Saudi Arabia's new airline will shake up Gulf competition

Saudi Arabia’s Riyadh Air has yet to launch its first flight, but the startup airline is already surprising skeptics and ruffling neighbours as Crown Prince Mohammed Bin Salman pushes ahead with plans to reshape the kingdom’s economy.

Former Gulf airline executives and aviation experts predict Saudi Arabia will lavish funds on Riyadh Air from a windfall in oil revenue, as the carrier gears up to take on established competitors like Qatar Airways and Dubai's Emirates.

“Does the market need another major airline? Not necessarily,” John Grant, a partner at consultancy Midas Aviation told Middle East Eye. “But that’s not the point.”

“The Saudi sovereign wealth fund won’t let this thing fail. This is going to be disruptive,” he said.

Riyadh Air was unveiled in March to coincide with an announcement that the startup, and the country’s established carrier, Saudia, would purchase 78 Boeing 787 Dreamliner jets, with an option to purchase 34 more, in a deal the White House valued at $37bn.

The announcement has rippled across the region’s hotly contested aviation sector, where national airlines are a source of pride but often a drain on state coffers as they soak up subsidies and chalk up losses.

Saudi Arabia’s splurge on the Boeing 787 - twin-aisle planes that carry about 300 passengers and are typically used for long-haul travel - has already elicited some jeers.

“If you run an airline in the US as a publicly listed company, first you define your network: where will you fly and how often? Then you calculate capacity. Once you have done that, you order aircraft,” a former CEO of a Gulf airline told MEE on condition of anonymity.

“A manufacturer doesn’t build a production facility first and look for product to produce after. But that’s exactly what just happened. The Saudis have so much money, $35bn is nothing to them,” he said.

'The Saudis are going to have to go on offence'

- John Grant, Midas Aviation

But Riyadh Air is part of a bigger transformation underway in the kingdom, experts say

Crown Prince Mohammed Bin Salman is using what some analysts say could be one of the last great oil booms to plow ahead with massive developments designed to diversify his country's economy away from its reliance on fossil fuels.

While he has overseen a severe crackdown on dissent at home, he is pushing through some social and economic reforms to attract foreign businesses.

Saudi Arabia has told multinationals that if they want a shot at lucrative government contracts, they must relocate their regional headquarters to the kingdom.

In November, Saudi Arabia announced plans for a new airport in Riyadh designed to triple the number of travellers it can accommodate to 120 million by 2030. The government is also rolling out a new downtown based on its goal to swell the capital's current population of eight million to 15-20 million at the end of the decade.

“The Saudis are clearly banking on a burgeoning population in Riyadh,” Robert Mogielnicki, a senior resident fellow with the Arab Gulf States Institute in Washington, told MEE.

Saudi Arabia’s $650bn Public Investment Fund (PIF), which owns Riyadh Air and is chaired by the crown prince, is leading efforts to reshape the economy.

The PIF is behind a $500bn futuristic mega-city and luxury resorts on the Red Sea. It's also talking up the tourist credentials of the ancient desert trading post of Al-Ula.

In addition to Riyadh Air and Saudia, the kingdom plans to launch Neom Airlines by 2024.

The plan is to attract 100 million visitors annually by the end of this decade. Saudi officials want tourism’s contribution to GDP to rise from three to 10 percent in 2030, and see the sector providing one in 10 jobs.

“Tourism is a big part of Vision 2030,” Mogielnicki said. “The Saudis are supremely confident they will have the demand for this new airline.”

‘Executing commands’

The Gulf’s premier airlines are viewed as appendages of the state and tend to be run by insiders.

Qatar Airways is headed by the mercurial and outspoken Akbar al-Baker, known for his public clashes with aircraft manufacturers. Sheikh Ahmed bin Saeed Al Maktoum, the CEO of Emirates, is a member of Dubai’s ruling family and chair of its biggest bank. He made the tabloids for his secret marriage to an Egyptian socialite and subsequent high-drama divorce.

Saudi Arabia tapped Tony Douglas, a British national and former CEO of Abu Dhabi’s Etihad Airways, as Riyadh Air’s chief executive.

The former Gulf airline executive who spoke to MEE said the decision offers clues into how the upstart carrier will be run.

“The Emiratis called all the shots when Tony [Douglas] was at Etihad. He was the guy that executed commands," said the former CEO. “It’s going to be exactly the same at Riyadh Air. He will do what he’s told”.

'The Saudis have so much money $35bn is nothing to them'

- Former CEO of a Gulf airline

Real control of the airline is likely to rest with its chairman, Yasir al-Rumayyan.

Born to a Saudi father and Syrian mother, the golf-playing Rumayyan has emerged as Crown Prince Mohammed Bin Salman’s top financial fixer and overseer of high-profile projects.

