Lebanon prosecutor bans five bank board chiefs from travel

A Lebanese prosecutor on Thursday issued travel bans against the heads of the boards of five Lebanese banks as a precautionary measure while investigation into transactions by their banks is ongoing, the prosecutor told Reuters.

Judge Ghada Aoun issued the bans against Salim Sfeir of Bank of Beirut; Samir Hanna of Bank Audi; Antoun Sehnaoui of SGBL; Saad Azhari of Blom Bank; and Raya Hassan of Bankmed, she told Reuters.

Aoun has not charged any of them with a crime.

When contacted, Hassan told Reuters she was “speechless” and noted she had joined the bank after the transactions took place.

Azhari did not immediately respond to a request for comment, neither did officials from Bank Audi, SGBL and Bank of Beirut.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

In February, Aoun indefinitely extended a subpoena for central bank governor Riad Salameh after he failed to attend three hearings as a witness in investigations into his alleged misconduct at the central bank, which includes accusations of fraud.

He faces several other investigations in Lebanon and several European countries.

He is being investigated in Lebanon and European countries, including Switzerland, for alleged money laundering and embezzlement of hundreds of millions of dollars at the central bank.

Salameh has denied wrongdoing and described accusations against him as politically motivated.

He had previously accused Aoun of bias and sought her dismissal from investigations against him.

Worsening economic crisis

On Wednesday, Lebanon’s deputy prime minister warned that a hole in the country’s financial system estimated at $69bn in September was expected to grow to $73bn, and losses in the central bank reserve would increase while the country's financial crisis remains not addressed.

Saade Chami also said the state's contribution to plugging the hole would be "limited" to ensure public debt sustainability, while a depositor contribution was inevitable, in reference to how the losses would be distributed in a financial recovery plan that the government has yet to agree.

Chami made the comments in remarks to an economic council on Wednesday, a copy of which he sent to Reuters.

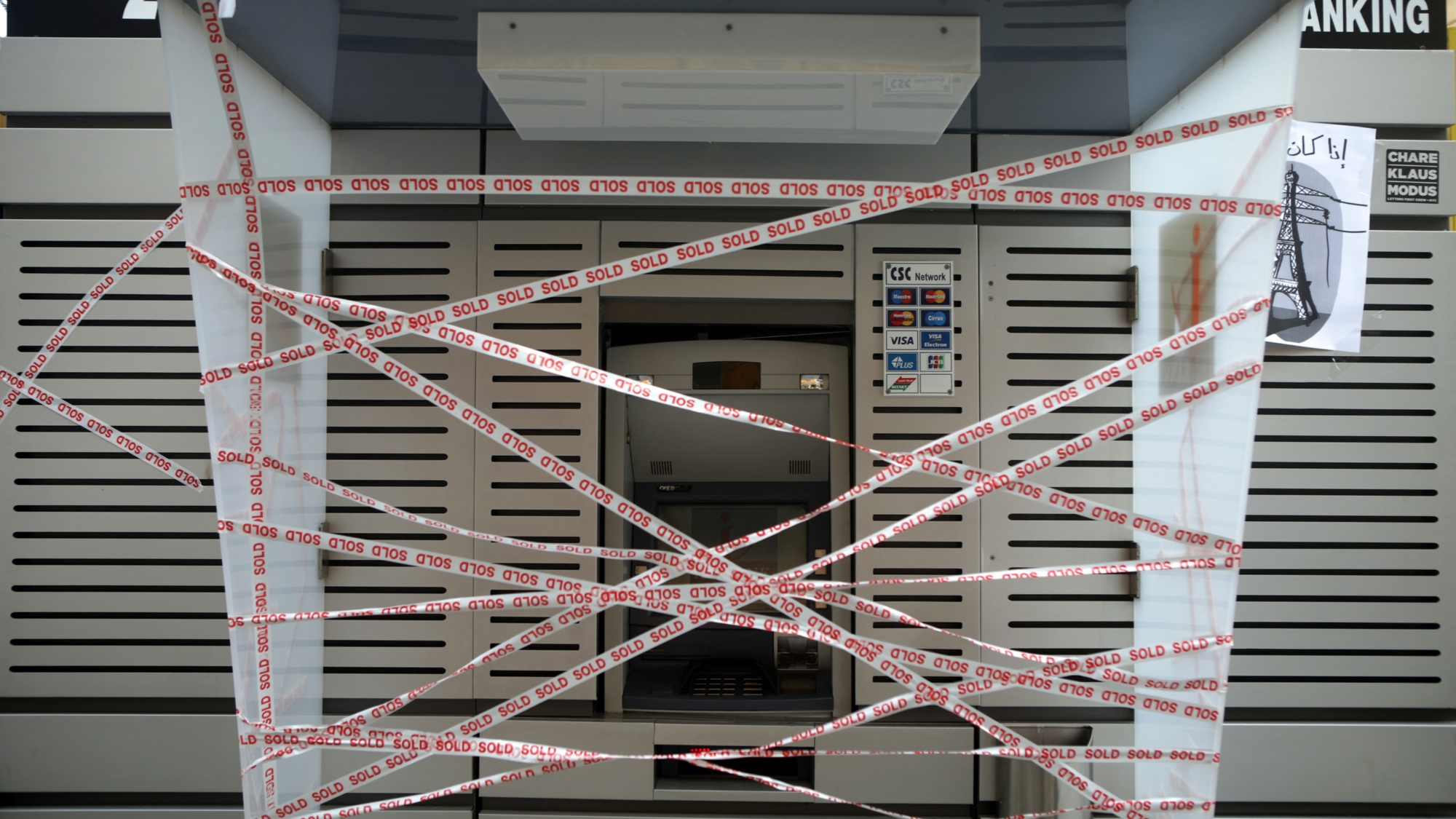

Lebanon has been mired in a devastating economic crisis since 2019, when the financial system collapsed under the weight of decades of state corruption, waste and mismanagement, paralysing the banking system.

Despite soaring poverty, Beirut has yet to come up with a financial recovery plan addressing the losses, or other steps seen as vital to plotting a path out of the crisis and making progress towards a deal with the International Monetary Fund (IMF).

Chami said the government and IMF had agreed on the need to protect small depositors, but had not yet agreed on the ceiling for defining a small depositor. There were "great difficulties" in returning foreign currency deposits in full, he said.

"The contribution of the state (in covering) the losses in the financial sector will be limited due to the necessity of ensuring public debt sustainability, likewise with the contribution of the central bank," Chami said.

Even if commercial banks lost all their capital of $12bn, Chami said there must be a depositor contribution, and there were "numerous formats" for compensating depositors.

These included issuing government bonds, swapping deposits for bank shares, and the possibility of establishing a fund to manage state assets with part of the proceeds paid to depositors.

A draft plan seen by Reuters earlier this year proposed turning the bulk of $104bn of hard currency deposits into local currency, with the financial hole covered mostly by depositor contributions.

The plan was not approved by government.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.