After the war: Who’s going to pay for Syria’s reconstruction?

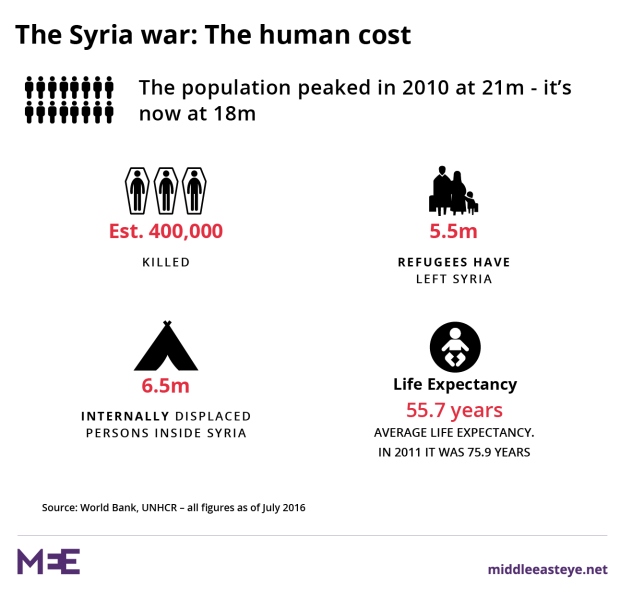

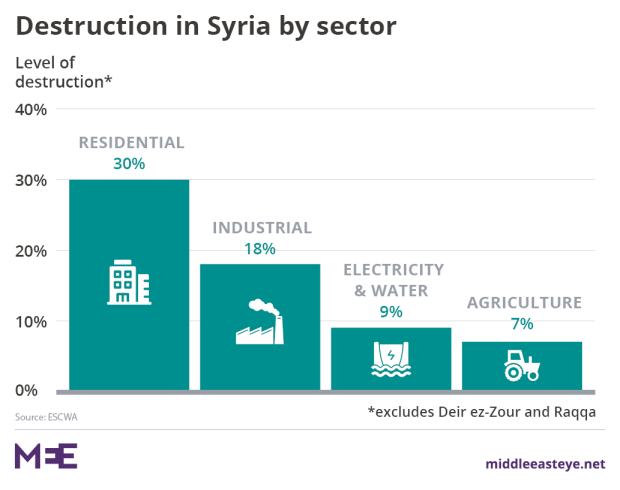

The seven-year conflict in Syria is still unresolved. Millions of Syrians now live outside its borders, often in refugee camps. Fighting continues across the country. The infrastructure has been wrecked, with an estimated cumulative cost to Syria of $226bn.

But there is widespread international belief that at some point the government of President Bashar al-Assad and its allies will claim victory – and begin rebuilding.

