of transfers and led to a reduction in dollar sales through the auction, the adviser said.

The Federal Reserve also introduced checks on the source of funds held by private banks participating in the auction, prompting many of them to withdraw and increasing the unofficial exchange rate, the adviser said.

Crisis meeting

Late in December, the Coordination Framework, the largest political coalition backing the government, held a meeting in Baghdad to discuss the rising cost of the dollar and the crisis in the Iraqi markets.

The meeting was limited to senior leaders in the coalition, Sudani and Mustafa Ghaleb, the governor of the Central Bank.

Ghaleb told the meeting that the Federal Reserve had “serious indications” of dollar-smuggling operations to neighbouring countries, according to one leader who attended the meeting.

Ghaleb named two Egyptian banks based in Dubai to whom most of the dollars bought in the auction had been transferred in the period being investigated, the leader said. The dollars had then been transferred on to Oman and then to Iran.

Four private Iraqi banks which had transferred the bulk of the money to the two Egyptian banks had been ordered by the Central Bank of Iraq to stop dealing with them in November, following a directive from the Federal Reserve, the leader said.

According to a document seen by MEE, the Central Bank also ordered banks and other financial institutions to stop dealing in dollars with the four banks “for audit purposes” on 6 November.

This was challenged in lawsuits brought against the Central Bank by all four banks - Al-Ansari Islamic Bank for Investment and Finance, Al-Qabidh Islamic Bank for Finance and Investment, Asia Al Iraq Islamic Bank for Investment and Finance, and the Iraqi Middle East Investment Bank.

But their cases were rejected this week by the Financial Services Court, which affirmed the right of the Federal Reserve to prohibit them from dealing in dollars.

A financial adviser involved in the “theft of the century” investigation told MEE that the episode had furnished the Federal Reserve with “conclusive evidence of the theft of government funds that were taken out with government instruments.

“They could not turn a blind eye to it,” said the adviser. “It provided the required motivation for the Federal Reserve to impose its procedures on private banks and the Central Bank of Iraq.

"They [the Americans] have been looking for this opportunity since 2014 to pounce on foreign currency auction sales, but former prime ministers have always obtained exceptions under the pretext of buying electricity, fuel and other things from Iran.

“But this time the story is different."

MEE contacted the Federal Reserve for comment but had not received a response by the time of publication.

Oil sales revenue

The Iraqi government needs at least eight trillion dinars (about $5.5bn) per month to pay the salaries of government employees, retirees, beneficiaries of social welfare, victims of terrorism and others, and this is secured largely through the currency auction.

Most of this comes from Iraq’s oil revenue, which since 2003 has been paid in dollars into an account held by the Federal Reserve Bank in New York.

'The pressures are increasing and the situation will get worse if the government does not take decisive measures to contain the crisis'

- Prime minister's adviser

The US Treasury transfers $10bn annually to the Central Bank of Iraq from the proceeds of oil sales, in order to strengthen its foreign currency balance.

This amount is delivered in cash in four instalments. All dollars are new and have serial numbers registered with the Federal Reserve for easy tracking, officials said.

The Central Bank of Iraq then sells the dollars through the foreign currency auction and other channels to obtain dinars for the Ministry of Finance.

Now the decline in dollar sales has caused a shortage of dinars for the Central Bank of Iraq. Even at its peak, the auction does not usually raise enough to meet the $275m which the government needs each day.

This shortfall is usually covered from currency stocks held by the Central Bank, through internal loans between the bank and the government, by printing more currency, or by other financial activities.

Foreign currency auction data for the past four years reviewed by MEE shows that the amount of dollars traded remained stable, at an average of about $200m per day during 2019 and 2020, despite the decline in oil prices, the Covid pandemic and a recession.

In the first three months of 2021, the amount traded in the auction dropped to historic lows, with just $3m traded on some days.

But in the second week of April, the daily amount jumped suddenly, with an average of $190m traded every day until the end of the year.

In 2022, dollar sales did not fall below an average of $200m per day for the first 10 months of the year.

Two financial advisers who spoke to MEE said the increase from April 2021 was likely linked to the “theft of the century” plot.

They said the figures aroused suspicion that the theft had started earlier than September 2021, as preliminary investigations had suggested, although they offered no further information to back up this claim.

'Options are limited'

Since the collapse in auction revenues, the Central Bank has opened new outlets selling dollars directly to citizens through the currency auction system, in an effort to raise more dinars.

But data showing foreign currency sales for the past few weeks show that the bank is still selling an average of less than $90m a day.

Iraqi officials expect the situation to deteriorate further over the next few weeks, after the Central Bank launched a new electronic platform for the currency auction earlier this month.

The Central Bank said in a statement that it had launched the platform "in coordination with international bodies for the purpose of ruling and organising window operations for buying and selling foreign currency and ensuring effective control over it”.

The new platform links all banks with the Central Bank and requires banks to disclose information about their customers requesting financial transfers, beneficiaries, correspondent banks and other details.

"The new platform has complicated things more. The actual owners of the money do not want to reveal their identity or the source of their money, so we don’t expect the auction sales to improve soon," one of Sudani's advisers told MEE.

"The pressures are increasing and the situation will get worse if the government does not take decisive measures to contain the crisis. The problem is that the options available are very limited and need time," he said.

The Iraqi parliament has not yet approved the annual budget for 2023, but the amounts allocated for salaries and compensation in the proposed budget, which must be paid in local currency, amount to about 100 trillion dinars ($68bn).

The senior official at the Central Bank told MEE that the bank currently holds about 83 trillion dinars ($56bn), and that quick solutions were needed.

“This does not bode well, and we cannot relax," he said.

“The foreign currency auction window is our primary means to call up the Iraqi currency, so if auction sales remain low, the Central Bank will have to issue a new edition of the local currency."

Devaluation risk

Issuing a new edition of the currency would reduce the value of the dinar and further raise the rate of inflation, officials told MEE.

During their meeting with Sudani and Ghaleb, the leaders of the Coordination Framework rejected the governor’s proposal to issue a new edition of the dinar "as it is a risk that will add new burdens on the shoulders of the government and the citizen", one of the attendees told MEE.

Instead, they urged Sudani and Ghaleb to go to Washington to seek to negotiate a six-month grace period before new measures are brought into force, to allow the government and the Central Bank “to be prepared”.

They also called for audits imposed by the Federal Reserve to be relaxed, for procedures for external money transfers to be quicker, for an increase in the number of official dollar sale outlets, and for tighter controls on dollar smuggling through the Kurdish autonomous region of northern Iraq.

"We know that the new measures strengthen the Iraqi economy despite the great pressure it places on everyone, but this will not last for a long time and they will limit corruption in the currency auction," the leader told MEE.

"The leaders know that private banks and the foreign currency auction represent the infrastructure of major corruption networks in Iraq, so they agreed that fighting corruption will only be achieved by addressing this issue.”

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].