Libya's oil industry: phoenix or mummy?

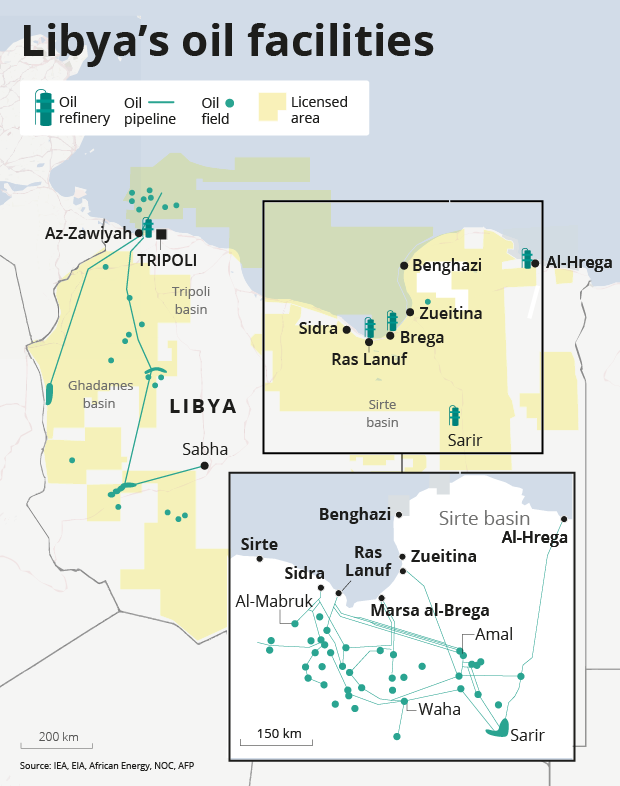

Before the uprising against Muammar Gaddafi's regime in 2011, Libya exported around 1.6 million barrels of oil each day through six oil export terminals: Az-Zawiyah, Sidra, Ras Lanuf, Brega, Zueitina, and Al-Hrega.

This production has sharply dropped since 2013 when Ibrahim al-Jathran, head of the Middle Region of the Libyan Petroleum Facitilities Guard (PFG), announced the shutdown of the four ports under his control over alleged claims of corruption in the oil industry.

The shutdown, which took around 900,000 bbl/day off the grid, was later combined with the closure of Az-Zawiyah export terminal amid conflict between local militias over the control of oil fields in the south. Libya's production currently sits at 330,000 bbl/day, yet the country's National Oil Corporation announced this month that it aims to triple its production before the end of the year. But challenges lie ahead for these ambitions.

Since the Saudis' decision to cripple OPEC's ability to cut down production and to control market supply, oil prices per barrel have fallen from a steady $115 to painful mid $20s. The supply glut has extended beyond most pessimistic analysts' projections, supported by the longer-than-expected production life of shale wells, the lifting of sanctions on Iran, and a historical ramp up of Iraq's production. This has hit the oil industry hard, leading to hundreds of thousands of layoffs, and has pushed several companies to file for bankruptcy. Volatility has been a theme for the oil market for the past two years.

Brexit jitters

Since the Brexit referendum, oil has lost ground and prices have fallen more than 20 percent, from $51 on 9 June to flirting with the $40 this week, despite the fact that oil inventories have dropped by roughly 20 million barrels over the last 10 weeks. This price decrease was initiated by market fears of the global economy slowdown following the Brexit vote. There was also a major concern that the supply glut would continue with the spread of news from Libya that the newly appointed UN-backed government has signed an agreement with the Ras Lanuf-based PFG to end the three-year closure of Libya's Middle Region oil terminals, and that the country would resume exporting soon, an extremely optimistic assumption.

Technically, the damage to the country's petroleum infrastructure over the last couple of years has created two major bottlenecks. First, the shutdown of oil production has had a negative impact on the overall upstream capacity as oil fields remained idle for three years with nothing but corrosion eating their hearts out, in addition to the deterioration of field productivity as a result of the lack of drilling and maintenance operations needed to sustain previous production levels.

The second bottleneck is at the export terminals. In December 2014, a coalition of Misrata-based militias attacked Assidra and Ras Lanuf, the largest oil terminals in the country, in an attempt to gain control over the critical region. The 75-day operation led to the complete destruction of seven oil tanks at Assidra and further damage to the rest of the facilities. One year later, the Islamic State group attacked the same oil port and destroyed four additional tanks, reducing the country's production capacity until such damages are rectified.

Oil majors flee

The combination of Libya's civil war, which erupted in Libya in the middle of 2014, and the global oil crisis which hit the markets later in the same year, pushed most foreign oil companies to flee the country. Halliburton, Schlumberger, Baker Hughes and Weatherford have all either completely shutdown or laid off the vast majority of their employees, and are unlikely to return until the country's security and financial situation shows some signs of stability.

Schlumberger has recently sent a signal to its clients globally by pulling out of Venezuela as PDSVA state oil company struggled to pay its bills as a result of a shortage of cash. For the same reason, it is unlikely that international oil service companies will be interested in growing their account receivables by working in Libya until the country shows real signs of political and financial stability.

Most importantly, the ongoing division of the petroleum assets between rivals in Libya makes it almost impossible to sustainably resume the country's oil production without reaching a consensus that would put an end to the country's political crisis and military conflict, and bring the country back to stability.

The United Nations Support Mission In Libya, UNSMIL, has lead a 15-month long negotiation between Libya's factions. The negotiation ended last December with a political agreement among the parties to form the General National Accord government (GNA). However, the agreement has not been endorsed by either of the negotiating factions in Tripoli and Tobruk, and the country has now become divided between three governments.

While the GNA now has control over the export facilities through the PFG, the Tobruk-based government claims to have control over the oil fields through its military arm, the Libyan National Army. In western Libya, a tribal militia has shutdown the pipeline between oil fields in the southwest and the export port in the north, also over dispute of territorial control.

In light of all the small pieces of the Libyan puzzle, it seems very unlikely that the country would be able to regain its previous oil production levels without reaching political consensus between parties on the main elements of the conflict. The economic crisis and the pressure of the deteriorating value of the Libyan dinar in a purely import economy does not seem to influence the positions of the conflicting parties. Losing control over oil resources may mean losing the whole battle, and no party would give that up without a fight.

- Ahmed Ben-Mussa is an energy industry expert. He worked for Halliburton for 10 years in the Middle East and the US as a business development executive. He also worked the World Food Programme. Ahmed holds an MBA degree from the IE Business School in Madrid.

The opinions expressed in this article are those of the author and do not necessarily represent those of the Middle East Eye.

Photo: Smoke pours out from a refinery near Ras Lanuf as a rebel fighter looks on (AFP)

This article is available in French on Middle East Eye French edition.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].