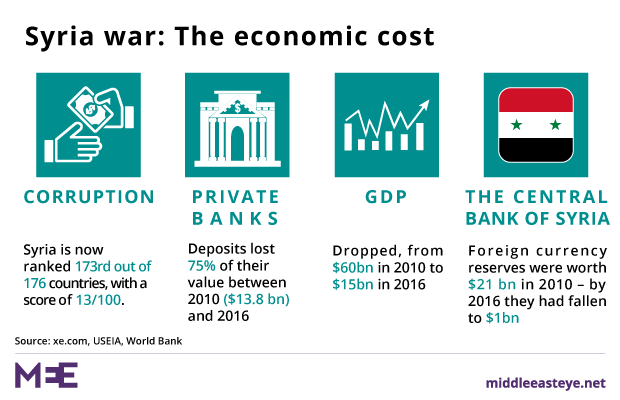

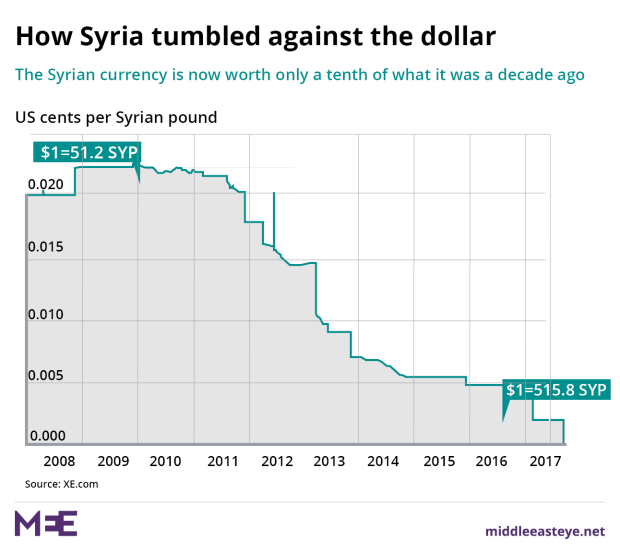

The expectation is that supporters of Damascus, both at home and abroad, will win the lion's share of those reconstruction contracts. Neighbouring countries, such as Lebanon, will also benefit, so the wisdom goes. Contractors, entrepreneurs and financiers could be forgiven for salivating about a potential reconstruction bonanza.But it is not that straightforward. The Syrian state is financially broke. It's not even clear how Damascus has managed to finance the six-year war without external support (Iran has provided at least $8bn in credit). The national budget for 2017 is just $5bn. Foreign-currency reserves plunged from $21bn in 2010 to a mere $1bn in 2015.

How much will it cost to rebuild Syria?

Most estimates range from $100bn to $350bn, with some as high as $1 trillion. Jihad Yazigi, editor of independent financial paper Syria Report, puts the sum at the lower end of the range. “The World Bank and UN estimate it will need $100bn to repair what has been destroyed, with more needed to get Syria back on track.”

During the early stages of the war, the United Nations Relief and Works Agency (UNRWA) estimated it would take 30 years for Syria's economy to bounce back to its pre-2011 level. That timescale has now lengthened.How much does Syria need?

The world is facing its worst humanitarian crisis since 1945 in Yemen, according to the UN. Global debt is put at $217 trillion, or 327 percent of global GDP, the Institute of International Finance has warned, with many countries still in austerity mode. The UN appealed for $4.6bn for its 2017 Syrian refugee response plan but has had a shortfall of $2.8bn.

Amid such donor fatigue, there is little desire or ability to fund yet another reconstruction project, more so given the international politicisation of the Syria conflict.

Sources at the World Bank told Middle East Eye that it will not pull out its chequebook for Syria. Western governments have signalled that they will not fund any reconstruction without some form of leadership transition (upshot: Assad quits).That leaves Damascus' allies such as Russia, Iran and China to potentially pick up the tab after spending billions of dollars on the war – but the returns are uncertain.

Rashad al-Kattan, a non-resident fellow at the Atlantic Council and researcher on the Syrian banking sector, told MEE: "Will they be able to convince their private businessmen to go in to Syria, in a transparent way? No. They will have to compete with nasty [Syrian regime] businessmen to stay in business."

What can Syria offer investors?

Not much. In particular, it lacks two key elements which would make it attractive should the country remain under international sanctions

1. A lack of natural resources means Syria does not have the oil reserves that have made Iraq – the world's fourth-largest oil exporter - attractive for reconstruction funds since 2003.

The country's oil reserves have tumbled for years due to depleting reserves, reaching just 375,000 barrels per day prior to the conflict – that is only 0.2 percent of global production. Its gas reserves are also insignificant at 0.1 percent of global production.

Yes, Russia was awarded tenders during the conflict to develop offshore gas fields in the Mediterranean, but the rest of Syria's hydrocarbons are in the northeast, the former stronghold of the Islamic State group and where the Kurds are now campaigning for independence.

2. High tariffs have been imposed by Damascus on Western imports. That makes their products less competitive compared with imports from countries with which Syria has free-trade agreements. Syria does not have a free-trade agreement, for example, with the EU.

