Saudi Arabia’s digital dream: Silicon Valley for the Middle East

Saudi Arabia is spending billions of dollars, and hopes to attract billions more, to become the digital hub of the Middle East, investing in data centres, metaverses and fibre optic cables.

Global players Microsoft, Google, Oracle, Meta and Apple are all piling into the kingdom, attracted by its deep pockets, high internet usage and plans for the future.

Riyadh is keen, under its Vision 2030 economic plan, to diversify away from hydrocarbons - and that includes investing in information and communications technology (ICT) infrastructure and services.

The aim, Fahad Alhajeri, CEO of Center3, a subsidiary of the Saudi Telecom Company (STC), told the media in October 2022, is to become “the main digital hub connecting the three continents Asia, Europe and Africa, as well as leading the largest share of internet exchange and data traffic in the region".

But to achieve this, the kingdom needs more data centres and infrastructure to handle vast amounts of data traffic, including fibre-optic cables running directly to the Arabian peninsula from Asia, Europe and beyond.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Riyadh also faces several other challenges, including the ongoing tech war between Washington and Beijing, questions over the kingdom’s approach to human rights and digital privacy; and the economic viability of its strategy.

Can Saudi Arabia build Silicon Valley on the Arabian Peninsula?

Saudi Arabia is already a digital giant in the Middle East. It is home to more than 55 percent of the region’s largest telecoms market and 51 percent of the region’s IT industries, according to Goldstein Research. Internet penetration stands at 98 percent.

But consumer spending on IT is only 0.7 percent of GDP, compared to 1.3 percent in developed markets. That means there’s room for growth.

And that growth is coming. Cloud services in Saudi Arabia are forecast to reach $10bn by 2030. Google has entered into a joint-venture with state-owned oil giant Aramco. Oracle announced in February 2003 that it will invest $1.5bn to open cloud centres. Microsoft is to invest $2.5bn in a new cloud data centre. China’s tech giant Huawei is to invest $400m in a cloud region. Meta, the parent company of Facebook, is to open the region’s first metaverse academy, to train people how to build the new digital environments, in Riyadh in May. Apple is to locate its first distribution hub in the Middle East near Riyadh.

James Shires, senior research fellow at Chatham House and author of The Politics of Cybersecurity in the Middle East, says: “The big technology companies recognise the future is non-western, so they need to engage with these regions, especially with countries like Saudi Arabia that are going to be important markets for them.”

The Saudi government is backing major plans to digitalise the kingdom - necessary to enable projects such as Neom, the multi-billion dollar megalopolis it is building in the north of the kingdom, to become a smart city.

In 2022, Riyadh earmarked $6.4bn for future technologies and entrepreneurship. It includes $1bn for the Neom Tech & Digital Company to develop XVRS, the world’s first cognitive metaverse, which integrates the virtual and real worlds.

On top of that, the Ministry of Communications and Information Technology plans to attract $18bn to build a network of large-scale data centres. MIS, a Saudi-based information systems company, has established a $320m fund to develop six data centres. State-backed STC is investing $400m to build the “largest cloud-enabled data centre in the region”. And Aramco is to invest $1bn in a venture capital fund to focus on new technology.

Yet to realise its data hub ambitions, the kingdom needs to significantly bolster capacity from its current data capacity of 60 megawatts (MW) to 1,300 MW by the end of the decade, according to a report by Al Rajhi Capital.

“But what drives a hub is content,” says Paul Brodsky, senior analyst at telecommunications research firm TeleGeography in Washington, “what people are looking at on computers and smart phones. In the Gulf people are no different.

“For the most part, what people consume is served up from local content caches. So someone in Saudi Arabia is most likely streaming a cricket match from within a server located within the country. The caches themselves get filled from European or - to a lesser degree - Asian hubs.

“To be a hub, you want that data stored locally and pushed closer to the end user. You need a critical mass of people that demand and want content.”

