Turkish lira in free-fall as Trump doubles metals tariffs

President Recep Tayyip Erdogan told Turks to exchange gold and dollars into lira on Friday, with the country’s currency in free-fall after US President Donald Trump turned the screws on Ankara by doubling tariffs on metals imports.

On Friday, Trump announced that the US will impose a 20 percent duty on aluminum and 50 percent one on steels as tensions mount between the two NATO allies over Ankara's imprisonment of US pastor Andrew Brunson.

'If there is anyone who has dollars or gold under their pillows, they should go exchange it for liras at our banks. This is a national, domestic battle'

- Recep Tayyip Erdogan

The announcement came as Erdogan had already been forced to dismiss concerns over Turkey's plunging lira after the currency hit record lows overnight on the back of the widening rift with the US.

"I have just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward against our very strong Dollar!" Trump said in an early Friday morning post on Twitter.

"Aluminum will now be 20 percent and Steel 50 percent. Our relations with Turkey are not good at this time!"

The White House said later that Trump had authorised his administration to prepare documents imposing the increased duties under a section of US law that allows for tariffs on national security grounds.

Ankara and Washington have been at loggerheads over the detention of Brunson on terrorism charges, earlier prompting US sanctions against two of Erdogan's ministers and threats of trade restrictions.

Turkey's currency plunged to more than six and a half lira against the dollar, a fall of about 20 percent, overnight and into Friday after a Turkish delegation returned from talks in Washington on Thursday with no apparent solutions to the row.

"The last time I can remember a currency exploding into a similar acceleration of weakness to what we have seen in the past 24 hours is the Russian rouble crisis that transpired late in 2014," said Jameel Ahmad, head of currency strategy at FXTM.

"It is astonishing that no matter how punished the lira looks, traders are showing absolutely no indication that they are finished with pricing in 'bad news' into the market."

The pastor, who is also accused of supporting the outlawed Kurdistan Workers' Party (PKK), denies the charges and faces 35 years in prison if found guilty.

Brunson's cause resonates with Christian conservative supporters of Trump, who could also be influential as Republicans seek to retain control of Congress in midterm elections in November.'National battle'

Speaking on Friday, Erdogan urged Turks to exchange gold and hard currency into lira, framing Turkey's currency crisis as a "national battle" against economic enemies.

"The dollar cannot block our path. Don't worry," Erdogan told a crowd in the northeastern city of Bayburt.

"However, I say it once again from here. If there is anyone who has dollars or gold under their pillows, they should go exchange it for liras at our banks. This is a national, domestic battle," he said.

"This will be my people's response to those who have waged an economic war against us."

Speaking to supporters in the Black Sea province of Rize late on Thursday, Erdogan again spoke of campaigns against Turkey.

"There are various campaigns being carried out. Don't heed them," Erdogan said.

"Don't forget, if they have their dollars, we have our people, our God. We are working hard. Look at what we were 16 years ago and look at us now."

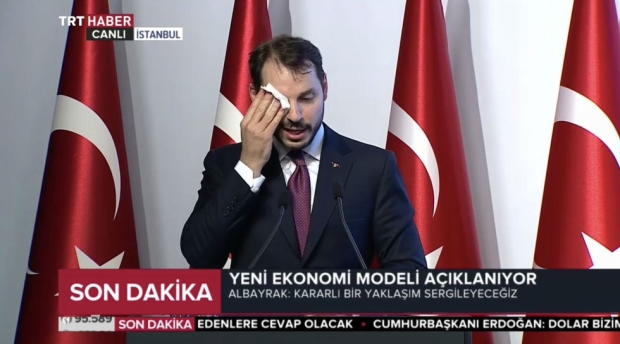

In response to the economic problems, Finance and Treasury Minister Berat Albayrak, who is Erdogan's son-in-law, outlined a "new economic model" on Friday.

He said: "I refrain from talking about the Central Bank as much as I can and when I have to speak, I use a sensitive language.

"The Central Bank’s independence should always continue as a principle."

Albayrak also said steps on reducing the current account deficit would be taken and that Turkey would emerge stronger from this period.

'Enemy of interest rates'

As well as the ongoing row with the US, the recent sell-off in the lira has been fuelled by investor concerns over Erdogan's grip on monetary policy under a new powerful executive presidency.

Erdogan, who was re-elected as president on 24 June and is a self-described "enemy of interest rates," wants banks to lend cheap credit to fuel growth, but investors fear the economy is overheating and could be due for a hard landing.

They are also concerned over the central bank's ability to rein in persistent double-digit inflation with the president repeatedly calling for lower rates.

"The backdrop to endemic lira weakness is of course the familiar one of an economy suffering rising inflation and a burgeoning balance of payments crisis alongside a central bank that has in effect been stripped of much of its independence since Erdogan was re-elected... in June," Ray Attrill, head of foreign exchange strategy at National Australia Bank, said in a note.

Concerns were intensified on Friday by a report in the Financial Times that the supervisory wing of the European Central Bank had over the past week begun to look more closely at eurozone lenders' exposure to Turkey.

The report said the situation is not yet seen as "critical" but Spain's BBVA, Italy's UniCredit and France's BNP Paribas are regarded as particularly exposed.

Shopowners hit

Speaking to Middle East Eye this week, small shopowners in Turkey said the dramatic fall in the lira had had devastating consequences for their businesses.

Zafer Tulus, whose family has owned a butcher shop for more than 200 years, has been forced to close down the business. "I used to sell 100kg of meat, but eventually I started to sell 10kg in the same period of time," he said.

'I used to sell 100kg of meat, but eventually I started to sell 10kg in the same period of time'

- Zafer Talus, butcher in Istanbul

"That's because the price of the animals increased dramatically, and the price of one kilogramme of meat went up to 40 lira ($7.50). It was eight lira in 2006. You do the math."

Cenk Mutlu, who has owned a small jewellery shop in Istanbul's Grand Bazaar for decades, has been forced to display signs which read "discount" and "big sale".

In 2016, when the dollar began to rise, the Grand Bazaar said it had decided to accept rent in lira to support the Turkish economy.

But the shop owners say that change never came and that they still pay their rent in dollars.

New MEE newsletter: Jerusalem Dispatch

Sign up to get the latest insights and analysis on Israel-Palestine, alongside Turkey Unpacked and other MEE newsletters

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.