Western multinationals were barely present before the war. Now Syria needs them more than ever, to get foreign direct investment (FDI) levels back to pre-conflict levels, when FDI surged from $110m in 2001 to $2.9bn in 2010.

More obstacles...

Since then, Syrian access to foreign banks and the use of the SWIFT network – a global payment system – has been restricted, effectively cutting Syria off from the international financial sector.

The sanctions were subsequently expanded. The latest round, introduced by the US Treasury in 2016, targeted private companies, including the interests of Rami Makhlouf, cousin of Assad, such as the airline Cham Wings and private security firms.

Western regulators have kept a close eye on Syria, while international financial institutions avoid any transactions due to the risk of being fined for non-compliance.

Kamal Alam, a visiting fellow at RUSI in London, said: "Syria has been asking for the basic sanctions to be removed, but I doubt it will happen any time soon. The sanctions will be a hindrance to reconstruction efforts."

4. No government strategy: A Syrian inter-ministerial committee, established in 2012, only met for the first time in October 2017 to devise a reconstruction strategy. Some $200m has been allocated for projects by the committee during the past four years, although little has actually been spent, according to Yazigi.

"What is telling is that the Syrian government doesn't have an economic development strategy," he said. "Will they focus on specific sectors? Will they start in specific cities or areas? What are their economic and fiscal policies? We don't know."

5. No money: Syria's state-owned and 14 private banks have sustained major losses during the war and do not have the liquidity to invest seriously in reconstruction. Deposits in private commercial banks have plunged to $3.5bn in 2016 from $13.8bn in 2010, according to the World Bank.

This has raised questions about the viability of public-private partnerships (PPPs), which have been floated by the government as a reconstruction strategy.

6. No transparency: Yazigi said that many investors fear that the PPP law, passed in January 2016, could legalise the transfer of state assets to private investors close to the government.

It's a natural conclusion: many of the laws passed during the conflict have been to the benefit of the elite such as Makhlouf, according to Yazigi.

"One strategy is prioritising regime cronies and upscale urban real estate," Yazigi said. "But they don't declare that of course. What they have done is lowered tariffs and the subsidies for the industrial and agricultural sectors, so they've destroyed local production."

Companies linked to reconstruction, such as the Syrian Metals Council, established in 2015, are run by powerful figures such as Mohammed Hamsho.

The war economy has become very organised. There's no competition

- UN source in Beirut

In May 2015, a law allowed local administrative units to establish fully owned holding companies, thereby boosting infrastructure work. But these units have close links to leadership supporters: for example, Hussein Makhlouf, the minister of local administration, is another relative of Assad and of Rami Makhlouf.

"For local administrative units to work there needs to be complete reform, as everything is centralised," said a member of the UN in Beirut, speaking off the record as he is not allowed to speak to the media.

"The economy is being run by the warlords, four big ones, with 20 to 30 under each. The war economy has become very organised. There's no competition. Each has his own sector. They will keep running the economy."

Sounds familiar? That is because it recalls Lebanon's post-civil war reconstruction in the late 20th century, which benefited politicians, warlords, banks and contractors close to the Beirut elite.

Iran: Syria the geo-political pawn

So what is the likely international response to Syria's need for investment?

Tehran, which has had economic problems of its own, has discovered that Syria is no easy partner. Iran was awarded a mobile-phone licence in January to become Syria's third provider, as a reward for its support during the war.

But that has now been delayed, to the benefit of Syriatel, a telecoms company owned by government ally Rami Makhlouf. It posted a large increase in revenues in 2017, according to Syria Report.

Iran was also awarded rights to mine phosphate near Palmyra, but then a Russian firm started mining in the same area. The UN source said: "Iran complained to the government, but was told: 'You are both our friends'."

Khodro and SAIPA, two Iranian car manufacturing plants established in Homs and Damascus, were not awarded preferential tax rates as they might have hoped, making them less competitive than rival Chinese and European brands.

