UK steams towards trade war with Turkey over ironing boards

The UK is steaming towards a possible trade war with Turkey in defence of the country’s only manufacturer of ironing boards.

In a report published this week, the UK’s Trade Remedies Authority (TRA) said Turkish manufacturers had benefited from state subsidies, and UK ironing board prices had been kept unfairly low because of a surge in imports from Turkey.

It said it intended to recommend the imposition of a 4.44 percent tariff, to be paid by companies importing ironing boards from Turkey to the UK, in order to protect the British manufacturer.

Oliver Griffiths, chief executive of the TRA, said: “Our provisional finding is that subsidies have kept prices of the imported goods unfairly low, causing injury to the British producer, and so we’re intending to recommend a new tariff on ironing boards from Turkey.”

The TRA is a public body set up in 2021, following the UK’s exit from the European Union, “to defend the UK against unfair international trade practices”.

It investigates complaints raised by British industries and advises the Department for Business and Trade on measures to redress unfair trade practices.

The investigation into Turkish ironing boards is the TRA’s first into foreign state subsidies affecting British industry since it was established. If a tariff is imposed, it would be the first new anti-subsidy measure to be applied since the UK left the EU.

A tariff on ironing board imports would be compatible with the free trade agreement signed by the UK and Turkey in 2020 because both sides agreed to adhere to World Trade Organization rules which allow action against subsidies which cause harm to a domestic industry.

The investigation was launched by the TRA following a complaint filed by the UK ironing board manufacturer in April 2022.

It found that Turkish ironing board manufacturers based in free zones, special areas set up within Turkey since the 1980s to promote export businesses, had benefited from corporation and income tax exemptions which amounted to government subsidies.

Manufacturers also benefited from loans provided by the state-owned Turk Eximbank, the Turkish government’s export credit agency, which investigators determined also amounted to subsidies.

In a response to questions from investigators, Turkey’s Ministry of Trade said there was “no government involvement in policy, economic regulation and decision-making activities related to the production of ironing boards”.

As part of the investigation, TRA inspectors visited the factory of one manufacturer, Milenyum Metal, based in a free zone in the central Anatolian city of Kayseri.

Milenyum Metal was the only Turkish company to submit evidence to the inquiry. Two other Turkish companies registered an interest in the case but did not respond to questions from the TRA.

A spokesperson for Milenyum Metal declined to comment because the TRA investigation is still ongoing.

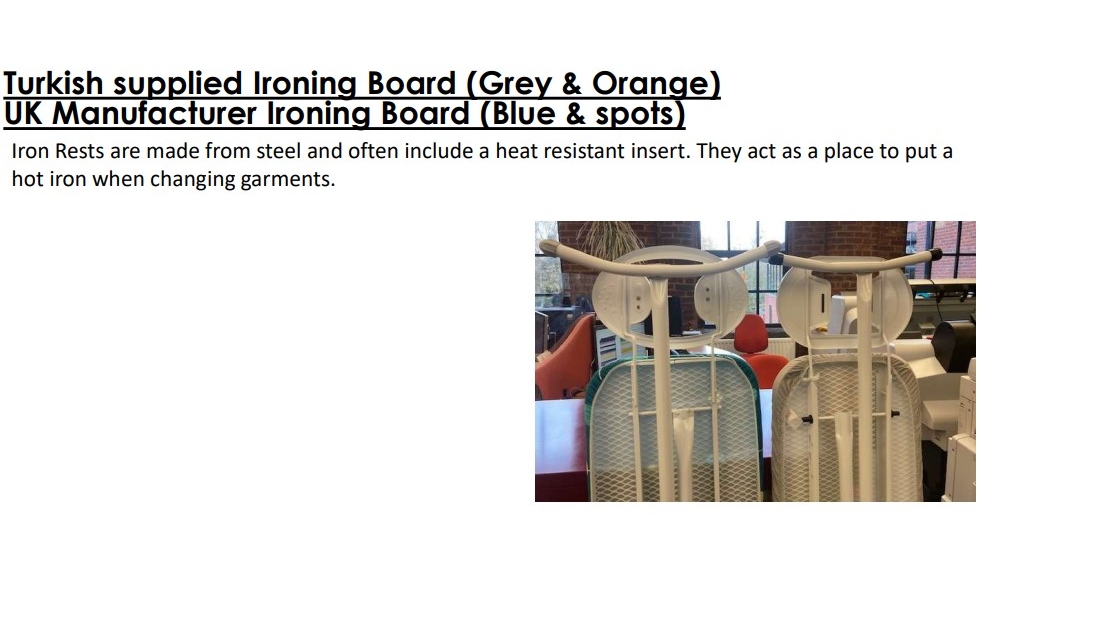

Inspectors compared the physical and functional characteristics of ironing boards manufactured in the UK and Turkey as well as similarities in production methods.

They concluded that the items were “directly comparable and interchangeable".

The report said: “We found that the basic product type consists of steel legs, steel top, iron rest and textile cover. The primary use of all product types is the ironing of clothes."

The investigation found that imports of Turkish ironing boards to the UK increased sharply in 2019. But sales of ironing boards fell in 2020 because of “changes in consumer habits” linked to the Covid-19 pandemic.

The ironing board market had displayed “signs of recovery” in 2021 with approximately 1.4m sold in the UK, the report said.

The report said the British producer held a market share of between 30 and 40 percent, but Turkish manufacturers retained an increased share of the import market and accounted for between 15 and 25 percent of the total market.

This had resulted, it concluded, in “significant price undercutting”, driving down the price of British-made ironing boards and preventing the UK manufacturer from raising prices in line with increased production costs.

The report noted that consumers were especially sensitive to price changes because of the “durable nature of ironing boards” and the existence of substitutes such as “table ironing mats, hand-held garment steamers, non-steel ironing boards, dry cleaning, or even wrinkle-free clothing".

“UK ironing boards compete directly with ironing boards produced abroad, as they share physical and technical characteristics. Consumers are therefore driven by prices and would be willing to switch between brands to avoid higher prices,” it said.

The report said the British manufacturer, which is not named in the report, told investigators that it could be forced to cease production of ironing boards if a duty was not imposed on Turkish imports.

It is identified as having production sites in Rochdale and Manchester, with about 110 employees - just over a third of its total workforce - involved in making ironing boards. The company had a turnover of £42m ($53m) and a net profit of £1.8m ($2.2m) in 2021, according to data it submitted to the investigation.

Rochdale is the home of Minky Homecare, which describes itself as “the UK's number one brand in the laundry market, with Minky ironing boards and covers found in over 70 percent of UK homes”.

Ironing boards advertised on Minky’s website are described as “designed and manufactured in the UK”.

Minky had not responded to requests for comment at the time of publication.

Wednesday's report was a preliminary summary of the findings and likely recommendations of the investigation. Parties to the case, who also include UK importers of ironing boards, now have until 29 May to make further submissions prior to the publication of the TRA’s “final determination”.

The UK’s tax office on Wednesday announced that a provisional tariff on Turkish ironing board imports set at 4.42 percent would be imposed from 26 May.

The final decision on imposing a tariff rests with Business and Trade Secretary Kemi Badenoch.

A spokesperson for the UK's Department for Business and Trade declined to comment. Turkey’s Ministry of Trade did not respond to a request for comment.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].