War on Gaza: How Turkish sanctions against Israel will impact bilateral trade

Turkey’s decision to halt the export of 54 products to Israel in response to its war on Gaza isn’t likely to have far-reaching results, since both countries' economies are complementary in nature rather than central to each other.

The Turkish trade ministry announced earlier this week that Ankara would continue to implement the restrictions as long as Israel denies uninterrupted flow of humanitarian aid to Gaza Strip, citing UN Security Council decisions and an International Court of Justice (ICJ) preliminary judgment against Israel’s conduct in the coastal enclave.

The export restrictions encompass items such as aluminium wire, steel, cement, construction materials, granite, chemicals, pesticides, engine oils, jet fuel and bricks.

Before the war, Turkish-Israeli ties had been steadier than they had been for years. After years of tensions over Palestine, the two normalised relations in 2022.

Yet, while Turkey and Israel quarrelled over the past decade, and even stopped cooperating with each other, trade had never been interrupted. In fact, it flourished over time.

The Turkish public has been outraged at Israel’s actions in Gaza, where more than 33,000 Palestinians have been killed in six months.

Lists of ships carrying goods to Israel circulated on social media as Israel's onslaught grew. People also highlighted companies close to the Turkish government that continued commercial relations with Israel during the war.

'These export restrictions in a time of war will be a big warning sign not to proceed with the [gas] pipeline idea'

- Gallia Lindenstrauss, analyst

Even though there is no evidence to back claims that Turkey sold weapons to Israel, the controversy was stoked by a small quantity of hunting gear or hunting equipment parts being found among the exports. They were broadly classified by the Turkish Statistical Institute (TUIK) as “weaponry”.

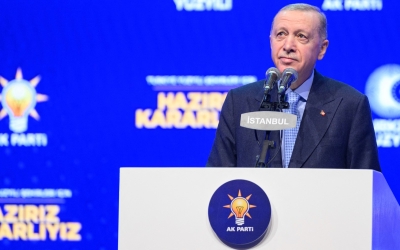

In response to this domestic pressure and serious setbacks for the ruling Justice and Development Party (AKP) in local elections last month, the government decided to act against Israel.

Ties have been cut on the Israeli side, too. In October, several Israeli supermarket chains halted imports from Turkey in response to Ankara’s critical stance on the Gaza war.

Israeli food company Strauss in December changed the packaging for one of its most well-known products, Elite Turkish coffee, adding an Israeli flag and patriotic slogans.

An important market

But is the trade between the two countries vital? Many say no, but Israel is nonetheless an important export market for Ankara.

Turkey’s exports to Israel were worth $5.4bn in 2023, or 2.1 percent of its total exports, according to official data.

Although bilateral trade has dropped by 33 percent since the 7 October Hamas-led attack, it has nonetheless continued and exports to Israel have increased each month in 2024 so far.

Both countries have had a free trade deal in place since 1996 and there have been no tariffs on certain products since 2000, which has enabled major increases in bilateral trade, largely favouring Turkey.

From 2009 to 2023, trade between the two countries nearly tripled. By the end of that period, Turkey had become the fifth-largest supplier of imported goods to Israel, while Israel ranked as Turkey's tenth-largest export market, based on data from the Central Bureau of Statistics.

Turkey exported steel, automotive industry products, chemicals, ready-made clothing and apparel, electricity and electronics, cement, glass, ceramics and soil products, furniture, paper, and forestry to Israel, according to a report published by the Turkey Exporters Assembly covering the period between 2011 and 2020.

“The economies are complementary but not intertwined,” Gallia Lindenstrauss, a senior research fellow at the Institute for National Security Studies (INSS), told Middle East Eye.

“Turkey can find also substitutes to what it imports from Israel, and anyhow, of the bilateral trade, three-quarters are Turkish exports to Israel and only one-quarter is Israeli exports to Turkey.”

Trade with Israel has traditionally been highly advantageous for Turkey, which enjoyed a trade surplus of $3.9bn last year.

Israel serves as a significant market for Turkish steel, purchasing 726,000 tonnes last year. This figure constitutes over 20 percent of Turkey's total steel exports. The ban is expected to significantly affect these exports.

In terms of dependence on imports, Israel heavily relies on Turkish cement, with imports from Turkey making up 29 percent of Israel's total cement imports last year. Additionally, Turkish imports represent about 11 percent of Israel's total plastic and rubber products, and around 10 percent in textiles.

Sources familiar with the construction industry told Israeli news outlet Mako that the new restrictions were expected to increase the prices of apartments and rent in the country if they are implemented.

“In terms of long-term repercussions, the fact the Turkey halts construction materials when these are needed to repair damaged houses in the south and north of Israel because of rockets and other damage will likely taint relations also in the future,” Lindenstrauss said.

“Also, while anyhow there were question marks regarding a possible gas pipeline between Israel and Turkey, these export restrictions in a time of war will be a big warning sign not to proceed with the pipeline idea.”

Impact on Palestine

Turkey’s decision to restrict exports to Israel likely has an impact on Palestine as well.

“Israel has complete control over the border crossings as Palestinian imports arrive at Haifa or Ashdod seaports, and the goods are then transported to Palestinian territories via trucks," Rashad Yousef, director of policies and planning at the Palestinian Ministry of National Economy, told Anadolu Agency.

Yousef added that Palestinian-Turkish trade volume in 2022 exceeded $900m, representing a 12 percent increase over 2021.

'The economic relations were what kept the relations going even in times of political crisis'

- Gallia Lindenstrauss, analyst

He also said that the main Turkish exports to Palestine are iron, wood, vegetable oil, tobacco, food products and items from the plastic industries.

"If we exclude Israel, Turkiye is the largest source of goods and products in the Palestinian market," Yousef said.

However, there are ways to continue to trade with Israel by rerouting trade through third countries, as the Ukraine war has proved following western sanctions on Russia.

Israeli importers are mulling bringing in Turkish goods via Slovenian ports Koper or Ljubljana, according to an Israeli report.

“But still, the economic relations were what kept the relations going even in times of political crisis, so it is regrettable we have reached this point,” adds Lindenstrauss.

“And despite it having been a painful step, I don't see it in itself changing Israel's policy - the pressures from the White House are much more significant.”

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].