Then there was the MoU with Iran to pipe natural gas to Syria via Iraq - signed in 2011 - which has still not materialised.

For Tehran, as for Damascus' other allies, intervention in Syria was less about opening up new markets for Iranian goods and services, more about regional strategic goals.

Emad Kiyaei, an Iran specialist and principal at consultancy IGD Group in New York, said: "Iran is playing a long-term game for a key ally in the region. Syria was never meant to be a milking cow, as they don't have the resources to milk."

Instead Kiyaei highlights how Iran has worked on reconstruction throughout the war. Central to this has been the commercial arm of the Iranian Revolutionary Guards Corp, which reconstructed the Islamic Republic following the devastating Iran-Iraq war of the 1980s. "The IGRC has vast engineering capabilities in post-war reconstruction. We are seeing a similar model in Syria."

For Iran, the return on investment is not just in capital terms but in strategic influence to have a more permanent foothold

- Emad Kiyaei, IGD Group

Then there is Iran's geopolitical standing. Aside from Syria, it is also involved in the Yemen war and is coming into increasing conflict with regional rivals, most notably Saudi Arabia.

"For Iran, the return on investment is not just in capital terms but in strategic influence to have a more permanent foothold," said Kiyaei. "Yes, some MoUs have not worked this time, and prior to the conflict agreements also faltered, but Iran has a presence today in Syria it never had before."

The Marshall Plan, introduced by the US after World War Two to prevent Western Europe from coming under the control of the Soviet Union, is regarded by the international community as a default template for any post-war reconstruction.

Many believe Iran might be trying this approach in Syria. If something similar were to happen there, then it would be driven by Iran's interests to counter Saudi Arabia.

Kiyaei said: "Iran wants to keep Saudi Arabia out of Syria. As the situation stands now, the Saudis will not be able to crawl back into Syria for years. That is worth every billion Iran will drop in Syria."

Russia: Using the Ukraine model

Russia has only just dragged itself out of recession. It has been a central player in the Syrian conflict, initially providing diplomatic support and from September 2015 direct military intervention, reportedly spending $3-$4m a day on the war. But Russia-Syria bilateral trade crashed to $210m in 2015 - little more than a tenth of the $1.8bn of business done in 2011.

In October 2017, it was reported that Moscow is to provide financing for some electricity projects – the first case of direct funding from Moscow in many years, according to the Syria Report.

If Russia is to invest, much of it will be a publicity stunt

But Russia's reconstruction will be selective to emphasise that it is part of its humanitarian mission, said Andrew Bowen, a Russia specialist and associate at the Initiative for the Study of Emerging Threats at New York University.

"It is about offering a softer image of Russia in the Middle East. If they are to invest, much of it will be a publicity stunt. They want to drag TV crews out to sell a narrative that Russia is rebuilding Syria."

Bowen expects Russia to follow the model used in its other current theatre of conflict: Ukraine.

"Projects in Crimea were given to firms either directly or indirectly connected to oligarchs close to the regime. They are told to invest in certain sectors: build 10 hospitals, 20 schools, and you'll do it for us as a favour. It's hard to see a legitimate business return for these investments."

Lebanon: You have to go through Hezbollah

Hezbollah, which is based in Lebanon and is an ally of Iran, has fought alongside the Syrian army. It now wants reconstruction to benefit its business interests, affiliates and supporters.

There is also the obstacle of the Hezbollah International Financing Prevention Act (HIFPA). The US legislation has prevented blacklisted members of the group, related businesses and individuals from accessing the global financial system - including in Lebanon itself.

Some in Beirut believe that China may offer more hope of rewards. Lebanon has been trying to persuade Beijing to invest in the northern port of Tripoli, which is being sold as a potential logistics hub for goods and materials to enter Syria.

