Saudi king hosts British finance minister amid renewed Aramco listing talk

Saudi Arabia's King Salman hosted British finance minister Philip Hammond for talks in the western city of Jeddah on Sunday, state media said, amid renewed prospects of an overseas stock listing of oil giant Aramco.

The leaders discussed ways to "strengthen economic and financial cooperation" and also reviewed security matters in the wake of "Iranian threats" to regional waterways, the Saudi Press Agency said.

Hammond's visit comes after Saudi Crown Prince Mohammad bin Salman reiterated last month that state-owned Aramco's much-delayed initial public offering - dubbed as potentially the world's biggest stock sale - would take place in late 2020 or early 2021.

Saudi Arabia has not announced where the listing will be held, but London, New York and Hong Kong have all vied for a slice of the much-touted IPO.

In April there was huge demand for Aramco's inaugural international bond, seen as a gauge of potential investor interest in the IPO, attracting around $100bn of interest from investors for the $12bn raising.

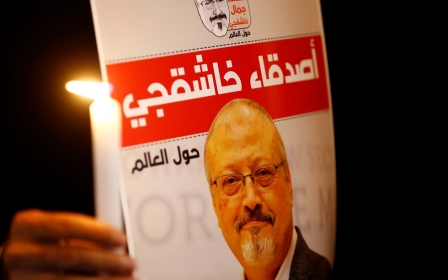

Aramco met investors at the beginning of April as part of a global bond roadshow ahead of the issue, seeking to reassure them after the murder of Saudi journalist Jamal Khashoggi in October and a sweeping crackdown against dissent in the kingdom.

Neither banks nor investors were deterred from participating in the bond deal, despite initial displays of outrage from companies such as JPMorgan, which brokered the deal with Morgan Stanley, over the death of Khashoggi in the Saudi consulate in Istanbul.

Yemen arms suspension

Hammond was accompanied by London Stock Exchange chief David Schwimmer and investment minister Graham Stuart on his two-day visit to Jeddah that began on Saturday, according to a British government statement.

Saudi Arabia plans to sell up to five percent of the world's largest energy firm and hopes to raise up to $100bn in the IPO.

The planned offering forms the cornerstone of a reform programme envisaged by the crown prince to wean the Saudi economy off its reliance on oil.

The CIA concluded last autumn that bin Salman was behind Khashoggi's murder.

In a detailed report released last month, UN rapporteur Agnes Callamard accused Saudi Arabia of being responsible for the crime, calling it a "state act" in violation of international law.

The document also put forward several recommendations for the US, including determining the possible involvement of the crown prince in the murder.

Bin Salman has denied any knowledge of the killing or its botched cover-up, which Riyadh has described as a "rogue operation".

Hammond's visit comes after an apparent setback in relations last month when Britain temporarily suspended approving new Saudi arms export licences that might contribute towards the kingdom's five-year bombing campaign in neighbouring Yemen.

The decision came after a British court ordered the government to "reconsider" the sales due to their toll on the civilian population in Yemen.

Saudi Arabia leads a Western-backed military coalition that intervened in Yemen in 2015 to restore the government of President Abd Rabbuh Mansour Hadi, which was kicked out of power in the capital, Sanaa, by the Houthi rebels in 2014.

The conflict has claimed tens of thousands of lives, according to relief agencies, and triggered what the United Nations describes as the world's worst existing humanitarian crisis.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.