Cable guys

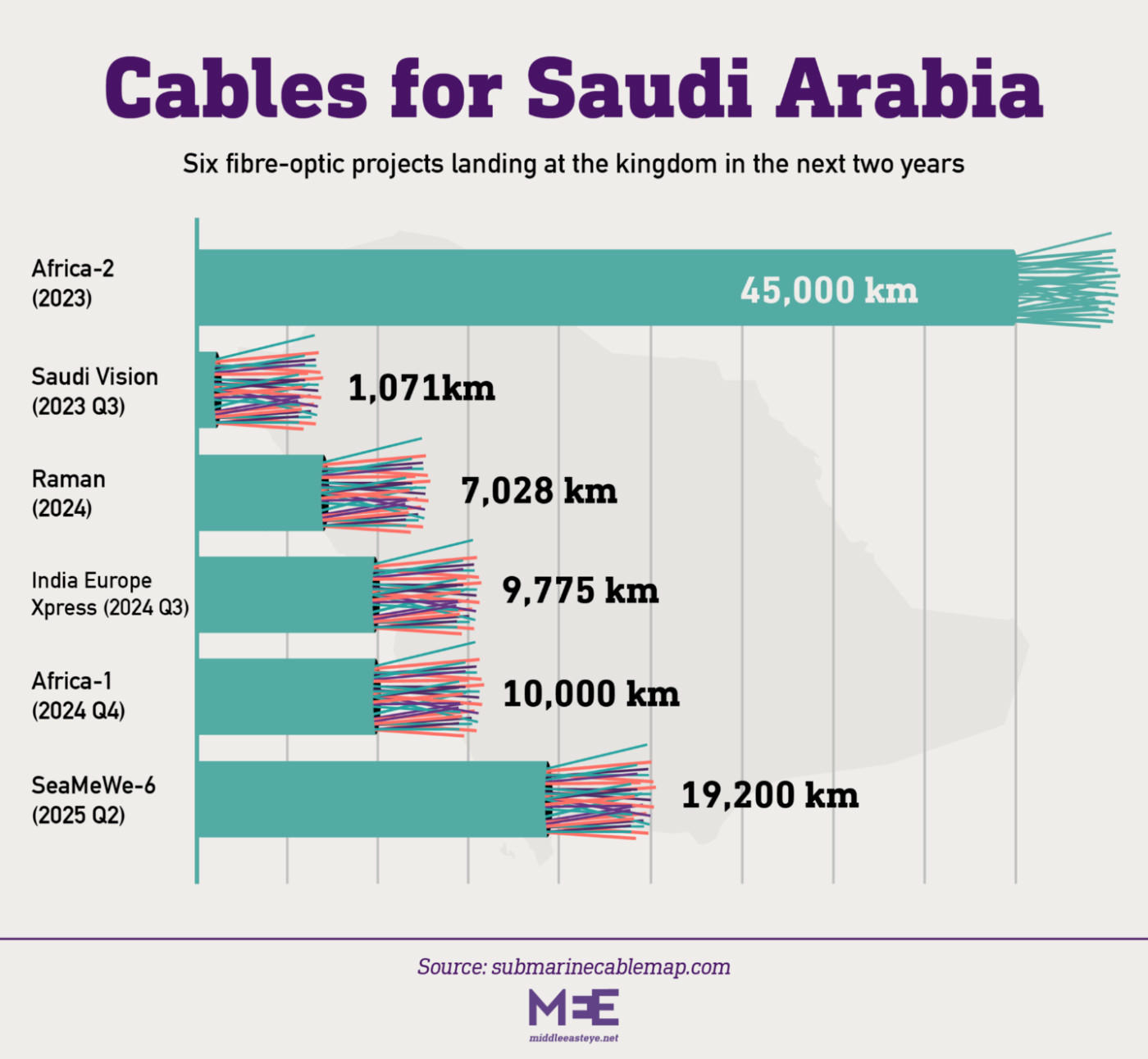

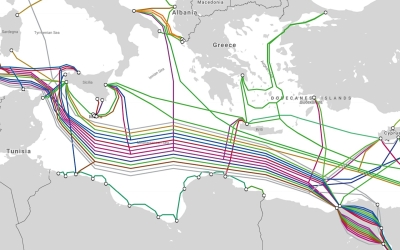

Key to that growth are fibre-optic cables, the pipes which carry 95 percent of the world’s internet traffic. The Middle East is connected to Europe via routes running across the Mediterranean, and through Egypt and the Red Sea to the Gulf.

Until now, the kingdom has taken a backseat to Egypt’s role as the region’s dominant cable player.

But this is set to change, with the planned development of fibre-optic cables necessary for Saudi Arabia to become an IT hub. “Any time you see big data centres coming in, you need to connect them up, either to existing subsea cables that can handle increased demand, or you need more cables,” says Brodsky.

There are plans for STC to build the 1,100km-long Saudi Vision Cable, which will run along the Red Sea coast from Jeddah to Al Haql, near Neom.

The company is also reportedly backing the Trans Europe Asia System (TEAS), the first terrestrial cable to run across the kingdom, from Ras al Khair in the Persian Gulf to Amman in Jordan and then on to Israel. A second cable is planned to run along the Red Sea coast, then north to Aqaba and Israel. Additionally, the Google-funded Blue-Raman cable will land near Neom.