But Wang Kejian, the Chinese ambassador to Lebanon, said at the Issam Fares Institute in Beirut in September: "Chinese shipping companies have limited relations with Lebanon and are not considering Tripoli yet due to economic factors. Maybe after the Syrian crisis ends there will be linkages between Lebanon and the region, and for a transport network."

China: Security interests

Beijing has supported Damascus at the UN, as well as having provided troops and humanitarian aid.

It also has a history when it comes to overseas reconstruction. For example, Beijing became heavily involved in Angola after its 27-year civil war ended in 2002, as part of Beijing's global Resources for Infrastructure strategy.

More than 50 Chinese state companies and 400-plus private firms pitched in and were rewarded with a share of Angola's $25bn per year of oil exports. But despite Damascus' overtures to Beijing, China has, as yet, not responded. It comes down to what Angola, also Iraq, could offer but which Syria cannot: oil.

Yes, Syria is part of China's $1 trillion, 60-country "Belt and Road Initiative" (BRI), a land and maritime infrastructure development strategy covering much of Eurasia. But it is not a member of the Beijing-backed Asian Infrastructure Investment Bank (AIIB), so it cannot appeal for funds despite the country's strategic importance to China in the Middle East.Alam said: "The money trail regarding Syria and China is impacted by the lack of [Syrian] resources." China's real interest in Syria is security, he said, not the economy.

Beijing fears the radicalisation of Uighur Muslims in its unsettled Xinjiang province by some of the 4,000-plus Chinese Uighur fighters returning from Syria and Iraq, where they supported the likes of Islamic State.

Turkey has historically been a supporter of the Uighurs, to Beijing's chagrin, increasing China's need for reliable intelligence in the Middle East.

China has shown no real confidence about investing in Syria, not just due to the regime. They know that investments will go down the drain

- Rashad Al Kattan, researcher on Syrian banking sector

"The Turks have never been reliable allies when it comes to capturing Uighurs, so Syria is an important monitor of the local situation," said Alam. "If that means economic investment on the ground [in Syria], fine, they can do that, but not like in Africa or other places where China is investing."

Syrian appeals for stronger investment appear to have failed, outside of private initiatives such as the agreement to locally manufacture China's Dongfeng Motor DFM brand in Homs.

Earlier this year, Beijing refused to issue visas to Syrian officials, although it did grant permission for private businessmen, according to the UN source. That echoes how Assad was snubbed during his first state visit to China in 2004, which was abruptly cut short, according to Andrew Tabler, author of In the Lion’s Den, because Beijing wanted to give greater preference to a visit by Israel's then-trade minister.

Imad Moustapha, the Syrian ambassador to China, has been trying to get more support from Beijing.

But Kattan warned: "China has shown no real confidence about investing in Syria, not just due to the regime. They know that investments will go down the drain due to nepotism and corruption. Maybe they've learned the lesson that there's no leverage over the [Syrian] government."

US: Cheque book firmly shut

Washington is unlikely to fund any reconstruction efforts, despite having backed opposition groups during the war. While there was pressure on the US to "pay for what it broke" in Iraq following the 2003 invasion, Syria is different.

"Funding from the Americans is out of the question," said the UN source.

Both the Obama and Trump administrations have stated that Assad must go, and they will not perform a policy volte face.There is minimal appetite for funding reconstruction following the scandals in Iraq and Afghanistan over misappropriated funds. A US Congressional commission estimated that between $31bn and $60bn was lost out of a total of $160bn due to fraud and waste.

There is minimal appetite in the US for funding reconstruction following the scandals in Iraq and Afghanistan over misappropriated funds

As of 2013, Washington allocated some $60bn in reconstruction grants for Iraq, while additional investment was generated by releasing Iraqi funds frozen during the Saddam Hussein era.

Despite ongoing security problems, Baghdad was still able to raise reconstruction funds from its huge oil reserves. In 2016 it produced an estimated 3.6m barrels per day (bpd) to fund its annual budget of close to $100bn.

