Saudi oil minister says US is 'not in a position to tell us what to do'

The United States should not try to dictate policy to OPEC, Saudi Arabia's Minister of Energy Industry and Mineral Resources Khalid al-Falih has told reporters ahead of an OPEC meeting in Vienna.

"We don't need permission from anyone to cut," said Falih on Thursday.

The US "is not in a position to tell us what to do," the oil minister added, a day after US President Donald Trump urged the cartel to keep the taps open so as to push prices down.

Falih made the comments as OPEC members and other oil-producing countries mulled cuts in output on Thursday to prop up plunging prices.

"We're looking for a sufficient cut to balance the market, equally distributed between countries," Falih said.

Oil ministers from 20 or so countries are in Vienna for two days of meetings - first, the 15 members of OPEC, then a wider group including countries outside the cartel.

The meetings come a day after it was reported that global carbon emissions will jump to a record high in 2018.

The price of a barrel of Brent, the European benchmark, fell four percent to below $60 on Thursday, hit by the Saudi comments, which were taken on the markets to be very cautious, and concerns over an economic slowdown.

On Wednesday, Trump had taken to Twitter to urge producers to keep pumping.

"Hopefully OPEC will be keeping oil flows as is, not restricted. The World does not want to see, or need, higher oil prices!" said Trump, who has repeatedly accused the cartel of keeping prices artificially high.

Coordinated move

At the end of 2016, OPEC's regular members joined forces with other countries, most notably Russia, to scale back output in a bid to reduce a glut that was weighing on prices.

The coordinated move, which has since been extended, stimulated a long rally in oil prices right up until October 2018.

Over the past two months, however, prices have plunged again.

"A million b[arrels cut] would be ideal," said Falih. "Ideally, everyone should join equally. I think that's the fair and equitable solution."

OPEC's daily output of crude stood at 32.99 million barrels in October, according to the International Energy Agency.

Iran, OPEC's third-largest producer, does not want to be part of the Saudi plan. Given the economic sanctions being reimposed by the US, Tehran doesn't intend to join any agreement for cutting production, the country's oil minister Bijan Namdar Zanganeh said.

Zangeneh said the estimated surplus currently on the market amounted to 1.3 to 2.4 million barrels per day.

Ideally, "the price would be better to stand at $60-70. That is acceptable for most OPEC countries".

Delicate position

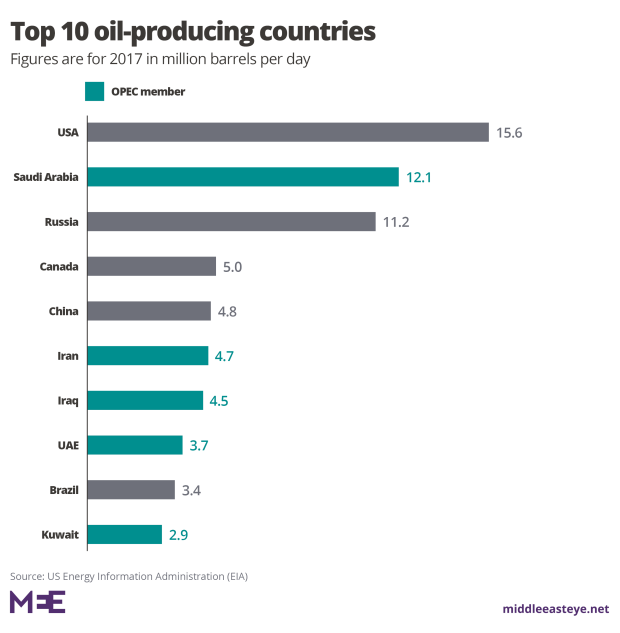

The boom in shale production in the US has made the country the world's largest crude producer, surpassing both Saudi Arabia and Russia for the first time in decades.

Since overtaking Saudi Arabia, many in Washington feel the US no longer needs to shackle itself to Riyadh.

Saudi Arabia, the de facto head of the cartel, finds itself in an especially delicate position in the wake of the murder of journalist Jamal Khashoggi.Khashoggi, a prominent critic of the polices of Saudi crown prince Mohammed bin Salman, was killed in the Saudi consulate in Istanbul on 2 October.

Trump has continued to support the kingdom despite worldwide outrage over the murder but he is at the same time keeping up the pressure for lower prices.

"The big unknown is how President Trump will react to any production cuts," said analysts at ING.

Iran's Zangeneh said it was the first time a US president was trying to tell OPEC what to do.

"They should know that OPEC is not part of their secretary of energy," he said.

Most OPEC members felt the same way, but "some members are going along with US policy," Zangeneh said.

Negotiations between OPEC members are fraught, however, as some feel that Saudi Arabia wields too much clout in setting policy.

Iran has accused Saudi Arabia of being in thrall to the US.

Qatar quits

In a surprise move on Monday, Qatar - which has been an OPEC member since 1961 - said it would quit the cartel next month in order to focus on gas production.

Doha accounts for only around two percent of OPEC output but the move caught the headlines given the political overtones.

Qatar minister Saad Sherida Al-Kaabi said he had met several other OPEC ministers, but not his Saudi Arabian colleague.

"I don't think they want to meet me. They are blockading our country," he told journalists.

Qatar has been isolated by a group of countries led by Saudi Arabia since June 2017, in the worst political fallout between the energy-rich Gulf powers.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.