Already, regional talent is being scooped up to ensure there are enough skilled workers to achieve Saudi Arabia's digital dreams.

Mohamad Najem is executive director of SMEX, a Beirut-based NGO that works to advance digital rights in the Middle East and North Africa.

“From Egypt, Jordan and Tunisia, all the talent is going to Saudi Arabia,” he says. “They are getting everyone they can, and paying tonnes of money for English speakers.”

But creating such a large ecosystem to become a digital hub is not just about throwing lots of money at it.

Rachel Ziemba, an adjunct senior fellow at the Center for a New American Security in Washington, says: “Saudi Arabia has a lot of ambitions. But as we’ve seen around the world, it’s hard to recreate an ecosystem like [California’s] Silicon Valley. Part of that has to do with getting the academic, business and governance support right.”

The kingdom will also have to decide in which areas it can innovate and compete at a global level, and in which it cannot.

“Where will they be in the supply chain of the tech industry to move away from being large consumers of IT products, software and data clouds,” says Ziemba, “and actually make it themselves?”

Caught in China versus US trade war

Riyadh’s aspirations for its digital ecosystem also come at a difficult time.

Washington, during the past three years, has ramped up its economic war with China and made it clear it does not want countries to use Chinese technology. As a result, Chinese telecoms giant Huawei has lost contracts to roll out 5G networks in the UK and India: in turn, Beijing has introduced legislation to prevent US tech companies from involvement in Chinese telecoms consortiums.

“An issue facing any jurisdiction developing IT right now is: ‘Do they use Chinese or US software, hardware, networks, and components?'” says Ziemba.

'If they use Chinese tech, at what point do they run the risk of restrictions from the US?'

- Rachel Ziemba, Center for a New American Security

“If they use Chinese tech, at what point do they run the risk of restrictions from the US and pressure around say Huawei components and networks? A lot of Gulf countries have faced question marks on how to navigate Chinese-US tech competition for years, and this is still a factor.”

Saudi Arabia has entered into joint ventures and partnerships with tech companies globally, including Huawei. It is also hosting the Global Tech Hub, a joint venture between Russia and the kingdom.

“Saudi Arabia is operating in a kind of work-with-anyone way,” says Ziemba, “but down the line it might be difficult to adopt technologies in partnership with all the prevailing producers. We are especially seeing the US look to using export controls as a more meaningful tool of economic coercion and foreign policy.”

There is also, Ziemba believes, far more risk of the emergence of different and fragmented technology ecosystems.

“But whatever concerns that the US has with Saudi Arabia, technology is probably an area where they would like to find areas to work together rather than seeing developments as a threat.”

Human rights concerns

One further area of concern for outside companies doing business in Saudi Arabia are human rights, digital privacy and surveillance.

The kingdom has introduced a Personal Data Protection Law (PDPL), which came into full effect in March 2023, but it has been criticised by digital rights groups such as SMEX, which said the legislation might still allow violations of the rights to privacy and data protection.

“The problem is not with the text of the law per se, the problem would be its applicability and implementation within Saudi Arabia, given the kingdom’s authoritarianism,” said SMEX in its report.

The US government and private sector have also voiced concerns.

In July 2022, the International Trade Administration, which is part of the Department of Commerce, stated: “US industry has noted that there are significant discrepancies between some of these laws and regulations, which creates ambiguity. Perhaps the most significant factor… is Saudi Arabia’s strict data localisation requirements which are out-of-step with global best practices for privacy and data protection, and potentially raise the cost of doing business in Saudi Arabia…”

Any American tech giants looking to engage with the kingdom will need to circumnavigate such concerns, as well as face pressure from NGOs and other groups about human rights and digital privacy.

Shires says that while tech companies want Saudi business, upholding their moral commitments and internal corporate values may not be easy. “There are questions about the safety of online spaces for dissenting voices. And if we talk broadly about Saudi Arabia being a responsible digital leader in the region, it has not always demonstrated that responsibility.”

SMEX, for example, said it had asked Google in 2021 about its human rights due diligence reporting in the Gulf. The tech giant said it had undertaken the research, but has still to release the report. It has not explained the reason for the delay.

Najem says: “We are still trying to create pressure, as we are not sure if they have done anything. All these projects with big companies in the Gulf, the issue is, who controls the data and what is their human rights due diligence? If you are a US tech company and do business in an authoritarian country, you need to do due diligence.”

Such concerns may give some pause for thought - but ultimately the success or failure of Saudi Arabia’s desire to become a regional digital hub will depend on economic viability.

“Governments can do what they want, but ultimately it is up to the market,” says Brodsky. “It is possible Saudi Arabia could become a big ICT hub.”

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.