By comparison, Syria was producing 375,000 bpd in 2010, the last available figures before the conflict and only around 0.2 percent of the global total. That number has now dropped: Damascus' budget was only $5bn in 2016.

Egypt: Problems of its own

Cairo has had a tumultuous relationship with Syria during the past few years.

Relations deteriorated in 2013 when Egypt backed the Syrian opposition, shut the Syrian embassy in Cairo, recalled its own charge d'affaires from Damascus and tried to raise funds for the rebels.

Since then, Cairo has had to perform a balancing act, caught as it is between Damascus and allies including the US and the Gulf Cooperation Council (GCC), which numbers Saudi Arabia and the UAE among its members.

Egypt sent business delegations to Syria in August 2017 and is keen to normalise relations, which would help Damascus. But with its economy struggling and the country in debt, Egypt can offer only token support and private sector investment.

Cairo itself has tried in vain to attract investors following the 2011 uprising

Cairo itself has tried in vain to attract investors following the 2011 uprising, despite support from the IMF and the GCC. In 2015, it organised the Egypt Economic Development Conference in Sharm el Sheikh, which was publicised as Egypt's Marshall Plan. It turned out to be a damp squib.

Kattan said the gathering reminded him of what may now happen in Syria: "They invited all these multinationals, and the UAE and Saudi Arabia supported them. Billions of dollars in investments were announced, but not much materialised.

"Even if Syria reaches the same stage, with a development conference in April 2018, we will hear of billions pledged, but look at the track record. Maybe only 20-30 percent materialises."

The rest of the Arab world: We want change first

Turkey and members of the GCC have long wanted Assad out. If he had gone, then perhaps these nations and the West would have been willing to bankroll the new Syria. But he hasn't gone. And they won’t cough up cash.

But the source said that there was "no way" that the GCC would give contracts and financing to any entity – such as the Syrian government – that has close ties to Shia players such as Hezbollah and Iran.

Alam said the counter-argument is that the GCC may, grudgingly, provide funds and private investment to counter the influence of Tehran and the Shia in Syria. But if that is to happen, then the GCC would have to do a U-turn on its position on Assad.

Ankara has opposed Damascus while paying $12.5bn during the conflict to host Syrian refugees within its own borders

The same would apply to Ankara, which has opposed Damascus while paying $12.5bn during the conflict to host 3.2 million Syrian refugees within its own borders.

Atilla Yesilada, an Istanbul-based analyst at Global Source Partners, an international business advisory service, said that while Turkey was a natural choice to lead economic reconstruction, political obstacles remained.

"Turkey has no interest in ending the Syrian war and will do its best or worst to keep it going, through proxy or direct intervention, for a solution. Then again, Ankara is relatively pragmatic when it comes to business interests, especially if there is a transitional government in Syria, which would be more palatable to the world."

Europe: Refugees as leverage

The EU is keen to contain the flow of refugees to Europe itself and Syria's neighbours. At present there are more than 970,000 Syrian asylum seekers in EU countries.

The EU is also a key business partner for Syria. In 2016 EU trade with Syria came in at $500m - just under seven percent of what it was before the war in 2010 at $7.2bn.

Would an extensive programme of rebuilding encourage the five million-plus refugees who left Syria to return home?

"Some Western governments have been visiting Damascus to restart those relations bilaterally outside of the EU framework. It is opportunistic but important for the government."

The EU has said that it wants to contribute to the "stabilisation and early recovery of areas where violence has decreased".

The EU wants Assad to relinquish power. Likewise, Assad has said that the EU has no role to play in Syria's reconstruction

Kattan observed: "'Early recovery' in my mind is reconstruction and development."

But there is one caveat: the EU is another party that wants political transition – that is, Assad to relinquish power. It prompted Moscow to accuse Brussels of "politicising aid".

The same conditions have also been stipulated by western aid organisations, which met in Brussels in April 2017. In a joint statement, CARE International, the International Rescue Committee, Norwegian Refugee Council, Oxfam and Save the Children said that “international support should be conditional on a political solution being agreed, respect for human rights and protection of an independent civil society. Absent these conditions, a move towards reconstruction assistance risks doing more harm than good.”