In addition to serving as governor of the PIF, he is a financier of the upstart LIV Golf League, chairman of state-energy giant, Aramco, and English football club, Newcastle United.

He has a reputation for being a micromanager. A US district court judge recently described him as “up to his eyeballs” directing operations at the upstart golf league in its ongoing legal dispute with the PGA tour.

Rumayyan’s multiple roles at Saudi Arabia’s investment fund, national oil company and big-name sports ventures could set the stage for synergies between the airline and other Saudi ventures. Aviation experts predict a slew of branding deals that could help distinguish Riyadh Air from its rivals.

Such agreements are common in the Gulf. Abu Dhabi's Etihad, for example, is the principal sponsor of Manchester City, the English football club owned by Sheikh Mansour, brother of Emirati President Mohamed bin Zayed Al Nahyan.

“Forming alliances with non-aviation businesses could help Riyadh Air expand its network and offer more comprehensive travel packages to its customers,” Linus Bauer, Managing Director of the Dubai-based consultancy Bauer Aviation Advisory, told MEE.

'Fight for passengers'

Saudi Arabia is taking a page from its smaller neighbours by linking its new airline to a nascent tourism sector. Dubai launched Emirates Airlines in 1985, just as it was beginning to position itself as a business and tourism hub for the region.

In 2021, Dubai received 29 million passengers, making it the busiest international airport in the world. Doha ranked sixth, according to Airports Council International.

Emirates has benefited as visitors flock to Dubai’s glitzy skyscrapers and beach resorts. And Qatar Airways, which relies heavily on transit traffic, saw an added boost in passengers during the 2022 World Cup.

Riyadh Air's success will be dependent on Saudi Arabia's tourism sector, experts say.

“It will be first in line for traffic growth generated by investments in the kingdom's tourism. Uniquely for the region, Saudi Arabia also has a huge domestic market,” Andrew Charlton of Aviation Advocacy, a consultancy based in Switzerland, told MEE.

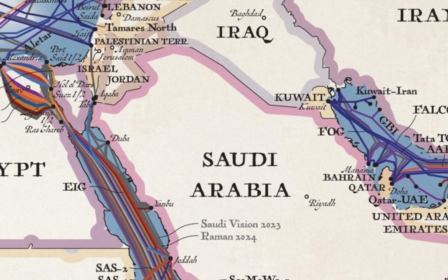

Gulf airlines, and their Turkish rival, have also leveraged their home airports' locations to position themselves as transit hubs for long-haul flights from Asia to Europe and North America.

Grant, from Midas Aviation, says the scale of Riyadh Air’s ambitions is going to shake the model.

He expects the upstart airline to compete with rivals by tapping markets in Asia. Gulf migrant workers currently transit via Dubai, Doha and Abu Dhabi. He predicts Riyadh Air will also look to lure connecting traffic from Europe and the Indian subcontinent.

“The Saudis are going to have to go on offence,” he said. “Everyone is gonna be fighting for the same connecting passenger.”

Grant warns Gulf carriers against entering a price war but is concerned that too much supply might be hitting the market. Just before Saudi Arabia announced its Boeing purchase, Air India unveiled a deal to purchase 220 new Boeing planes in the largest commercial-jet order in aviation history.

Some experts say that Gulf carriers' traditional business model of serving as a transit hub is under threat with the number of long-haul, non-stop flights ticking up.

Charlton, from Aviation Advocacy, however, says there is enough demand for another player, “There are still good reasons for the Gulf connector model to continue.”

Many passengers will continue to look for more affordable layover flights. There are also destinations in Africa and Asia that are growing but “not strong or big enough for super long haul, hub by-passing services,” he added.

The airline could also benefit from Saudi Arabia’s independent foreign policy streak.

Western airlines' decision to cut service to Russia following the invasion of Ukraine leaves room for the upstart carrier, Charlton said. Saudi Arabia, like the UAE, has maintained friendly relations with Moscow.

The Saudis' move in March to restore diplomatic ties with Iran in a deal brokered by China also opens a potential new market. On Thursday, the two's foreign ministers met and agreed to resume flights.

Saudi Arabia's deep-pocketed neighbours, Qatar and the UAE, will likely find ways to compete with Riyadh Air. But analysts warn that smaller Gulf states risk marginalisation as the kingdom flexes its economic muscles.

"The smaller guys are going to come under a lot more pressure," Gant said.

Kuwait Airways hasn’t made a profit in more than 30 years. Oman Air has been weighed down with financial troubles for decades.

“This will naturally be detrimental to smaller players that are not transit destinations, and are behind on price and service,” Adel Hamaizia, a visiting fellow at the Center for Middle Eastern Studies at Harvard University, told MEE.

This article is available in French on Middle East Eye French edition.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].