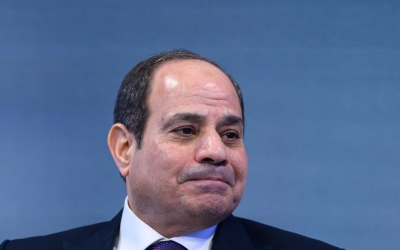

Egypt has hit a financial deadlock. Sisi's only hope now is a miracle

At a finance summit in Paris last month, Egyptian President Abdel Fattah el-Sisi called on lenders to show more “understanding” of his country’s deteriorating debt crisis. The previous week, Sisi appeared to have ruled out a future devaluation of the pound, which has lost half of its value since February 2022.

Sisi justified this because of “national security” concerns, a thinly veiled reference to possible mass disturbances if the pound loses even more of its value and inflation continues to soar. The move contravenes a key condition of the $3bn International Monetary Fund (IMF) support package approved for Egypt late last year, which stipulated adherence to a flexible exchange rate.

On the heels of the Paris summit, the Egyptian central bank decided to keep interest rates steady, despite rising inflation that reached 32.7 percent in May.

This series of statements and policy decisions seems to reflect an awareness by Cairo that continued devaluation and monetary tightening will not remedy Egypt’s burgeoning debt crisis, while at the same time, it is showing remarkable resistance to necessary reforms that could alleviate the crisis.

The regime’s solution seems to revolve around waiting for a miraculous inflow of dollars to allow it to manage another currency devaluation, which does not seem to be forthcoming. In simpler terms, Sisi has hit a dead end and is waiting for unexpected deliverance.

The decisions made by the regime are rational, however, barring a radical transformation of the model of militarised state capitalism at the heart of the crisis. The decision to keep interest rates steady reflects the understanding that inflation is not caused by increased demand; orthodox economic theory assumes it can be remedied by raising interest rates.

This awareness was reflected in an IMF panel discussion attended by Central Bank Governor Hassan Abdalla, who identified supply issues as the root cause of the inflationary wave hitting the country.

Heavy burden

At the same time, Sisi’s decision to rule out another currency devaluation for fear of instability tied to rising prices reflects an awareness that a rapidly weakening currency, rather than increased demand, is the cause of inflation. What remains unsaid is that increasing interest rates are imposing a heavy burden on the state budget, worsening the debt crisis, and failing to attract hard currency capital inflows, which are critical to alleviating the crisis.

In the upcoming fiscal year, loan and interest repayments are set to consume 56 percent of the budget - an astounding figure

In the upcoming fiscal year, loan and interest repayments are set to consume 56 percent of the budget - an astounding figure, more than public spending and social support combined, which stand at 13.5 percent and 12.2 percent respectively. Increased interest will hardly help to alleviate the debt burden on the state budget.

Higher interest rates have also failed to attract badly needed capital inflows in Egyptian debt instruments, as was made clear in a bond offering in April, which saw only 0.04 percent of the three-billion-Egyptian-pound ($97m) offering sold, with investors deterred by an expected pound devaluation.

In spite of a number of devaluations over the past year, the pound has remained under pressure, with the devaluations failing to generate the required hard currency capital inflows.

On the black market, the Egyptian pound still trades at around 38 pounds to the dollar, substantially higher than the official 30.9 exchange rate.

This is coupled with a severe hard currency shortage that is crippling the Egyptian economy. A number of steel mills have either ceased production or reduced it due to their inability to import necessary raw materials. More alarmingly, there are reports of delays in payment for wheat shipments, although the government has denied this.

There are also reports of a return of Egypt’s import backlog, with items stuck in Egyptian ports, despite government assurances that the backlog was cleared at the start of the year. The regime seems to have realised that another devaluation is not a guaranteed solution to the crisis, and that it will take fundamental reforms to lure investors, which the regime is unwilling and unable to do. In simpler terms, Egypt has reached a deadlock.

Stringent demands

This raises an important question: how does the regime expect to meet its financing needs and build enough reserves to manage another devaluation? Egyptian policymakers are not offering clear answers, other than committing to a fire-sale privatisation programme. Yet the demand for Egyptian state assets from Gulf investors seems lukewarm at best, with stringent demands being made.

For example, a $400m offer was reportedly made last month by a Saudi real-estate investment firm for a 70 percent stake in an Egyptian housing company - an offer far below the value of the lands owned by the company, estimated at around $2.5bn. This reflects the poor bargaining position of the government and the willingness of investors to apply pressure in the midst of a crisis.

Gulf states are demanding another round of devaluation, which the regime has already ruled out, paving the way for prolonged negotiations as Cairo’s obligations come due. Egypt’s debt repayment obligations are enormous, with $3.86bn in short-term borrowing and $11.38bn in longer-term debt due in the second half of 2023. Without a big turnaround in the privatisation programme or another large IMF loan, the situation will become very dire.

This stalemate will have significant consequences, the most obvious of which is the collapse of the regime’s model of debt-fuelled growth. Indeed, with the regime’s apparent inability to access additional sources of financing, it is hard to imagine that it will be able to continue its programme of debt-fuelled infrastructure projects.

But this does not mean that Egypt’s militarised form of state capitalism will disappear. Rather, it will likely become even more predatory, preying on other sources of public funds to fuel its growth.

Even more worrying are the consequences if the regime’s hard-ball tactics do not bear fruit, and creditors are not as “understanding” as Sisi hopes. Indeed, with the regime’s adamant refusal to de-militarise the economy and implement corporate governance mandates on military-owned companies, Sisi is gambling that Egypt is too big to fail, with the fate of millions of Egyptians hanging in the balance.

If the gamble is wrong, then a gargantuan economic crisis will engulf the country, with a rapidly devaluing currency, hyperinflation and a devastating economic downturn as its most likely outcome.

The views expressed in this article belong to the author and do not necessarily reflect the editorial policy of Middle East Eye.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].