Likewise, Assad has said the EU has no role to play in Syria’s reconstruction.

As things stand, smaller-scale investments from Europe seem the best hope. In October, Syria's finance ministry said it was preparing to relaunch bilateral business councils with several countries it considers "friendly," including the Czech Republic.

Alam said: "Syria doesn't need massive amounts from outside as people are predicting. They can get by with small infrastructure projects from outside and do the rest themselves.

"Indonesia has donated a few hospitals and ambulances, and the Malays have done the same. It is such small economic activity which keeps the government relevant. France and Europe are mistaken if they think they can blackmail Syria on their terms."

Multinationals: Deterred by tarrifs

Spending power among Syria's consumers is unsurprisingly weak after six years of conflict.

GDP in 2016 was only $15bn – a quarter of what it was in 2010. More than 80 percent of Syrians live below the poverty line, according to the UN. Even before the conflict, the market was one of mass volume. Low purchasing power means low profit margins for businesses.

Alam said: "The success of the Syrian government before the war was to open up the economy to countries that were not trading much. They [Damascus] are just reviving what they already had - nothing earth-shattering, yet it all adds up."

Kattan cited tariffs and the difficulties of operating in Syria as obstacles for Western FDI. "On the business level, look at the economic perspective prior to 2011. Why were no Western companies present, apart from in energy? Or the Gulf ones, which were affiliated with the regime when things were rosy?

"Now they have to convince multinationals to come in to make money. But the government could expropriate investments or property rights."

The ever-present dominance of warlords and leadership cronies are also deterrents, as are the international sanctions.

Syrians abroad: Are they welcome back?

The Syrian International Business Association (SIBA) was established in July in Marseilles. Sponsored by the World Bank, it is an initiative to encourage Syrian expatriate businessmen to invest in reconstruction.

Riad al-Khouri, director (Middle East) at political risk adviser GeoEconomica based in Amman, said it has potential.

The government needs the diaspora much more than before, so there's an opportunity. The financing will come much quicker than people expect

- Riad al Khouri, GeoEconomica

"There is close to $100bn of Syrian money outside of the country," he said. "A lot of this money will come back, as the government needs the diaspora much more than before, so there's an opportunity. The financing will come much quicker than people expect."

Such investment would fit into Damascus' apparent strategy of appealing for small investments from multiple players. However the country is sending mixed messages, according to Yazigi.

While some government members have appealed to expatriates to re-invest and offered incentives, such as industrialists in Egypt, state-owned local press has denounced businessmen who fled Syria as traitors. "There are a lot of conflicting interests," said Yazigi.

In October, Damascus froze the assets of Imad Ghreiwati, a businessman who made his fortune from ties to the government but headed for the UAE once the conflict broke out. "It is a message sent to investors: anyone not supporting us can't play with us," said Yazigi.

So where does this leave the reconstruction of Syria?

Unless there are major policy U-turns by the EU, the US and Turkey towards the Assad government then Syria is not going to get the tens of billions of dollars needed to get the country back on its feet. "The narrative that billions [of dollars] will come is wishful thinking," said Kattan.

Instead, Syria will have to rely on small-scale investments and infrastructure developments to push itself along. Reconstruction will only be a long-term project – and that is only if Damascus eventually develops a strategy.

Alam said: "It will be small investments and a gradual regeneration of businesses. No game-changers, but it will keep the local economy going."

This article is available in French on Middle East Eye French edition.

Middle East Eye propose une couverture et une analyse indépendantes et incomparables du Moyen-Orient, de l’Afrique du Nord et d’autres régions du monde. Pour en savoir plus sur la reprise de ce contenu et les frais qui s’appliquent, veuillez remplir ce formulaire [en anglais]. Pour en savoir plus sur MEE, cliquez ici [en anglais].